TMTB Morning Wrap

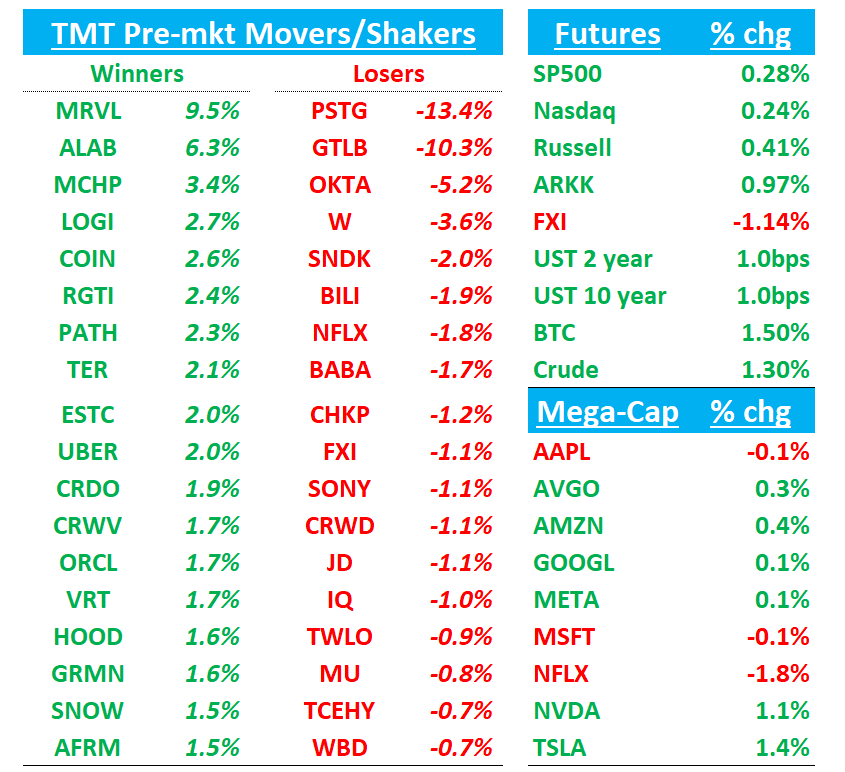

Good morning. Futures +25bps to start the day. BTC +1.5% as crypto continues to stabilize. Macro news overnight mainly on US/Russia not reaching a deal overnight on Ukraine war (despite “useful” talks). UBS conference continues today and we get CRM, SNOW, and GWRE earnings among others….Overnight: FTSE -10bps, CAC unch, DAX +20bps, Nikkei +1.14%, Hang Seng -1.28%, Shanghai -51bps.

We’ll hit up MRVL, GTLB, CRWD warnings first then the usual. Let’s get to it…

EARNINGS

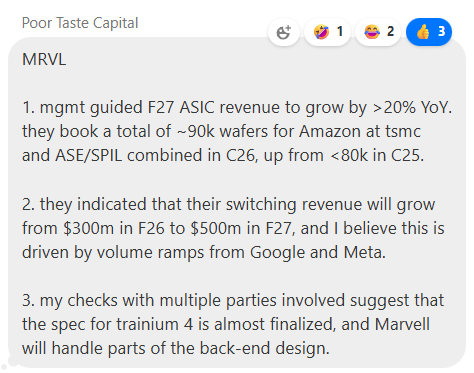

MRVL +8%: Clean quarter with a small beat, a modest top‑line guide up, and a big step‑up in multi‑year AI DC growth/margin ambition, helped by the Celestial AI deal. Skepticism around Mgmt targets still loud as many have PTSD from previous failed growth targets

The #s / Key Takeaways:

3QFY26 (Oct‑25) results: Revenue $2.075B, +37% y/y and +3% q/q (last q +58% y/y) vs Street ~$2.069B; data center $1.518B, +38% y/y vs Street ~$1.49B; non‑GAAP EPS $0.76 vs Street $0.74; non‑GAAP GM 59.7% and OM 36.3%, essentially in‑line.

4QFY26 (Jan‑26) guide: revenue $2.2B ±5% (mid +21% y/y, +6% q/q) vs Street ~$2.19B; EPS $0.79 (mid) vs Street $0.79; GM guided to 59.0% (‑70bps q/q, ~50bps below Street); opex $515M above Street as they reinvest.

Multi‑year AI data center outlook ratcheted up meaningfully: Since a September framework that assumed 18% cloud capex growth, cloud capex expectations are now “over 30%” and Marvell now expects: interconnect (½ of DC) to grow faster than that; custom (¼ of DC) to grow “at least 20%” next year; storage/switch/other (¼ of DC) to grow ≥15%. All‑in, mgmt now expects DC revenue to grow >25% y/y in FY27 and ~40% y/y in FY28, implying ~50% CAGR in DC from CY23 through FY28.

