TMTB Morning Wrap

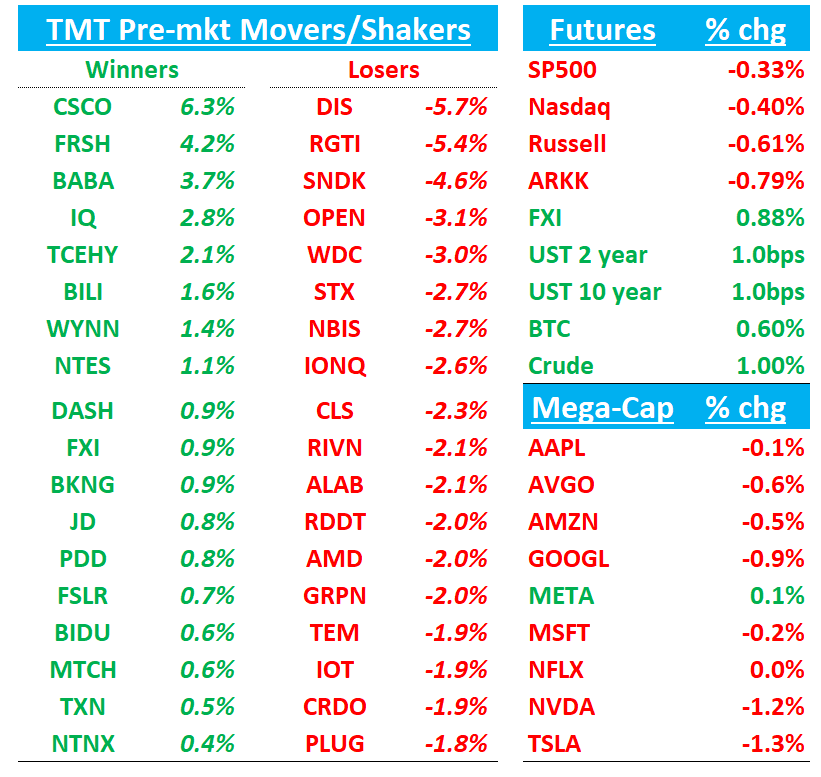

QQQs -40bps red to start the morning. BTC +70bps. Softbank -5%; Stocks in Asia generally saw gains on Thursday: TPX +0.67%, NKY +0.43%, Hang Seng +0.56%, HSCEI +0.63%, SHCOMP +0.73%, Shenzhen +1.53%, Taiwan TAIEX -0.16%, Korea KOSPI +0.49%, Australia ASX 200 -0.52%.

Memory names weaker on Kioxia’s miss : Hynix -2%; Samsung -1.3%; SNDK -4% although MU up on a bullish MS note.

We’ll hit up CSCO, DIS, Tencent earnings first then onto the usual

EARNINGS:

CSCO +6%: Cisco beat on revenue/EPS, raised both Q2 and FY26 guidance, and flagged sharply accelerating AI-networking orders, while security stayed soft on a mix shift to cloud.

The #s / Key Takeaways

FQ1’26: Revenue $14.883B, +7.5% y/y (last q +7.6% y/y) vs Street $14.78B, +~6.6%; EPS $1.00 vs Street $0.98; Non‑GAAP GM 68.1% vs ~68.0%; Non‑GAAP OM 34.4% vs ~34.0%.

Mix & orders: Networking +15% y/y; Security –1.8% y/y; Collaboration –2.8% y/y; Observability +6.2% y/y. Total product orders +13% y/y; Cloud +45%, Public +12%, Enterprise +4%

AI: Hyperscaler AI orders ~$1.3B in Q1; FY26 AI revenue guide ~$3B; mgmt expects ≥2x FY25 hyperscaler AI orders in FY26.

Q2’26 guide (midpoint): Revenue ~$15.1B, +~7.9% y/y vs Street ~$14.6B, +~4.4%; EPS $1.01–1.03 vs $0.99; GM 67.5–68.5%; OM 33.5–34.5%. FY26 guide: Revenue $60.2–61.0B, +~7% y/y vs Street ~$59.6B, +~5.3%; EPS $4.08–4.14 vs $4.04; tax ~19%.

Campus refresh turning into a multi‑year cycle. Cat4K/6K end‑of‑support plus new Wi‑Fi 7 and campus switches are ramping faster than prior launches, underpinning a multi‑year, multi‑billion‑dollar enterprise refresh tied to AI readiness.

Security soft near‑term but improving mix. Security rev –~2% y/y as Splunk shifted to cloud subscriptions, pushing revenue ratable; Splunk ARR and product RPO grew double‑digits; mgmt reiterated mid‑teens long‑term security growth ambition and said they don’t need security to materially improve to hit Q2/FY.

Macro/IT spend & tariffs/supply. Mgmt called out tightening supply and higher memory/PCB/optics prices, which are embedded in Q2/FY26 guidance; Q2/FY26 assumes current tariffs/exemptions remain (with China fentanyl tariff reduced 20%→10%). Public‑sector demand held up despite the shutdown; federal grew high‑single‑digits in Q1.

Bull vs. Bear Debate

Bulls see a multi‑year networking upcycle driven by AI clusters (training now; scale‑across & inference next) and a campus refresh catalyzed by Cat4K/6K end‑of‑support and Wi‑Fi 7, with usage growth from agentic AI requiring denser, more secure networks. Hyperscaler traction is visible ($1.3B Q1 orders; ~$3B FY26 AI revenue), optics attach is broad (all hyperscalers buying Acacia), and Silicon One is increasingly strategic (P200‑class router for 51.2T scale‑across). Orders breadth (+13% y/y with Cloud +45%) supports momentum beyond a single customer or product. With OM mid‑30s and strong FCF, bulls argue Cisco can compound EPS while funding buybacks/dividends and targeted AI/security M&A.

Bears focus on the non‑AI core growing only MSD despite refreshed campus and Splunk consolidation; Security declined and is unlikely to hit 15–17% long‑term growth this year as cloud mix drags reported revenue, and competition in cloud security remains fierce. They worry AI today is concentrated in a few hyperscalers, with sovereign/neocloud dependent on export approvals and called “not material” to the FY guide; any digestion or project timing could pressure orders. Mix also matters: rising memory/PCB/optics costs and webscale mix can weigh on GM; tougher 2H comps could slow top‑line acceleration. Guidance embeds tariff assumptions and component pricing—if those worsen, margin risk rises.

What changed this quarter: Cisco raised Q2/FY26, AI orders re‑accelerated to $1.3B, campus refresh commentary strengthened (faster ramps), ex‑hyperscale orders +9% suggest broader demand, and security softness was explicitly tied to Splunk cloud mix with mgmt saying it’s not needed for the FY guide—collectively skewing the narrative more toward durable networking + AI than single‑node upside.

DIS -5% after missing revs, due to weakness in Entertainment & Experiences. FY26 guide better than feared

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.