TMTB Morning Wrap

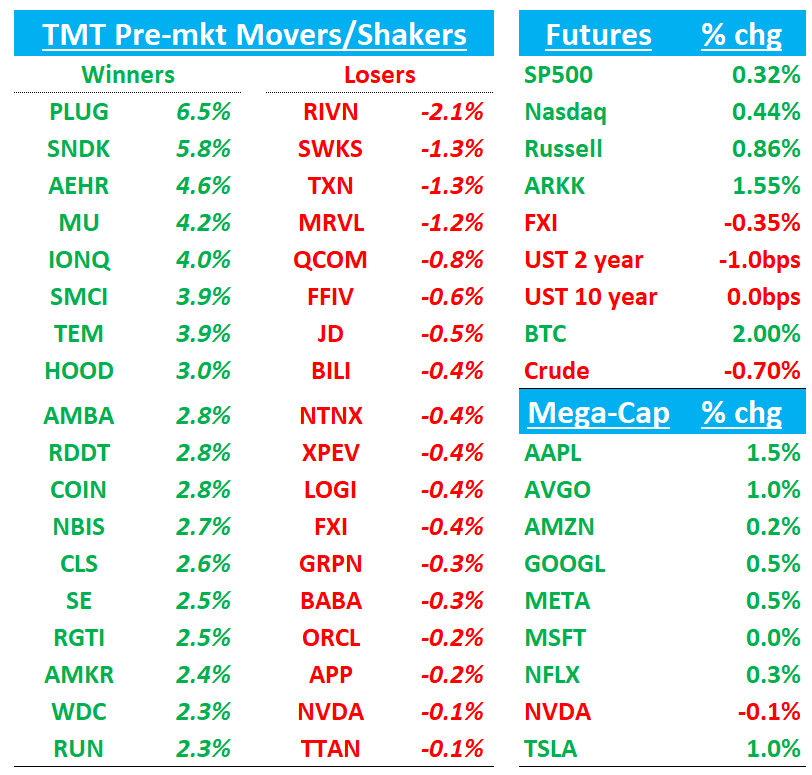

Good morning. Futures +40bps. Stocks up across Asia: TPX+2.46%, NKY +3.37%, Hang Seng +2.42%, HSCEI +2.45%, SHCOMP +0.63%, Korea KOSPI +1.76%,. BTC +2%.

NFLX kicks off earnings season tomorrow, followed by TSLA IBM and INTC later in the week.

Lots to get to, so let’s get to it…

AAPL

AAPL: Loop Raises to Buy on Strong iPhone Upside Through 2027

Loop Capital lifted its rating on Apple from Hold to Buy and raised its price target to $315 from $226. The analyst, Ananda Baruah, writes that supply chain checks point to a sustained iPhone shipment expansion through 2027, driven by upcoming refresh and design cycles. Loop says there’s “material upside” to current Street estimates over that period and believes Apple may be entering a stretch of three straight years of record iPhone volumes.

AAPL: ISI Adds Apple to Tactical Outperform List on Strong iPhone 17 Momentum

ISI says Apple is well positioned to deliver upside versus current September-quarter consensus and potentially guide higher for December, citing a “stronger-than-average” iPhone 17 cycle. The firm’s latest data points to robust demand and elevated lead times for the base iPhone 17, while survey results show an above-normal share of consumers planning to upgrade this year. ISI expects Apple to benefit from late-quarter iPhone strength and double-digit App Store growth, estimating roughly 12% App Store expansion during the period. The firm also highlights that DOJ and Epic-related headwinds have largely passed, setting up cleaner compares

Apple’s biggest iPhone overhaul in years ignites upgrade frenzy - FT

Apple’s new iPhone 17 is kick-starting the company’s strongest growth in smartphone sales since the Covid-19 pandemic, as the biggest redesign of its flagship product in years proves a hit. Early momentum for the redesigned versions of its mobile device has proven stronger than expected before its September launch, according to industry insiders who monitor Apple’s supply chain, mobile operators and the length of time customers must wait for deliveries.

ORCL: JPM Downgrades to Neutral on Heavy Capex Needs and Limited Funding Clarity

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.