TMTB Morning Wrap

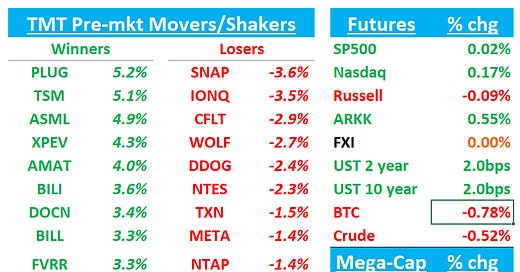

QQQs +18bps following yesterday’s strength. Yields ticking up 2-3bps. BTC-60bps hovering around $90k. China flat. Let’s get straight to it…

TSMC +4%: Solid print with mid 20s rev growth rate for CY25, better LT AI accelerator guide, better capex #

Given some investor fears around potential Q1 sub seasonal guide and conservative 2025 growth, this will be well-received by investors. Rev growth in Q1 is in line with seasonal despite a strong Q1. ‘25 guided to 25% at the mid point (TSMC typically guides conservatively)

Medium term revenue growth expectations were tweaked up to close to 20% but gross margins of 53% and higher was kept unchanged although TSMC reiterated it is aiming for the 'and higher' part. TSM guided capex $38-$42B for CY25 vs buyside expects of $36-$40B. Should help semi caps today although bigger questions on capex remain (weakness in memory, INTC/Samsung, China ).

The long-term guide of 20% CAGR from FY24-FY29 puts TSM at $220B in revs at 2029 and EPS power of NT $110-$220, assuming similar margins to 2025. The mid 40s AI accelerator guide form ‘24-’29 would imply AI revs reach $80B in revs or 33% of revs by 2029, which is a big raise. ISI pointed out a good comparison of Q1’24 guide and Q4 ‘24 guide. in Q1, TSM was guiding to $30-$35B in accelerator revs in ‘28. This morning they are saying it will be $80-$85B!

Key quotes:

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.