TMTB Morning Wrap

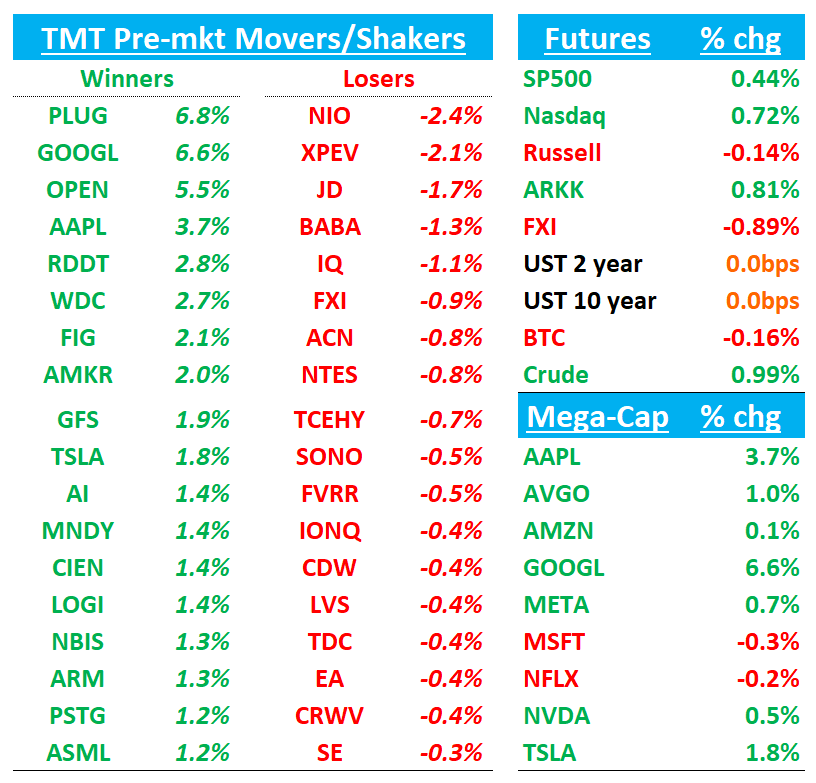

Futures +60bps as GOOGL +6.5% and AAPL +3.5% lead the way post a very favorable DOJ ruling. Asia markets mixed overnight with Nikkei -1%, SHCOMP -1%; KOSPI +40bps while Eurostoxx +1% driven by outperformance in cyclicals/semis. BTC flat. Yields flat.

Given GOOGL/AAPL are the underweights in large cap tech, let’s see if it causes some NT rotation…

Citi conference kicks off today. A lot of cos presenting including: AMD, CSCO, BKNG, INTU, APH, NOW, LRCX, IFX, SHOP, DDOG,, ON, MRVL, CTSH, SBAC, HPQ, COIN, NTAP, OKTA, STX, ENTG, GLOB, EPAM, VRNS, W, ROKU, ACVA, MB, XMTR

Agenda can be found here

We’ll start off with some bogeys for tonight (CRM/GTLB/HPE), move onto ZS earnings, then hit up GOOGL/AAPL takeaways, then Research/News.

The most interesting nugget for me came from Barclays:

Removing this regulatory overhang is comparable to when Google’s forward P/E multiple expanded roughly 40% after the FTC dropped its case in 2013

Feel like have to own at least a little GOOGL here. We went over r/r math yesterday:

At $230, we are getting close to my CY26 $10.75 x 22x ($240-$245) and I struggle with giving GOOGL much more than 22x so I can’t bring myself to add much up here. But bulls say roll it forward to ‘27 and you get another 10-15% upside. That’s fair - we’ll keep a small long on (which we had trimmed going into this event).

