TMTB EOD Wrap

QQQ -24bps - another day, another failed rally in Tech, but today saw a lot more green and dispersion on my screen than the previous couple of days. Spoos underperformed driven by neg pre-announcements from several of the airlines as they were the newest datapoints that Washington uncertainty is already seeping into the economy.

Other neg datapts from companies today:

DAL -7% said: "outlook impacted by recent reduction in consumer/corporate confidence caused by increased macro uncertainty, driving softness in Domestic demand. Premium, Int'l & loyalty revs growth trends are consistent w/expectations." Feb saw shift in GDP sentiment/output and consumer confidence coming down a bit, corp & consumer spending started to stall....

TER -17% after warning that tariff and trade uncertainty is negatively impacting its business causing pushouts and capital budget reviews at customers - Q2 sales now seen flat to down 10% vs Q1 (street was at +7.5% growth) and 2025 revs +5-10% vs street at 14%.

VZ -7% warned that gross adds in Q1 would be soft as industry competitive intensity remains elevated. T -5% also didn’t sound great at DB’s TMT conference.

HelloFresh (HFG) -18% guided 2025 down -3-8% y/y vs street +3% y/y citing “weakening consumer confidence in North America” alongside uncertain impact of “potential prolonged tariffs on agricultural and packaging products”

More tariff news as US/Canada seemed to back away from a tit-for-tat after Ontario suspended its 25% power surcharge although Trump continues to defend his tariff agenda. Next big piece of macro news is CPI tomorrow morning. Treasuries fell as yields climbed 5-6bps across the curve with Fed expects shifting hawkishly and now pricing in 75bps vs 80bps+ yesterday.

It continues to be a tough market as we’ve seen a big re-adjustment in priors re: growth/macro/policy narrative over the last month. I know it’s felt longer for many, but it’s happened in a very compressed period of time: as more $’s have flowed into multi managers, everyone else has been programmed to act faster now as well.

While uncertainty in Washington/tariff likely continues, it’s hard to imagine another large re-thinking of growth priors + de-risking/unwind that has occurred in such a short period of time — the current L/S Momentum (MSZZMOMO) drawdown is nearly inline with the median selloff now at -21%. That’s not to mean it’s all over, but fundamentals will eventually take a front seat again. And in a slowing economy, my experience has been there is a great opportunity for stock picking both long and short, which is good news (although investment time frames get compressed). For now, we remain in low-gross + pnl protection mode looking for tactical opportunities, but as things begin to stabilize and fundamentals take more of a front seat heading into Q1 earnings season, we’ll begin to layer on risk again.

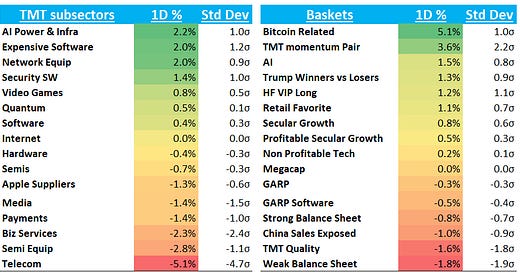

Saw some nice outperformance in AI semis and software today while momentum regained a bit of a bid. Let’s get to the full recap…

Internet

RDDT +14% after a brutal stretch where stock was down 50%+ over a few weeks

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.