TMTB Morning Wrap

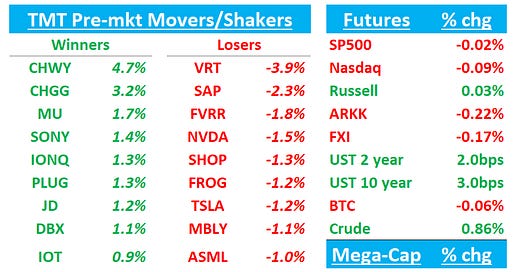

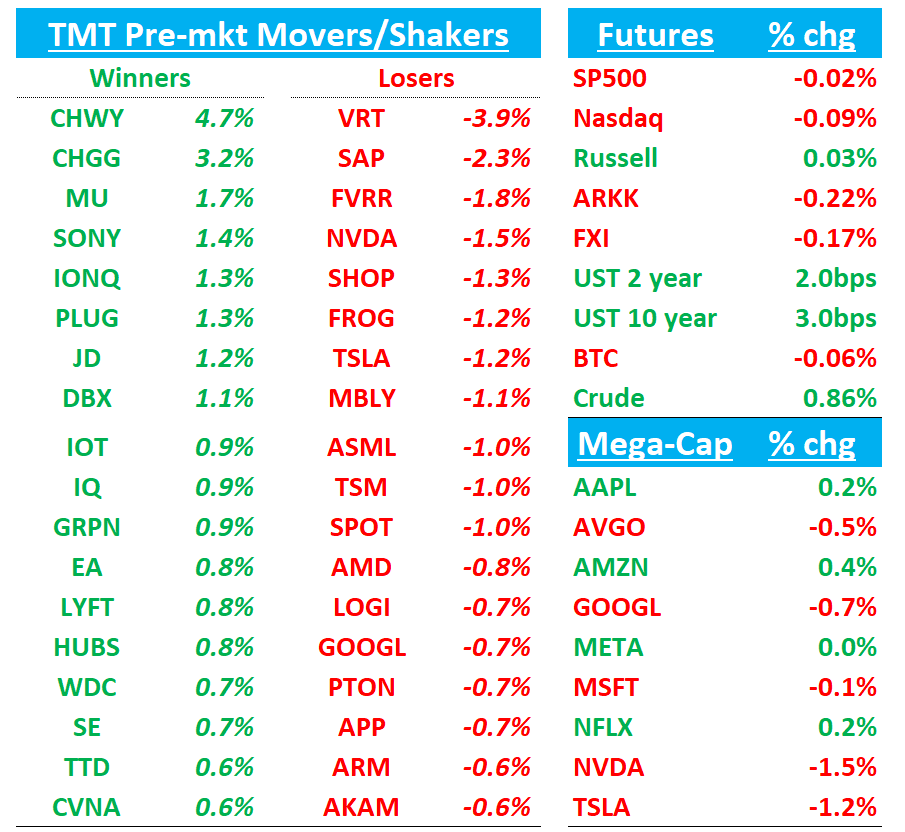

QQQs hovering around flattish while yields tick up 2-3bps across the curve. China flat. BTC flat. Let’s get to it…

CHWY +5%: Looks solid with Q1 Revenue guide better, full year revenue and EBITDA in line street

Q4 revs beat at $3.25B vs street at $3.2b

Q1 Rev Guide $3.06bn-$3.09bn vs. street est. $3.043bn

Q1 EPS Guide$0.30-$0.35 vs. Street est $0.33

FY26 Net Sales GUIDE $12.30bn - $12.45bn vs Street est. $12.425bn

FY26 EBITDA GUIDE 5.4% - 5.7% ($664mm - $710mm) vs. Street est. 689mm (5.55%)

CHWY RESULTS: Q4

- Net sales $3.25B, EST $3.2B

- Autoship customer sales $2.62B, EST $2.56B

- ADJ EBITDA $124.5M, EST $118.4M

- ADJ EBITDA margin 3.8%

- Number of active customers 20.51M, EST 20.31M

- Net sales per active customer $578, EST $584.66

- Net margin 0.7%, EST 0.3%

- SG&A expense $700.7M, EST $678.8M

- Net income $22.8M, EST $17.9M

- ADJ EPS $0.28, EST $0.20

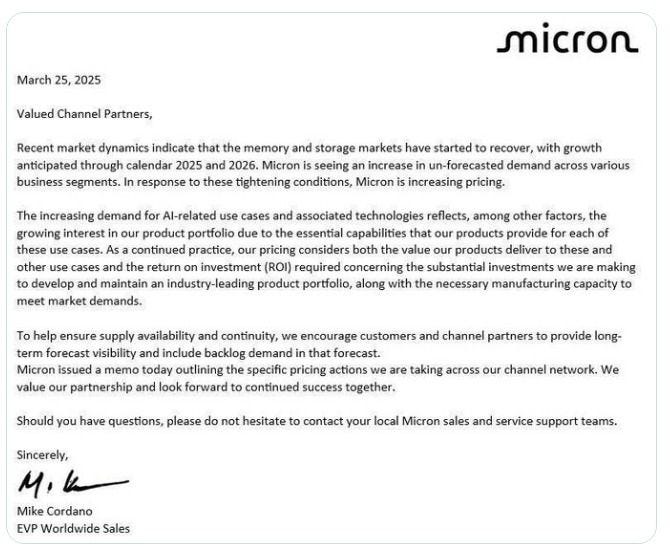

Micron Alerts Customers to Price Hikes, Signaling Robust 2025-26 Demand - Trendforce

These are the type of datapoints around pricing we should continue to hear and keep investors excited about the long.

Though the company has not specified the rate for price increase, previous reports from TechNews and MyDrivers suggest that Micron is targeting an 11% increase

MU: Micron downgraded to Hold from Buy at China Renaissance

3P Roundup:

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.