TMTB Morning Wrap

QQQs +15bps giving back most of its overnight gains after Lutnick post-close saying 25% tariffs on Mx/Canada could be dialed back (but no confirmation yet). Not a ton in Trump’s SOTU but he said he wanted to role the CHIPS act back and vowed to proceed with agenda even if it causes a “little disturbance.” Eurozone equities rallying as expectations for increased fiscal stimulus as Germany eases its strict debt break and the EU talks about ramping defense spending by EU800B (h/t VK)

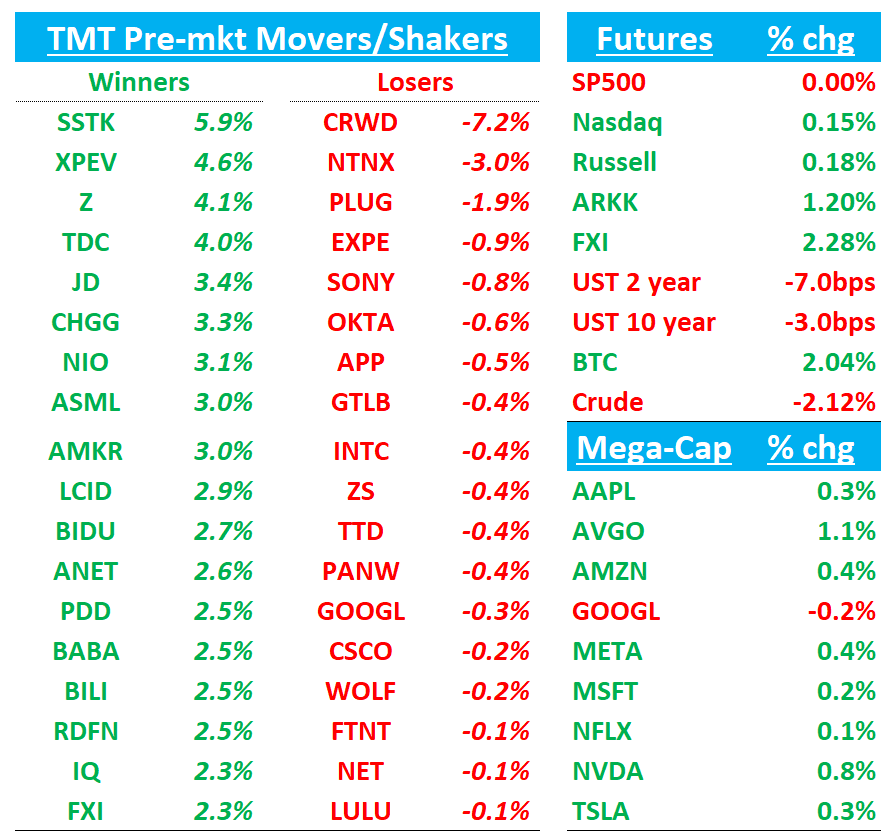

BTC +2% as Lutnick talks up strategic reserve. China +2.5%. 10 year down 3bps and 2 year dn 7bps.

MS TMT Day 3 today. I had some notes from day 2 yesterday here in case you missed it. Elon Musk (7am), SBAC, FLUT, META, PYPL, SIRI, ZG, SHOP, ROKU, NVDA, TTD, LUMN, NXST, NFLX, TMUS, BKNG, ETSY, Dario from Anthropic

Let’s get to it….Earnings first - CRDO, CRWD - then News/research/3p…

CRDO -5%: Very solid beat and raise but AMZN concentration question driving stock lower

Revs grew 154% Y/Y in Jan qtr with revs $135M vs est $120M (100% q/q growth). GM also beat at 63.8% vs est 62%. Guide strong as well: $160 mid point for Apr qtr revs vs est $137M driven by AMZN’s deployment of AEC with GM flat at 64% Q/Q and above cons est 62.8%. Management reiterated its view that F2026 would grow ">50%" as compared to F2025, which most seeing as conservative given the #s they just printed.

Lots of questions about why the sell off overnight given #s beat buyside bogeys handedly. Bears pointing to AMZN concentration (86% of revs), a sharp uptick in concentration from 33/52% the last couple of quarters. I think some here still bear (get it?) the scars of CRDO -50% drop in early 2023 when they lost MSFT as a customer. In addition, it implies >50% sequential growth in non-AMZN revs. Some also pointed to some concerns around CPO going into GTC/OFC in a couple weeks

Bulls will say concentration questions are misplaced as co said AMZN concentration coming down significantly to mid 60% range in the Apr Q (while anticipating seq growth of +19%) and the co anticipates three to four 10%+ customers in the coming quarters and for F2026, based on forecasts from the customers themselves

CWRD -7%: NNARR +$224M, seemingly hit bogeys of $210-$220M. Rev guide inline but operating inc guide weaker and NRR ticks down again

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.