TMTB Morning Wrap

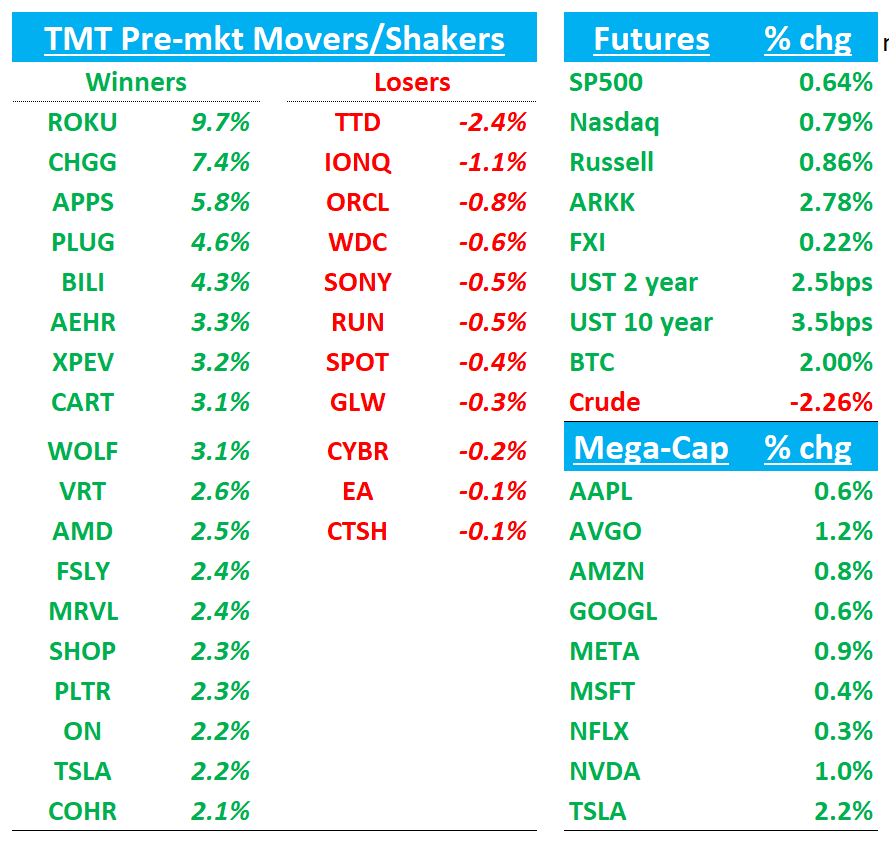

Good morning. QQQs +80bps as market shakes off Iran vs. Israel geo-political ruffles as hopes that Israel strikes could bring an end to the broader war started on Oct 7th. Oil is subdued falling 2%. Yields are up 2-4 bps across the curve. BTC +2%. China +2% on some better economic data overnight.

Lots to get to so let’s get straight to it…

CRWV: BofA Downgrades to Neutral on Valuation, Sees Upside Priced In Despite Positive Developments

BofA downgraded CRWV to Neutral from Buy after a 145% run-up post-Q1, citing limited near-term upside with the stock trading at 25x CY27 EBIT—well above the peer average of 16x. The price target was raised to $185 (from $76) to reflect positive updates including a new hyperscaler customer, expanded OpenAI partnership, and improved debt terms. Still, BofA warns CoreWeave faces a steep funding ramp, with $21B in negative FCF forecasted through CY27 and notes while AI capex growth is moderating from peak levels, demand remains strong—especially from OpenAI—underscored by recent $4B+ deals and extended contract durations.

AMZN/ROKU/TTD: Amazon Ads, Roku announce new integration

AMZN and ROKU announced a new integration that gives advertisers access to the largest authenticated CTV footprint in the U.S. exclusively through Amazon DSP. The new collaboration delivers logged-in reach to an estimated 80M U.S. Connected TV households, representing more than 80% of U.S. CTV households according to ComScore data. The exclusive partnership enhances addressability across major streaming apps; popular streaming services already available and all premium publishers. Early tests of this integration have shown significant results. Advertisers using this new solution reached 40% more unique viewers with the same budget and reduced how often the same person saw an ad by nearly 30%, enabling advertisers to benefit from three times more value from their ad spend. The integration utilizes a custom identity resolution service, allowing Amazon DSP to recognize logged-in viewers across the Roku OS and devices in the U.S.

Negative read-through for TTD as it raises the risk that advertisers shift some Roku-related spend away from TTD’s open-internet DSP toward Amazon DSP. Dollar impact looks could be low-single-digit percentage of revenue but impact will be felt only after the integration is fully live in Q4 2025. The larger issue is strategic: Amazon keeps chipping away at TTD’s “independent, omnichannel” sales pitch and further raises competitive concerns investors have.

Some quick math on TTD impact with help from o3:

Total advertiser spend on TTD little over $12 billion

Jeff Green says connected-TV now accounts for about half of the business, so CTV spend is roughly $6 billion (half of $12 b)

Agency buyers tell Digiday that spend flowing through TTD toward Roku inventory sits in the “mid-teens” as a share of their CTV budgets; taking 15 % as a midpoint puts Roku-through-TTD spend near $0.9 billion

Apply the same 20 % take-rate and TTD books about $180 million of revenue from that Roku slice (20 % of $0.9 b).

If Amazon’s new, identity-rich integration pulls away 10 – 25 % of those Roku dollars once it is fully live in 2026, the revenue that disappears is $18 – $45 million (10 – 25 % of $180 m). That equals only 0.7 – 1.8 % of company-wide revenue.

Clev out positive on ROKU/TTD today too (see below)

ROKU: Citizens JMP Maintains Market Outperform, Sees 28% Upside on Platform Monetization

Citizens JMP reiterated a Market Outperform rating on ROKU with a $95 price target, citing the company’s efforts to enhance home screen navigation and content discovery. Analysts see value in Roku’s control over its TV OS, which enables it to direct users toward The Roku Channel and expand monetizable ad inventory. With these changes, JMP remains positive on Roku’s platform leverage and ad growth potential, estimating a 27.7% upside from current levels.

THIRD PARTY DATA RESEARCH

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.