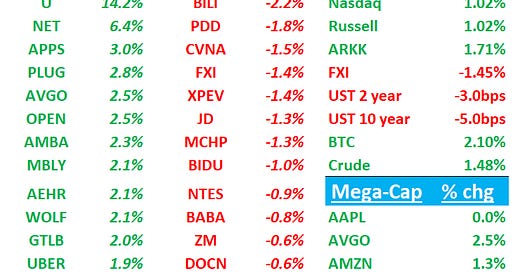

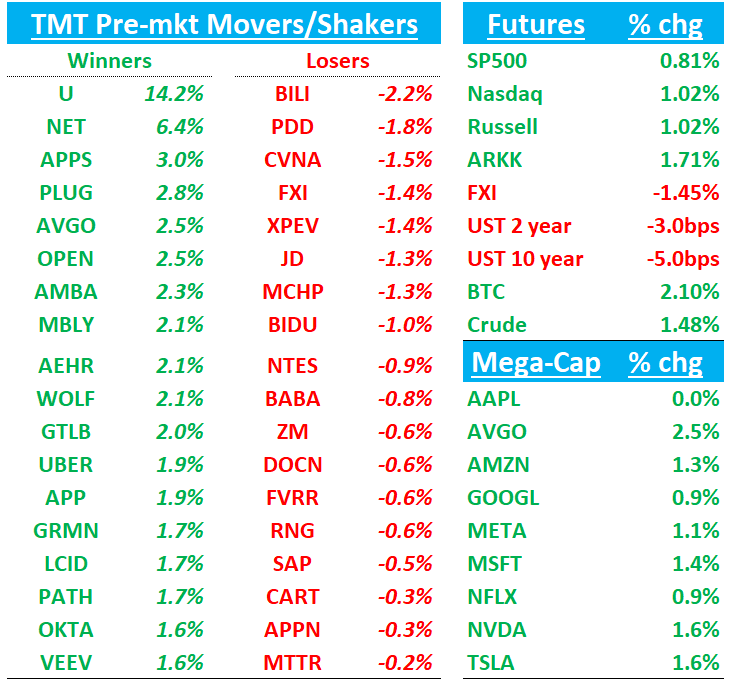

And we’re back! QQQs +1% shaking off some of the late December weakness this morning. BTC +2% starting off the year strong while China -2% faring less well on weaker mfg and retail sales numbers. Yields are ticking down 3-5bps across the curve.

TSLA deliveries will be out around 9am with bogeys a little over 500k. >515k would be viewed positively as would imply TSLA will hit their guide.

Good to be back. Let’s get straight to it…

AAPL: Apple offers iPhone discounts in China as competition intensifies

Apple is offering rare discounts of up to 500 yuan ($68.50) on its latest iPhone models in China, as the U.S. tech giant moves to defend its market share against rising competition from domestic rivals like Huawei.

The four-day promotion, running from Jan. 4-7, applies to several iPhone models when purchased using specific payment methods, according to its website.

The flagship iPhone 16 Pro with a starting price of 7,999 yuan and the iPhone 16 Pro Max with a starting price of 9,999 yuan will see the highest discount of 500 yuan. The iPhone 16 and iPhone 16 Plus will receive a 400 yuan reduction.

AAPL: UBS cuts estimates below street on iPhone data

UBS analyst David Vogt lowers iPhone estimates following weak sell-through data, with November's 8% Y/Y decline prompting December quarter unit forecast reduction to 74M from 77M ($67.2B from $69.7B revenue). UBS now projects 4% Y/Y revenue decline versus previous flat outlook and consensus +2%. UBS notes a slight offset from Services strength on AppStore performance but overall Q4 estimates reduced: revenue to $120.8B from $123.3B (below $124.9B consensus) and EPS to $2.25 from $2.31 (below $2.36 consensus). Maintains Neutral rating with $236 target.

NVDA: BAML reiterates Buy and $190 PT ahead of CES / Bernstein Asia analysts cautious / GB300 News

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.