TMTB Morning Wrap

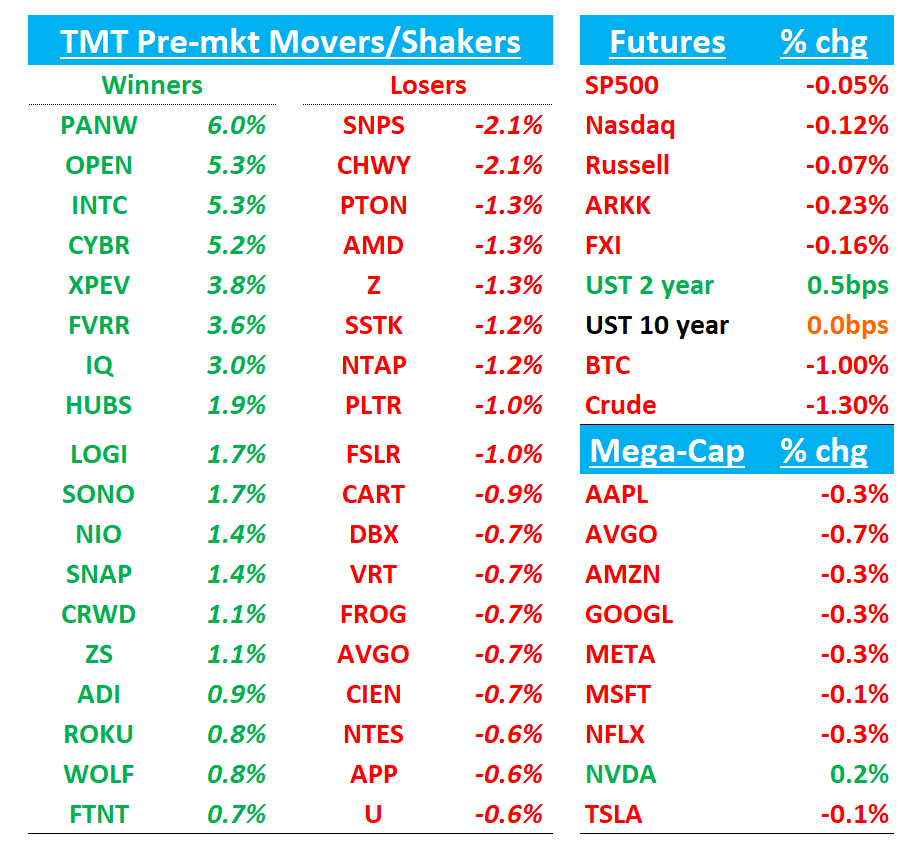

Good morning. Futures down small coming off a sleepy Monday yesterday as volumes were low across the board. Likely another slow day today. BTC -1%. Yields flattish.

We’ll hit PANW and FN first then move onto to Research/News.

PANW +6%: Solid beat across most KPIs vs. modest expectations

Q4 RPO re-accelerated to +24% vs expects of 20-21% (best in 7 quarters) and NGS grew 32% about in line with bogeys. drivers were software firewalls, SASE, XSIAM; AI ARR ≈ $545M, up >2.5× y/y. Product accelerated to +19% y/y with software 56% of product.

The Q1 RPO guide 23% above expects of 20% and NFS ARR guide 29%, slightly above.

FY26 also looks good with NGS ARR 26-27% vs expects of 25% and raising FCF margins to 38-39% vs street at 37% and targeting 40% margins post-CYBR. Top line guide for 14% vs 13% bogey. RPO +17.5% about in line. Zir, co founder and CTO is retiring.

Bull vs. Bear Debate

Bulls argue PANW’s platformization is translating into record large deals, a re‑accelerated RPO to +24% for the first time in 3 quarters (5 ppts accel on a 3ppt easier comp), and a durable software mix (56% of product) that should support double‑digit product growth even as hardware trends normalize. They point to NGS ARR +32%, visible FCF (38–39% in FY26), and the AI‑led consolidation narrative (secure browser, Prisma AIRS, XSIAM) as reinforcing both growth durability and margin expansion; Q1/FY26 guides landed above bogeys on multiple fronts. They also highlight record SASE deal sizes (including a >$60M win), XSIAM at ~400 customers, AI ARR at ~$545M (up >2.5x), and a path to 40%+ in FY28 including CYBR — at sub 20x FY27 FCF, stock looks cheap for mid teens Rev and ~20% RPO growth. Bulls will also point to positive initial channel/customer feedback from the CYBR deal which allows PANW to offer an integrated platform in the currently fragmented identiy security market.

