TMTB Morning Wrap

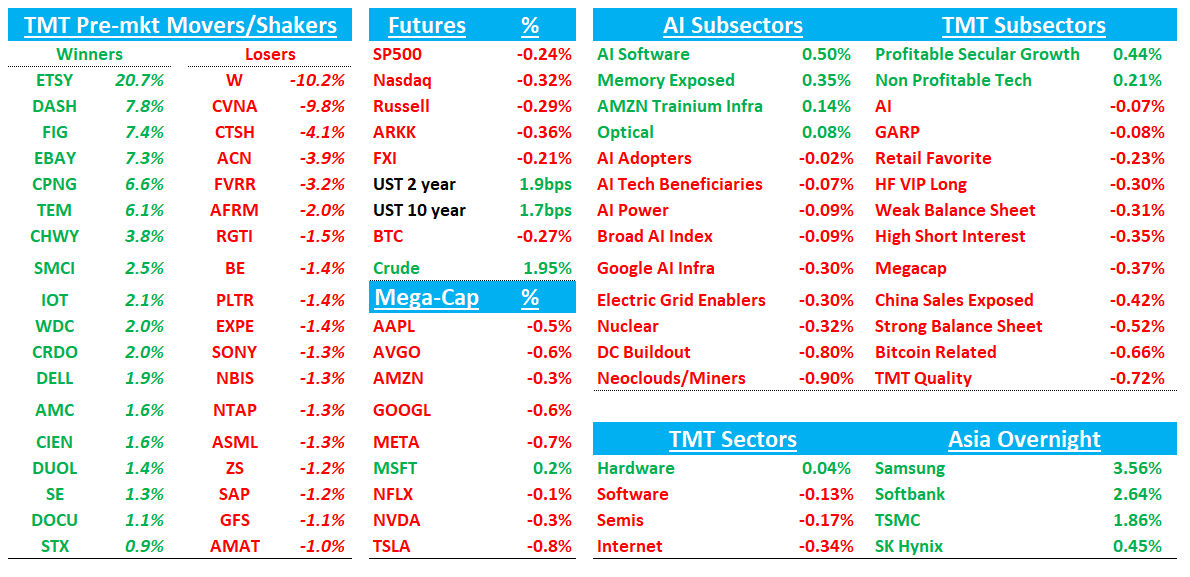

Good morning. QQQs -33bps off early. Asia mixed:TPX +1.18%, NKY +0.57%, Korea KOSPI +3.09%. China/HK remain closed. Yields are flat, BTC +1%. On the macro front, tensions increasing in Iran as US moves more military to the region and CNN reporting US military prepared to strike Iran as early as this weekend as reports say hopes of a diplomatic deal being reached are low.

We’ll dive into earnings first (DASH, BKNG, EBAY, CVNA, FIG) then onto the usual.

Let’s get to it…

DASH +8%: 4Q25 delivered modest GOV/Adj. EBITDA beats (with accelerating orders), but revenue slightly missed on take‑rate/mix, and 1Q26 Adj. EBITDA guidance came in light as investments/storms front-load while management reiterates a 2H profitability step‑up.

Stock rallied after an initial blip as call went well and bulls will say exit rate 2026 margins much better than feared and investments will peak in 1H, so 2027 story looks a lot better. For a stock where sentiment was mixed and a weaker NT guide was somewhat expected, the 2H/’27 forward looking commentary allowing stock to work this morning

The #s:

Marketplace GOV $29.683B, +39% y/y vs Street $29.314B, +~38% y/y; Orders 903M, +32% y/y vs Street 904M, +~32% y/y.

Revenue $3.955B, +38% y/y (last q +27% y/y) vs Street $4.001B, +~39% y/y (take rate 13.3% vs Street 13.6%).

Adj. EBITDA $780M, +38% y/y vs Street $773M, +~37% y/y; GAAP EPS $0.48 vs Street $0.58; FCF $648M vs Street $954M.