Busy morning so let’s get straight to it…

CRM/GTLB Bogeys

CRM:

Q2 CRPO: 10% y/y vs guide of 9%

Q3 cc CRPO guide: Inline with street at 9%

Reiterate rev and OPM guide of 9% / 34%

GTLB:

Q2 Revenue: ~2.5%+ beat ($231M+) vs guide of $226-$227M

Q3 Revenue: Inline with street at $241M

HPE:

Q3 Revs: $$8.4 - 8.45B vs street at $8.35B

Q3 EPS: 44c vs street at 42c

AI Backlog: $3.4B vs street at $3.3B

ZS: Clean beat with 32% billings growth (3rd straight q of accel, biggest beat in 2 years), ARR >$3B, and FY26 guide ~22% y/y, offset by a modestly under‑Street FCF‑margin guide and weaker NN organic ARR guide

Q4 revenue and EPS topped Street and billings beat by the widest margin in ~2 years, while DBNR held steady at 114%. Bears will pick at organic NNARR guide in single digits. Management is pivoting investors toward ARR (now defined more conservatively) and highlighted momentum across three growth vectors—AI Security, Zero Trust Everywhere (Users/Branch/Cloud), and Data Security—plus early success with Z‑Flex large‑deal motion

Key takeaways

F4Q billings +32% y/y ($1.202B) vs Street ~$1.143B and revenue $719M (+21% y/y) vs $707M. ARR ended >$3.0B (+22% y/y).

ARR is now “next‑12‑months subscription revenue,” not the prior exit‑rate method; management says the change makes ARR more conservative on ramp deals and aligns with peers.

FY26 revenue $3.265–$3.284B (+22–23% y/y) vs Street ~$3.204B and EPS $3.64–$3.68 vs ~$3.65; FCF margin 26–26.5% vs Street ~27.5% given high‑single‑digit % revenue capex. AI‑Security ARR expected to grow >60% y/y in FY26

Red Canary: FY26 guide assumes $95M ARR, no renewals, reflecting prudence; MDR churn structurally higher than ZS core.

1H NNARR ~46.5–47% (incl. Red Canary); CFO said organic NNARR growth is single‑digit in FY26.

SecOps ARR grew >85% y/y; with Red Canary, Agentic Ops expected to surpass $400M ARR in FY26; management called out AI‑Security ARR expected >60% y/y in FY26.

Mgmt said Demand is “through the roof”; ZT Branch displaces legacy SD‑WAN/firewalls with customers citing ~60% cost savings; ZT Cloud ARR accelerated and now features a “cloud gateway” enabling deployment <10 minutes.

TCV bookings >$100M in ~4 months (+50% q/q); intended to simplify multi‑module adoption and raise TCV/ARR without a consumption model.

F4Q gross margin 79.3% on a one‑time, lower‑margin government private‑cloud shipment; expected to return to ~80% in Q1. FY26 FCF margin guided to 26–26.5%.

Company assumes macro unchanged in FY26; Federal was high‑single‑digit % of FY25 revenue with a similar outlook.

Bull vs. Bear Debate:

Bulls on ZS see a durable platform‑led upsell engine (AI‑Security, ZT Branch/Cloud, Data Security) under a more seasoned GTM, with Z‑Flex catalyzing larger multi‑year, multi‑module deals. They point to >350 Zero Trust Everywhere enterprises already (ahead of plan), SecOps ARR >85% y/y, and AI‑Security ARR expected >60% y/y in FY26 as evidence the portfolio is widening beyond core ZIA/ZPA. With ARR now over $3B and RPO +31% and an asset growing 20% with limited disintermediation risk in time of scarcity of growth and AI-safe assets, bulls will underwrite ~22–24% top‑line growth through CY26 and argue a premium EV/S of ~14–15x on CY26 revenue is warranted (SSE leadership, Rule‑of‑50 profile), which is close to $310-$330+

Bears focus on signs of deceleration beneath the headline beats. Management’s first ARR guide implies ~22% y/y, but organic net‑new ARR growth only ~6–7% in FY26 (excluding Red Canary), and the CFO explicitly framed single‑digit organic NNARR growth—not the re‑acceleration many hoped for. They also note that incremental $100K+ and $1M+ customer adds have been weaker vs. 1–2 years ago, suggesting the land motion needs rebuilding even as upsell holds NRR around 114%. In a more competitive landscape (PANW/FTNT, single‑vendor SASE bundles, and cloud‑native peers), bears worry about pricing pressure and longer cycles that cap NRR and compress growth multiples, while the ARR methodology change and move away from billings may introduce KPI confusion. Red Canary introduces MDR churn dynamics and integration complexity; the $83M ARR recognized at close (vs. ~$140M pre‑deal run‑rate discussed externally) and management’s note that MDR has inherently less‑stable ARR leave skeptics questioning the quality and durability of that contribution. Bears will say ZS hitting same wall as PANW and trying to buy themselves out of it using the Red Canary Acquisition, which is just a 1 yr fix. . Given all this, bears argue ZS doesn’t deserve a premium multiple and just trading back a low dd ev/sales, means a stock closer to 250.