Bears will push back that FY26 growth decelerates despite easier comps (Guide is for NGS ARR +26–27% vs +32% in FY25; RPO +17–18% vs +24% in Q4), gross margin missed on inventory reserves, RPO strength benefited from longer durations, and subscription/support growth decelerated versus product, raising mix questions. They note that organic new ARR acceleration (after backing out small AIRS/SCM support and Protect AI contribution) looks modest. They’ll also flag the integration/identity execution risk around CYBR and the potential for subscription growth to run slightly below expectations short‑term.

We aren’t involved but tend to be sympathetic to the bull case. Stock hasn’t done anything in over a year and we think accelerating RPO/NGS ARR + an improving platformization/AI narrative + better positioning post CYBR deal likely makes the path of least resistance up over the next 6-12 months.

Gets an upgrade to Buy at BofA following what the firm calls "impressive performance on all fronts" in fiscal Q4.

Key quotes:

Platformization/CYBR:

“It’s the platformization story… the value is in platformization and being able to multiply and deploy all of our products in a consistent fashion… Customers see that if they commit to your platform, they will see a path to the next technology out there.

“We believe Palo Alto can accelerate CyberArk’s platform vision… by combining their leadership in identity security with our industry‑leading AI‑powered security platforms and our platformization approach… we will be able to offer the most complete integrated security solution in the market.”

“To provide some context, we have nearly 10 times the number of core sellers, and we see an opportunity to expand CyberArk’s presence into our much larger 75,000 customer base.”

“To get there, the only way to get near real time is to have some consistency in your platform where data talks to each other… AI is going to act as an accelerant towards the desire to consolidate… that’s what’s driving us to say, we need to get identity as part of the fold.

AI/security demand:

“The very fabric of technology is being rewoven by AI… Security is a foundational enabler… Customers are making larger, more strategic commitments with us than ever before.

“From our perspective, AI is going to act as an accelerant towards the desire to consolidate… which is driving us to say we need to get identity as part of the fold… maybe it’s time for an identity firewall.”

“You’re beginning to see consumer browser wars… what’s great for the consumer is dangerous for the enterprise… the case for secure browser just became a mainstream enterprise use case… it will become a critical part of your SASE stack.”

“For the longest of time, I believed that identity was not at an inflection point. But as we saw the emergence of agentic AI… we’re beginning to reach conviction that the identity market will inflect in the next 12–24 months.”

Macro/Federal:

“Macro is fine… there’s no big step‑up or step‑down… we’ll continue to see the benefits of consolidation.” “We saw double‑digit growth across all theaters and a year‑over‑year bookings growth improvement in our public sector business.”

FN -8%: Beat and raise, but near term air-pocket + high expectations & stock near highs = sell the news as Datacom guided lower q/q

Bulls will focus on structural AI demand driving a multi‑year up‑speed cycle (800G→1.6T) with Fabrinet gaining share across DCI/ZR and next‑gen system programs, plus a new, potentially large HPC category tied to hyperscalers. Bulls point to GM resilience around the mid‑12s even during ramps, the decision to pull forward Building 10, and better revenue visibility with DCI now reported. This quarter added evidence: 1.6T shipments started, 800G+ jumped 32% q/q, DCI disclosed at $107M, F1Q guide above Street, and HPC becomes its own segment starting Q1.

Bears center their focus on near‑term supply constraints (200G‑EML) forcing Q1 Datacom down, the concentration risk (NVDA/Cisco), and the potential for NVDA transceiver share shifting to merchant suppliers as the market matures. Bears also flag ramp inefficiencies/seasonality pressuring margins near‑term, auto softness, and a premium valuation that could already discount the 1.6T cycle. This quarter gave bears fresh talking points: management explicitly called out component shortages (likely EMLs) and guided Datacom lower q/q.

The Numbers

Revenue $910M, +21% y/y vs Street $883M;

GM 12.5% vs Street 12.2%;

OM 10.7% vs Street 10.3%;

EPS $2.65 vs Street $2.64.

Datacom $277M (−12% y/y, +10% q/q) was above Street; Telecom $412M (+46% y/y, +1% q/q) grew strongly but came in just below Street; DCI disclosed at $107M (12% of total); Industrial Laser $40M was ~5% below Street.