1Q26 guide: Marketplace GOV $31.0B–$31.8B (mid $31.4B), +~36% y/y vs Street $30.841B, +~34% y/y; Adj. EBITDA $675M–$775M (mid $725M) vs Street $798M.

Key Takeaways:

On margins, Mgmt highlighted front-loaded investment, including Deliveroo, and ~$20M winter-storm impact (January), reinforcing a “1H investment / 2H harvest” cadence. Commentary pointed to 2H26 EBITDA “significantly higher” than 1H26, with grocery/retail expected to become unit-economic positive / gross profit positive in 2H and international (ex-Deliveroo) moving toward contribution-profit positive in 2H, important for bulls underwriting 2027 margin trajectory. Re-platforming remains a major 2026 spend item (with some spill into 2027), with management highlighting improved feature velocity and AI-enabled productivity

Reported GOV benefits from Deliveroo, but investors are watching lower take-rate mix and investment timing. Management reiterated Deliveroo’s ~$200M FY26 EBITDA contribution target, while noting 1Q phasing (lower contribution in 1Q vs 4Q).

Management emphasized cross-category adoption (roughly ~30% of MAUs engaging with grocery/retail) and improving basket behavior (more “stock-up” trips). For bulls, this supports a bigger “local commerce OS” TAM and higher long-term monetization (ads, merchant services, fulfillment).

Management commentary on cohorts/MAUs/frequency suggested steady demand rather than consumer deterioration.

$5B share repurchase

Bull vs. Bear Debate:

Bulls view DoorDash as an “operating system for local commerce” with multiple durable growth engines that can coexist: 1) U.S. restaurant delivery continuing to compound on cohort health, selection, and affordability (DashPass), 2) grocery/retail shifting from a growth story to a profitability story as density and baskets improve, 3) international expanding TAM and extending the playbook via Wolt/Deliveroo, and 4) incremental monetization layers (ads, merchant services/software, fulfillment services, autonomy over time). Bulls will say DASH is not “just food delivery” but becoming the demand + logistics + software layer for local commerce, which supports a premium multiple. This quarter, bulls point to the fact that the fundamentals remained consistent: GOV and EBITDA were slightly ahead of Street, and order growth accelerated meaningfully year over year. The bulls also like the 2H26 setup management outlined (new verticals improving, international improving), because it helps investors underwrite a 2027 earnings power that looks better than the “investment-year” optics of 2026. The $5B buyback authorization adds another pillar to the bull case.

On valuation, bulls will say biz can sustain ~20% GOV growth into 2027 (with upside from international + new verticals + product velocity post re-platforming) and expand Adj. EBITDA to $5.5B+ by 2027 (vs street at $4.75B). At 20x+ gets you close to $250+.

Bears argue that DASH is still priced for “stronger-for-longer” execution, leaving little room for error when management is explicitly leaning into reinvestment. The bear worry isn’t that DASH can’t grow; it’s that the market may not reward growth if margin flow-through keeps getting deferred by (i) multi-year re-platforming spend, (ii) ongoing investments into autonomy and merchant services, and (iii) mix shift (grocery/retail and international) that can weigh on take rate and near-term profitability. Bears also stress that competition remains real across verticals (Uber in delivery, Amazon and others in grocery/perishables, and local players abroad), which can pressure incentives and limit take-rate expansion.

This quarter, bears have a clean set of “pushback” points: revenue missed consensus as take rate came in light, and 1Q26 EBITDA guidance was ~9–10% below Street at the midpoint, reinforcing the notion that near-term earnings power is being pushed out. Bears also highlight messaging that suggests less upside surprise going forward (i.e., management intent to land within guidance rather than repeatedly beat/raise), which can matter for a stock that often trades on expectation beats.

BKNG+1%: demand stayed resilient and U.S. share gains drove a clean beat with room nights better although helped by fx; 2026 outlook tilts incremental profit toward reinvestment (AI/Connected Trip) rather than near-term margin upside. 25-1 reverse stock split

The #s / Key Takeaways:

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.