Mgmt said The Celestial AI acquisition adds a photonic scale‑up fabric that mgmt sees as analogous to early Inphi in scale‑out; they now expect Celestial revenue to reach a $500M annualized run‑rate in 4QFY28 and $1B in 4QFY29, with a TAM for merchant scale‑up switch plus optics of >$10B by 2030. This is incremental to existing DC guidance; Celestial revenue is explicitly excluded from the >25% FY27 DC growth outlook.

XPU attach / NIC + CXL pipeline looks very large and better derisked. Marvell now has line of sight to > $2B of XPU‑attach revenue by FY29 just from NIC and CXL sockets already won, with attach rates running ahead of prior expectations. They have five CXL sockets across two Tier‑1 US hyperscalers (deeply engaged with a third) and are ramping NIC attach both to custom accelerators and, increasingly, into broader AI server fleets (>1M units annually at large hyperscalers).

Comms & Other grew 34% y/y and 8% q/q in 3Q, ~50% y/y ex the divested auto‑ethernet business, driven by normalized inventory and refreshed products in both enterprise networking and carrier. Mgmt sees Comms & Other up ~25% y/y (~40% ex‑auto) in 4Q, with enterprise networking exiting at a ~$1B run‑rate and then expected to grow in line with enterprise IT spending, while carrier after nearly doubling y/y in 4Q should settle to growth in line with carrier capex.

Bull vs. Bear Debate:

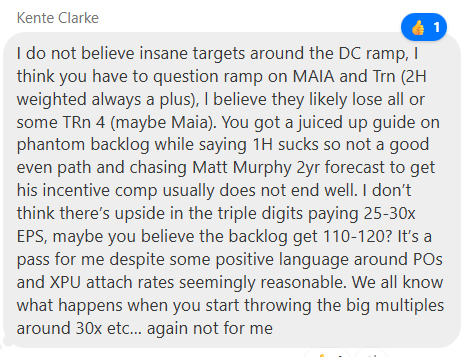

Bulls see Marvell as one of the purest, most leveraged plays on AI data‑center infrastructure across optics, networking, custom accelerators and now XPU attach. The company is already a share‑leader in PAM DSPs and coherent optics and has repeatedly been “first‑to‑market, first‑to‑ramp” at 400G, 800G and now 1.6T, with 3.2T on the horizon. That positioning, combined with a hyperscaler‑heavy customer base, has driven DC revenue CAGRs of ~50%+ since CY23 and is now backed by explicit guidance: DC up >25% in FY27 and ~40% in FY28, with cloud capex now expected to grow >30% next year. Bulls also point to highly visible drivers such as rising AI‑optical content per GPU, a ramping scale‑up switching TAM, and strong bookings that support sequential revenue growth in every quarter of FY27.

Quarter‑specific, bulls love the way mgmt has de‑risked the near‑term custom story and then layered on big optionality. Custom AI ASIC revenue was weak q/q this quarter, but mgmt explicitly reiterated at least 20% growth in FY27, no air pockets, and a doubling of custom revenue in FY28 vs FY27 as new XPUs and XPU‑attach wins ramp. The XPU‑attach pipeline now has line of sight to >$2B revenue by FY29 just from NIC and CXL sockets already won, Celestial AI adds a path to $500M / $1B run‑rates in FY28/FY29 in a >$10B scale‑up interconnect TAM, and Comms & Other is back to healthy IT‑linked growth after inventory normalization. On valuation, Bulls will lean towards something like $4-$5 in CY27 and apply a 35x+ multiple on it which gets you $150+

Bears’ main focus is lack of credibility of the management team. Further, they say Marvell’s AI‑exposed businesses are heavily concentrated in a few large hyperscalers and, particularly on custom ASIC/XPU, in a very small number of sockets; this was on display when the stock sold off sharply in Aug‑25 after a weaker near‑term DC outlook despite strong AI narratives. Custom revenue fell sharply q/q this quarter (Street estimates ‑30–40% q/q) even as optics and switching were strong, underscoring how lumpy that piece remains; a lot of the company’s 2H‑weighted FY27 custom growth assumes a smooth transition to a next‑gen XPU at one anchor customer. Skeptics also highlight that some of the EPS upside is being “spent” on opex: 4Q EPS is guided only in‑line with Street despite a revenue beat and strong DC mix, as GM dips and opex is guided meaningfully above consensus. Outside DC, Auto/Industrial remains very weak (‑58% y/y in 3Q) and consumer is still seasonal and volatile, limiting diversification.

GTLB -10%: Revenue and EPS beat modestly, margins beat strongly, but softer billings/NRR, SMB and U.S. public‑sector weakness, and a cautious guide on FY27 set‑up has stock selling off early

The #s / Key Takeaways:

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.