F1Q26 revenue guide $910–950M vs Street $917M;

F1Q26 EPS guide $2.75–2.90 vs Street $2.75.

Key takeaways

Datacom guide down q/q on 200G-per-lane EML shortages (impacting both 800G and 1.6T) and management saying it may take “one or two quarters” to resolve—i.e., delayed upside vs. what bulls were hoping for

Q1 gross margin flagged for ramp inefficiencies + seasonal headwind; capex likely up if they accelerate Building 10, and Q4 FCF was just $5M

Telecom grew 46% y/y; newly disclosed DCI revenue was $107M (12% of total) driven by 400ZR with early 800ZR.

AWS‑related high‑performance compute will be a new revenue category (HPC) from Q1 and is expected to be meaningful in FY26.

Customer mix & concentration…FY25: NVDA 28%, CSCO 18%; Top‑10 at 86% of revenue.

Demand is robust across AI data‑center builds; management has not seen meaningful tariff impact given shipping terms and where products land

RESEARCH/NEWS

INTC: SoftBank Makes Surprise $2 Billion Bet on Intel’s AI Revival

Bloomberg:

SoftBank Group Corp. agreed to buy $2 billion of Intel Corp. stock, a surprise deal to shore up a struggling US name while boosting its own chip ambitions.

The Japanese company, which is adding Intel to an investment portfolio that includes AI linchpins Nvidia Corp. and Taiwan Semiconductor Manufacturing Co., will pay $23 a share — a small discount to Intel’s last close. Shares of the US chipmaker, which will issue new stock to SoftBank, surged more than 5% in after-hours trading. SoftBank’s stock fell as much as 5.4% Tuesday in Tokyo, its most since April.

INTC: SoftBank held talks with Intel on buying contract chipmaking business

FinancialTimes:

SoftBank’s billionaire founder Masayoshi Son held talks with Intel’s chief executive about buying its faltering contract chipmaking business in the weeks before Monday’s announcement that the Japanese company would invest $2bn in the US group’s shares. Son has met Intel’s Lip-Bu Tan since the latter’s appointment in March to discuss a potential deal, according to multiple people with knowledge of the talks, as the US company tries to find a solution for its advanced chip manufacturing business, which is struggling to compete with Taiwan’s TSMC. The talks were wide ranging and could have led to multiple outcomes, including joint ventures with third parties or a minority investment similar to that announced on Monday. However, two of the people said the announcement did not preclude a bigger deal over Intel’s so-called foundry business in the future.

INTC: UBS Stays Neutral, Sees Limited EPS Power but $40 Upside in Bull Case

UBS says the downside in Intel shares is likely supported by tangible book value of around $17–18 per share following the Altera stake sale, assuming the company can cut costs enough to hit sustainable cash flow breakeven. The firm notes that upside feels capped in the mid-$20s given weak EPS leverage and the fact that Intel must share a meaningful portion of operating profit with Brookfield and Apollo under the SCIP agreements in Ireland and Arizona. UBS remains Neutral, but acknowledges investors are increasingly asking about a blue-sky scenario. UBS says if the market started assigning more value to Intel’s manufacturing assets — benchmarked to global foundry peers on capacity metrics — the stock could justify an upside case closer to $40.

INTC: Bernstein Flags Concern on CHIPS Stake Trade, Keeps MP Rating

Bernstein notes Intel was originally set to receive $10.9B in CHIPS Act funding at no cost, but giving this up for a 10% U.S. government stake “seems worse.” The firm argues that while a government stake might indirectly push customers toward Intel’s fabs, the pure equity-for-cash swap is unfavorable, warning that “funding a build-out with no customers probably won’t end well for shareholders.”

NVDA: Nvidia working on new AI chip for China that outperforms the H20, sources say

The new chip, tentatively known as the B30A, will use a single-die design that is likely to deliver half the raw computing power of the more sophisticated dual-die configuration in Nvidia's flagship B300 accelerator card, the sources said.

A single-die design is when all the main parts of an integrated circuit are made on one continuous piece of silicon rather than split across multiple dies.

The new chip would have high-bandwidth memory and Nvidia's NVLink technology for fast data transmission between processors, features that are also in the H20 - a chip based on the company's older Hopper architecture

NVDA: Nvidia's H20 price increase is rumored to be 18% in response to the US government's "profit sharing" - link

NVDA: Nvidia is continuing to see strong demand in China for its H20 chip despite efforts by Beijing to push domestic tech firms to buy local products – Nikkei

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.