No strong view here although bears were much more vocal overnight…

GOOGL/AAPL DOJ Takeways:

GOOGL: Barclays Calls DOJ Ruling “Home Run,” Sees Upside as Overhang Clears

Barclays frames the DOJ remedies as a “home run” for Google, arguing that with the Chrome divestiture and TAC payment ban off the table, the outcome amounts to only minor wounds. The firm’s key takeaway is that removing this regulatory overhang is comparable to when Google’s forward P/E multiple expanded roughly 40% after the FTC dropped its case in 2013 — implying today’s resolution could also reset the stock higher. Barclays stresses that the lighter-weight data sharing and syndication remedies may aid rivals like ChatGPT or Perplexity at the margin, but won’t dent Google’s core search dominance. With the risk backdrop fading, focus now shifts back to AI monetization and Gemini distribution, which Barclays views as important incremental drivers

GOOGL: ISI Reiterates Top Pick After DOJ Ruling, Calls Outcome “Best Case Scenario”

ISI says the U.S. District Court’s remedies in United States v. Google came in better than expected, describing the outcome as a “best case scenario.” The court rejected structural breakups but imposed modified conduct remedies, including limits on contracts, tailored data-sharing, and expanded syndication to GenAI search tools. ISI notes this decision effectively clears a major overhang and reiterates GOOGL as its top pick. The firm is removing GOOGL from its TAP Outperform list, explaining that the call was tactical post-Q2 earnings and the ruling itself serves as the true “clearing event.”

GOOGL/AAPL: Court ruling on Google Chrome a 'monster win' for Apple, says Wedbush

Wedbush reiterates its Outperform rating and $270 price target on Apple, highlighting what the firm calls a “massive win” after the court upheld the $20B search partnership with Google. The analyst says this removes a key overhang, noting the risk of a forced breakup of Chrome or termination of the Apple-Google search deal had been a “black cloud” for investors. Wedbush describes the outcome as a “monster win” for Apple and a “home run ruling” for Google, easing a major source of concern for both stocks.

GOOGL: Bernstein Sees Remedies as Manageable, But Notes AI Provisions Create New Risk

Bernstein says Judge Mehta’s search remedies looked favorable on the surface — with no Chrome divestiture or TAC payment ban — but cautions that extending non-exclusivity to AI chatbots could present new competitive risks. The firm notes Apple and OpenAI may actually come out stronger, as the ruling shifts the question from “how do I build my own search engine?” to “how can I better integrate with Google Search?” Bernstein argues that while Google is easier to own today than before the decision, the overlap between GenAI surfaces and search queries means competitive pressure could build over time. Still, without structural breakups, Bernstein views Google’s position as intact and says the chances of the verdict being overturned on appeal are low

GOOGL: JPM Calls Remedies “Much More Favorable,” Lifts TP to $260

JPM’s Doug Anmuth says Judge Mehta’s remedies were “much more favorable” for Google than expected, particularly given the GenAI competitive backdrop. The ruling lets Google maintain default placement agreements (capped at one year) without requiring Chrome or Android divestitures, choice screens, or Android partner mandates. The only real pushback is limited index/data sharing and ad syndication services to competitors, which JPM sees as immaterial to financials. With the regulatory overhang easing, Anmuth raises his target multiple to 22x ‘27F GAAP EPS (from 19.5x) and lifts his price target to $260

GOOGL: BofA Calls DOJ Ruling Favorable, Lifts PO to $252 on Lower Risk & AI Tailwinds

