TMTB Morning Wrap

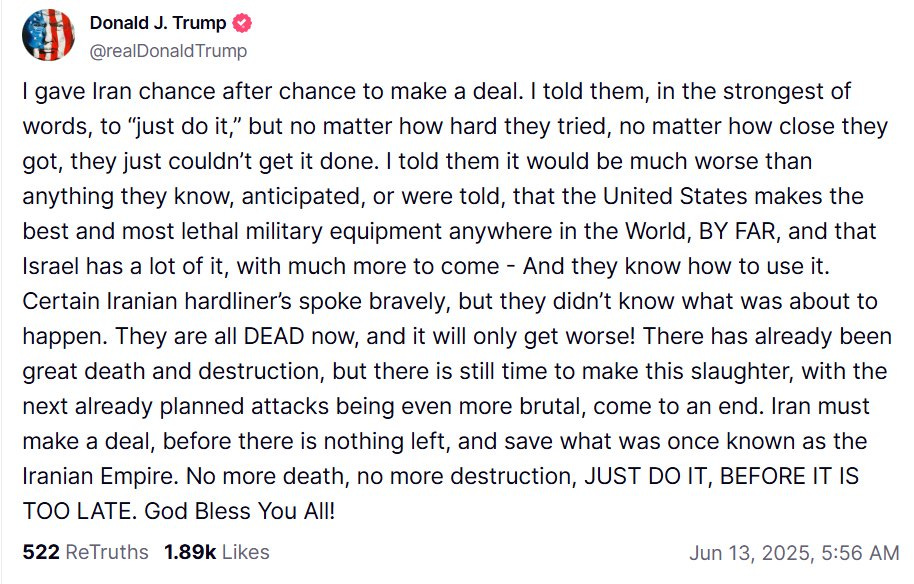

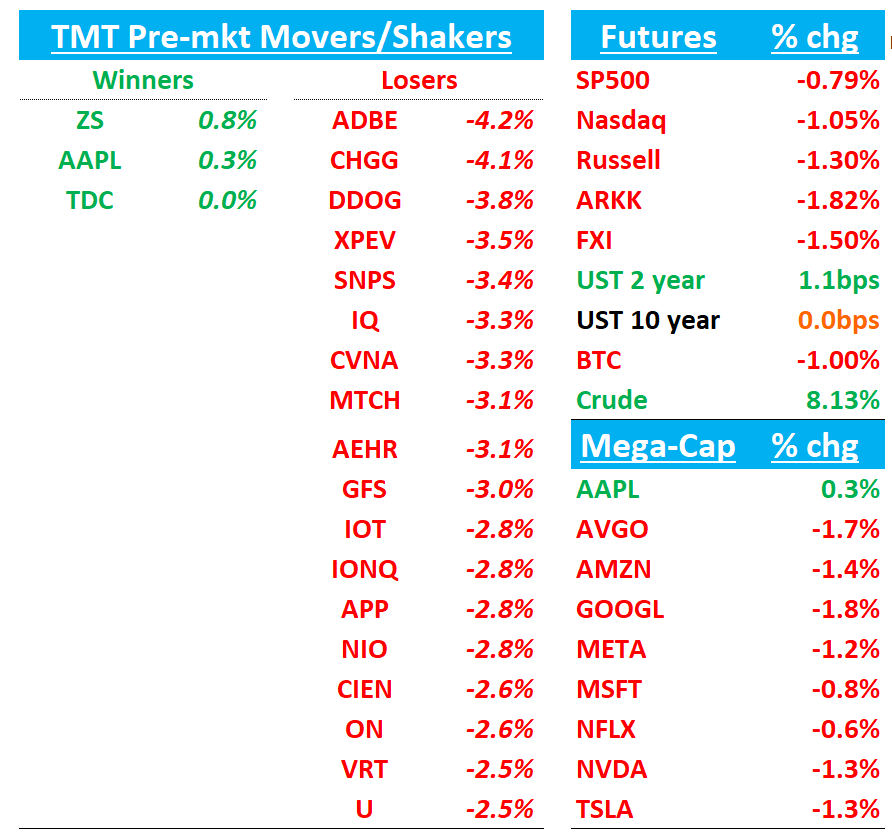

Good morning. QQQs - 1.1% although well off their lows after Israel began launching missiles at Israel, targeting missile and nuclear infrastructure along with senior military and nuclear officials. Crude is up 8%. Here’s what Trump said:

Yields don’t seem to be moving much after the initial spike in bonds.

Let’s get to the recap - we’ll cover ADBE (yawn!) and then get to Research/News/3p:

ADBE: In-lineish print does nothing to change bear vs. bull debate or materially change investor interest

Expectations were low heading in, and so was investor interest. The print didn’t change the latter as #s came in-line and mgmt didn’t do much on the call to change the bull vs. bear narrative. Boring print all around…

The Numbers

Net-new Digital Media ARR $460 M, roughly in line with bogeys

Revenue $5.87 B, up 11 % y/y vs Street at $5.80 B, 9 % y/y;

Non-GAAP EPS $5.06, up 13 % y/y vs Street $4.98, 11 % y/y;

Digital Media revenue $4.35 B, 12 % y/y vs Street $4.29 B;

Digital Experience revenue $1.46 B, 10 % y/y vs Street $1.44 B;

Non-GAAP operating margin 45.5 % vs Street 45.1 %.

For F3Q, Adobe guided revenue to $5.875-5.925 B (mid-point 9.5 % y/y) vs Street $5.88 B and EPS to $5.15-5.20 vs Street $5.11;

Full-year revenue raised slightly now $23.50-23.60 B and EPS $20.50-20.70, both modestly above consensus.

Key take-aways

Macro tone steady, no tariff impact: management sees healthy pipelines and broad geographic strength; FX is a 2H tail-wind

Firefly generations hit 24 B, AI-first SKUs are already running ahead of the $250 M FY-25 ARR goal, and management says AI is a “nice tailwind” for adoption.

Express + Acrobat flywheel is accelerating: MAUs crossed 700 M, up >25 % y/y, with an 11× y/y surge in Express usage inside Acrobat and 8 K new business logos added in the quarter.

Bull vs. bear debate

Bulls argue the quarter proves Adobe’s AI flywheel is starting to add real dollars—Firefly generations, Express enterprise traction and the new AI tiers all point to incremental pricing/upsell leverage. Bulls will also point to valuation: at ~18× CY-26 FCF, ADBE trades at a ~40 % discount to large-cap software peers, while management reiterated confidence in double-digit revenue and mid-40s margins.

Bears counter that core growth is still slowing—net-new ARR fell 6 % y/y, RPO growth decelerated again and Digital Experience lags the mid-teens targets bulls once hoped for. Bears worry AI monetization might remain immaterial near-term, point to tougher 2H comps, rising OpEx (11 % y/y) and a competitive overhang from Canva, Meta and other web-first tools. Bears will say meager FY-25 guide as merely FX-aided, not a demand inflection

TECH RESEARCH/NEWS

THIRD PARTY DATA ROUNDUP

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.