TMTB Morning Wrap

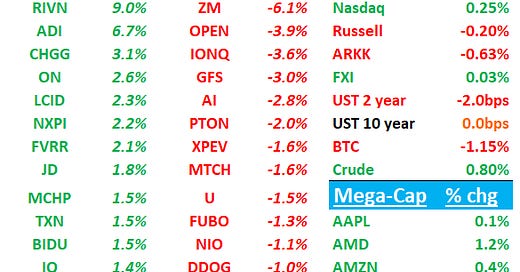

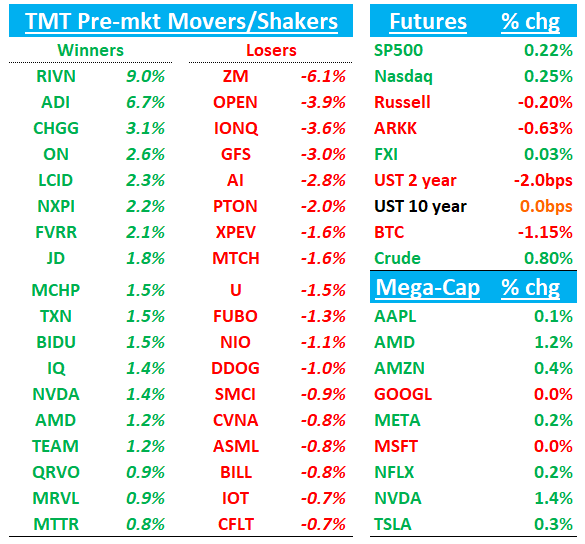

QQQs +24bps / BTC - 1% / China flat / yields down 0-2bps across the curve.

Trump came out after the close yesterday and said he would impose a 25% tariff on all products coming into the US from Mexico and Canada as well as incremental tariff of 10% on Chinese imports. Unclear how much this is just posturing vs real threat, but means headlines of Tariffs likely to stay in the fray as we head into 2025.

ZM indicated -7% on what I thought was an inline-ish beat. Although stock had rallied big into the print, so have many other sw stocks. Every sw beat has been rewarded with a better than expected earnings reaction heading into last week, but we saw a slight chg in dynamic with ESTC selling off on Friday during the day. We don’t think ESTC or ZM was anything like SNOW’s beat, but price action today will be a good tea leaf for the software earnings we have over the next week and half.

Fairly slow news day today and I Imagine tomorrow will be even slower. We’ll be here tomorrow morning but taking the rest of the week off after that.

We’ll cover ADI and ZM earnings first then move onto news/research…Let’s get to it…

ADI +6%: Looks solid with slightly better revs/eps and better than feared guide and +ve commentary

CFO: "Improved bookings in Q4, led by the Automotive segment, signal cautious optimism for fiscal 2025 amid macro uncertainties."

Overall, looks solid especially given the backdrop that many analog and auto semi peers missed or guided below on slowing auto. Despite slowing Q3, commentary around Q4 orders picking up should give investors confidence in bottoming of end markets. Call will be key to see what they are seeing in end markets that others aren’t

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.