BofA says the DOJ’s remedy decision in Google’s search antitrust case came in better than expected, preserving revenue-sharing for search defaults and avoiding a Chrome divestiture. The firm views the outcome as clearing one of two major overhangs, leaving Google’s TAC-based distribution model intact and reducing regulatory uncertainty. BofA raises its price objective to $252, noting that pre-2023 Google often traded at a 6-pt premium to the S&P, and believes that premium could return as risks ease. The bank also highlights accelerating paid click growth and emerging AI drivers — including Gemini integration, AI Overviews, and new search usage — which it sees as supporting multiple expansion. BofA reiterates its Buy rating

GOOGL: Cowen Flags AI Chatbots as Biggest Secular Risk but Sees Google Holding Share, PT $240

Cowen says the rise of AI chatbots like ChatGPT represents Google Search’s toughest secular threat yet, but argues Google can stave off disruption thanks to its scale, tech DNA, and new GenAI features. Proprietary survey work shows encouraging uptake of AI Overviews and AI Mode, with 52% of users saying these features are driving higher Google Search usage. Importantly, 45% of dual users rated AI Mode better than ChatGPT, and Gemini already commands ~22% share of chatbot prompts vs. ChatGPT’s ~60% The firm models ~8% annual Search revenue growth through 2031, largely in line with prior forecasts but increasingly supported by paid clicks and GenAI usage.

AAPL: Cowen Sees DOJ Remedies as Win for Apple Ads, Supportive for Future GenAI Monetization

Cowen views the court’s remedy ruling in U.S. v. Google as broadly favorable for Apple, since revenue-sharing from Google TAC payments remains intact and Safari search defaults can continue. The firm notes Apple’s ad revenues from Google TAC account for ~20% of Services revenue and ~10% of gross profit, making this outcome a clear positive. Importantly, Cowen highlights that Google’s rev-share framework could set a benchmark for GenAI competition pricing, which should aid Apple as it integrates OpenAI’s ChatGPT into Siri and prepares for a GenAI search option in Safari. With both revenue security and long-term GenAI upside, Cowen reiterates its $275 PT, applying a blended 35x FY26E EPS multiple

AAPL: ISI Says DOJ Ruling a Net Positive, Boosts Apple’s Leverage in Search

ISI argues the DOJ’s remedy ruling is a net positive for Apple, as Google can continue paying the ~$15–20B annually to keep Safari as the default search engine, while exclusivity provisions are barred. The firm notes this outcome not only secures Apple’s sizable ad revenue stream (about half U.S.-based) but also strengthens Apple’s bargaining position in future negotiations by allowing other search engines or AI players to bid for default placement. ISI adds that moving to annual renewals versus every three years gives Apple more flexibility and upside. Longer term, the firm sees this opening the door for an eventual AI-enabled search engine default on Safari, whether powered by Gemini or another model. ISI maintains an Outperform rating and $250 price target

AAPL: BofA Lifts PT to $260 on DOJ-Google Ruling, Sees Services Growth Tailwind

BofA raised its Apple price target to $260 (from $250) and reiterated Buy, citing increased confidence in Services growth after the DOJ-Google remedies ruling. The court barred Google from exclusive distribution contracts covering Search, Chrome, Assistant, and Gemini, but still allows one-year default placement deals. BofA notes this outcome effectively preserves the current setup where Apple keeps Google as Safari’s default while offering users the option to switch — with no mandated choice screen. The firm argues the ruling supports Apple’s ad revenue continuity and assigns a higher 31x multiple (from 30x) on C26 EPS of $8.37

Research/News:

HUBS: Bernstein Upgrades to Outperform, Sets $606 PT on Better Macro, Attractive Valuation

Bernstein raised HubSpot to Outperform from Market-Perform with a $606 target, saying the risk/reward has shifted meaningfully to the upside. The firm highlights that macro pressures which weighed earlier this year have eased or stabilized, while HubSpot’s valuation has pulled back to more compelling levels. Bernstein also argues that AI is unlikely to be a near-term headwind and may instead provide incremental growth tailwinds. With leading indicators suggesting a stronger second half, the analysts believe HubSpot is positioned to outperform, noting its continued share gains in SMB sales, marketing, and service

CRM: Salesforce CEO Marc Benioff says AI has already replaced 4,000 jobs - SF Chronicle

CEO Marc Benioff says Salesforce has cut its customer support staff from 9,000 to roughly 5,000 in 2025 after deploying AI agents to handle a growing share of its work, The San Francisco Chronicle reports, citing comments made on "The Logan Bartlett Show.

