TMTB Morning Wrap

Good morning. Futures +30bps. Stocks in Asia generally saw gains on Thursday: TPX +1.38%, NKY +1.34%, Hang Seng +2.12%, HSCEI +2.1%, SHCOMP +0.97%, Shenzhen +1.16%, Taiwan TAIEX +0.66%, Korea KOSPI +0.55%. Yields down 1-2bps across the curve.

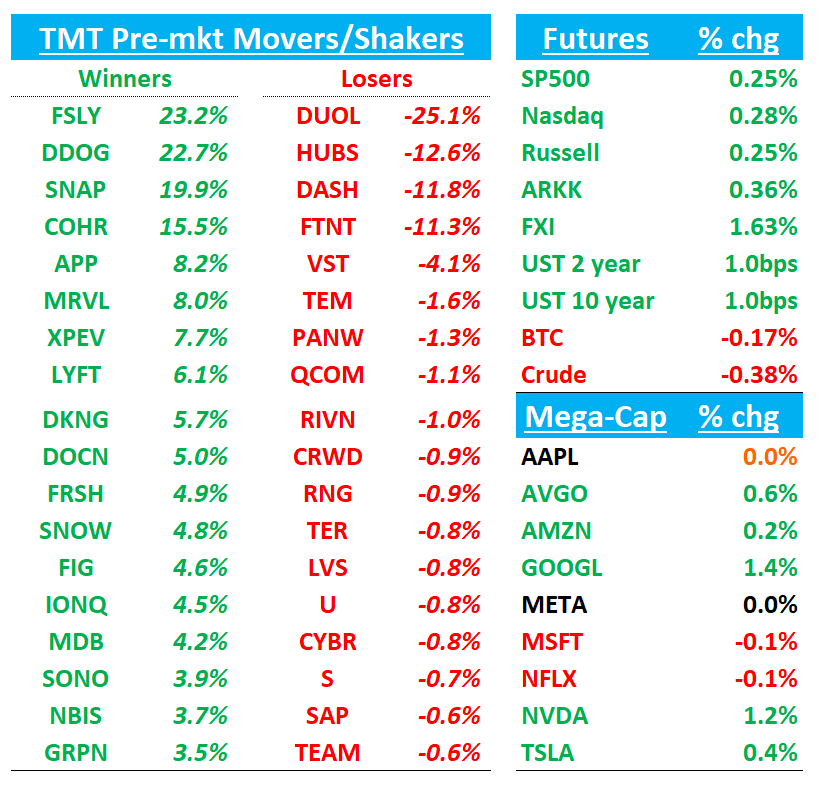

Lots of earnings to get to so we’ll hit those first (APP ARM DASH HUBS COHR DDOG DUOL FTNT), then move onto the usual…

APP +7% beat on Q3 and raised Q4, with growth still largely gaming/model‑driven while early e‑comm self‑serve is scaling from a small base; management emphasized 50% w/w spend growth from new self‑serve advertisers and reiterated a broader 2026 open GA target

#s were a bit better than buyside expected. The call went well and CEO sounded bullish, but wasn’t the massively bullish call like last quarter — things are progressing smoothly, guide is conservative and doesn’t assume any incremental advertisements. Mgmt said new self-serve advertiser spend is growing 50% w/w but remains “too soon to be significant.” Broader opening beyond referral planned in 2026; testing paid marketing and gen-AI creatives. “We’re demand constrained, not supply constrained.” Investors will continue to look at intra-q checks to guide them on e-comm rollout progress. Bull case remains intact here.

Key quotes:

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.