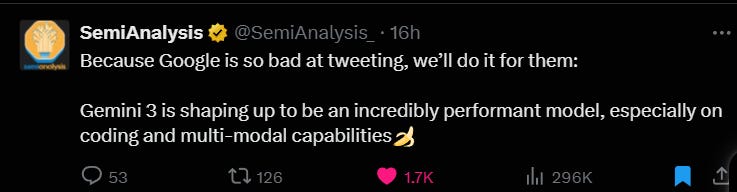

AMZN: New Street yesterday said "AWS still faces adoption challenges and we heard that Anthropic (the main Trainium user at scale) would rather have GPUs."

SPOT: Guggenheim Maintains Buy, $850 PT, Sees Pricing Upside Extending Beyond Near-Term Hikes

Guggenheim reiterates its Buy on Spotify with an $850 price target, arguing that investor focus on near-term subscription hikes underestimates the broader pricing power ahead. The firm highlights confidence that results from 2026 onward will exceed Street estimates as ARPU gains, expanding margins, and incremental contributions from audiobooks and podcasts compound growth. Guggenheim points to recent label and distributor agreements that support higher minimum royalty rates and ongoing price increases across peers like Apple, Amazon, and YouTube as evidence of rational industry dynamics. With Spotify’s individual plan still priced below ad-free competitors, the firm expects sustained ARPU growth and sees the stock re-rating higher as momentum in premium subs and product launches continue

APP: Wells Fargo Highlights Referral Program Leverage, Web Ads Ramp, Opex Build in ’26 after meeting with mgmt

Wells Fargo recaps its group meeting with APP management, noting three key themes: (1) attribution platforms like Triple Whale and Northbeam will serve as important distribution partners when the Oct. 1 web ads referral program launches, (2) expanding the pool of web advertisers should lift campaign performance, and (3) incremental OpEx investment is expected in 2026. The firm says attribution partners will be able to distribute referral codes at scale, making them a meaningful channel for web ads. Broader rollout from referral to GA depends on enabling smaller advertisers to automate creative and use AI agents. APP added that hurdles around UI, Shopify integration, and Conversions API have already been solved, while 2026 should see stepped-up spending on video ad generation APIs, biz dev, and inference.

ACN: Rothschild & Co Redburn Cuts to Neutral, PT $250 on Growth Headwinds

Rothschild & Co Redburn lowered Accenture to Neutral from Buy with a $250 price target, pointing to mixed growth dynamics. The analyst notes fiscal Q3 organic revenue grew 5%, with AI-driven consulting demand helping, but weakness in other segments offsetting the benefit. Near-term growth is also pressured by a roughly two-point drag tied to slower procurement activity and federal contract cancellations, the firm says in its note to investors.

SE: Sea Limited downgraded to Neutral from Buy at Arete

BABA: Alibaba upgraded to Buy from Neutral at Arete

NTES: NetEase upgraded to Buy from Sell at Arete

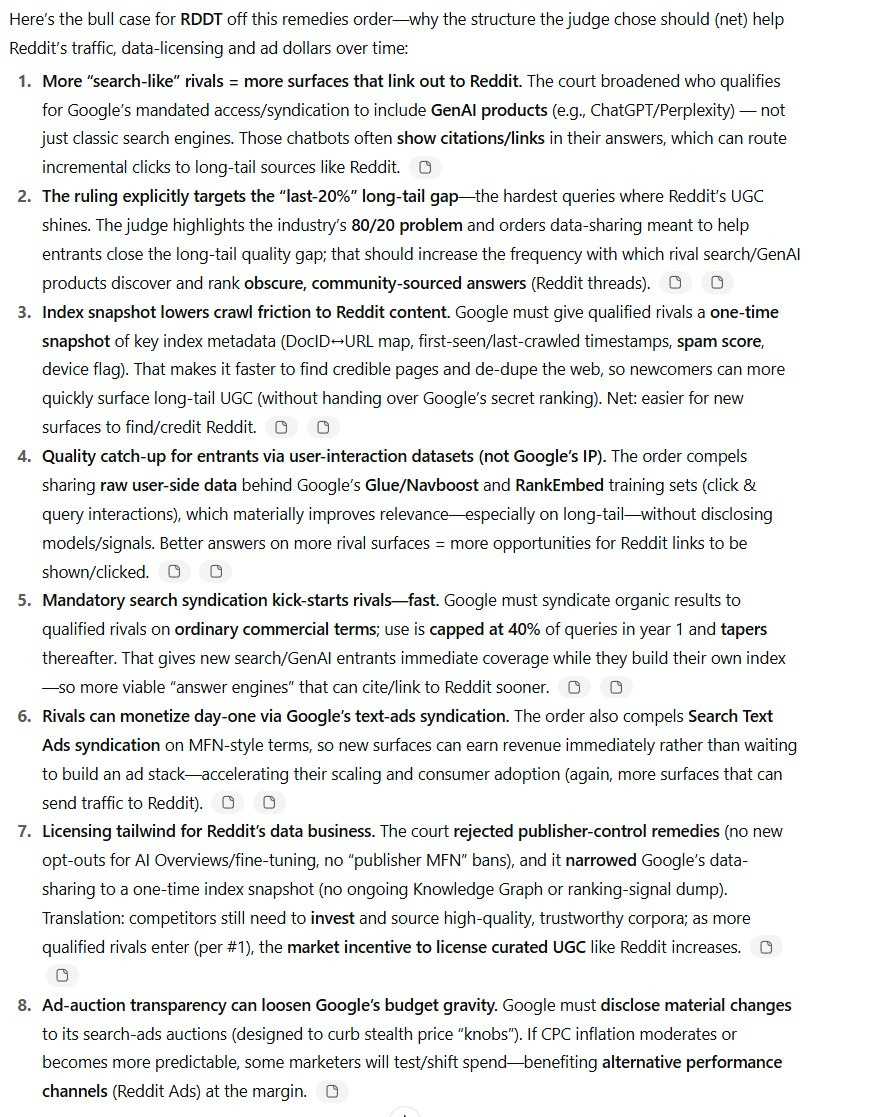

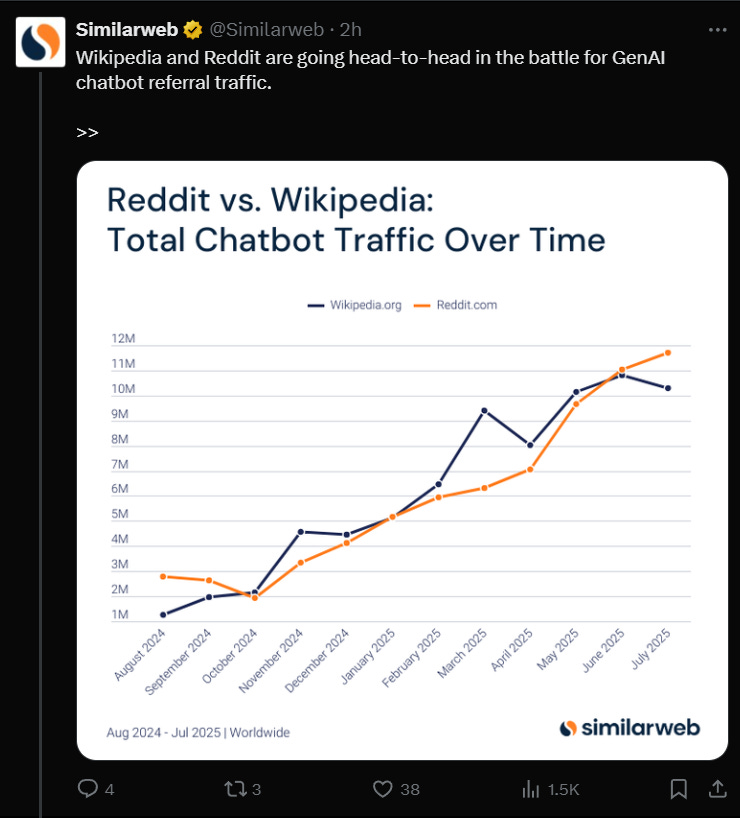

RDDT: GOOGL ruling removes a bit of overhang and should help

RDDT:

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.