TMTB MORNING WRAP

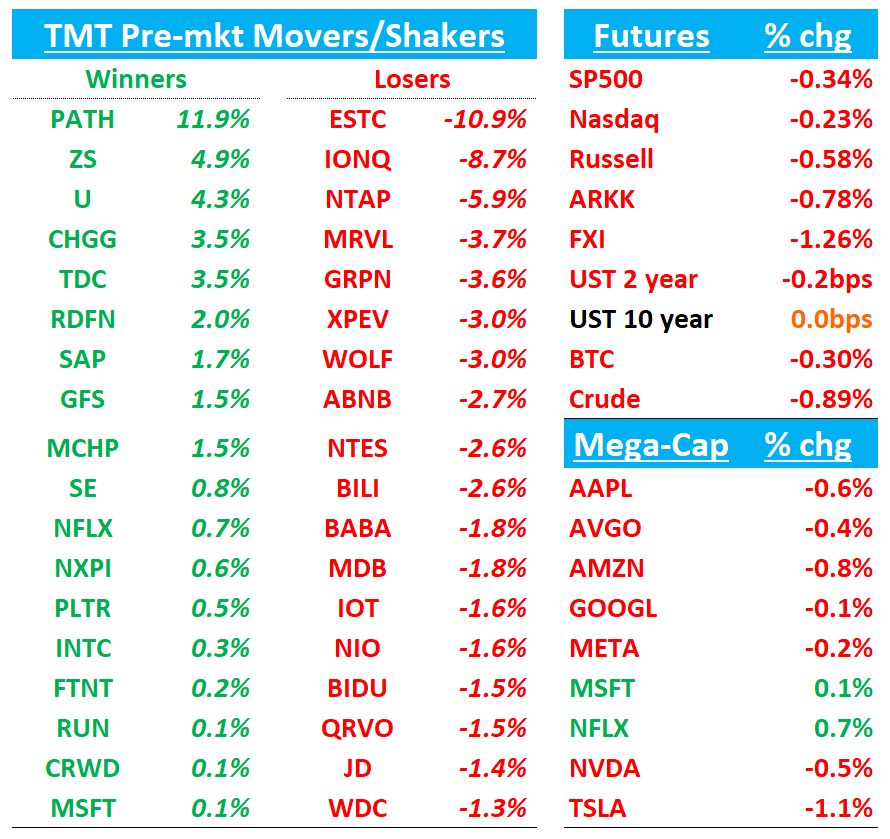

QQQ - 25bps as Trump has gifted everyone with a nice early morning surprise tweet, with some hawkish commentary on China: “so much for being Mr. Nice Guy”

Yields/BTC are flattish. China -1.25%.

We’ll hit Macro first, then Earnings (DELL, MRVL, ZS, NTAP), then move onto Tech/Research/Third Party Releases…

Happy Friday! Let’s get to it…

MACRO

Trump’s Team Plots Plan B for Imposing Tariffs

The administration’s tariff strategy was undermined when a court this week found it was illegal for Trump to impose sweeping duties by using emergency economic powers. A federal appeals court on Thursday allowed his duties to stay in effect while the administration’s appeal moves forward, but U.S. officials are weighing their options should they need to find a new legal authority to impose the president’s steep tariffs, which he argues will help rebalance trade in America’s favor.

The potential pivot reflects the challenges to Trump’s aggressive trade policy, which relied on a novel interpretation of trade law. Typically, tariffs are imposed using targeted authority delegated to the president by Congress, but Trump’s team relied on little-used emergency powers to impose the bulk of his wide-ranging second-term tariffs quickly.

With that strategy under threat, the president’s team is weighing a twofold response, according to people familiar with the matter.

EARNINGS

DELL: Weaker Q1 / Strong AI / Strong Q2 Guide but margins weigh

The Numbers:

Revenue was $23.4 bn, a hair above the $23.1-$23.2 bn consensus, but EPS landed at $1.55 versus the Street’s $1.70 as mix shifted to lower-margin AI racks and aggressive PC bids.

ISG did $10.3 bn (essentially in-line, but margins slipped to 9.7 % vs street at 10.8%

CSG $12.5 bn, handily ahead of the $12.0 bn consensus thanks to a 9 % jump in commercial PCs that offset a 19 % fall in consumer.

AI-server revenue was $1.8 bn, but orders up to $12.1 bn and backlog to $14.4 bn, vs bogeys closer to 11-12B.

Free cash flow printed $2.2 bn, enabling another $2 bn of buybacks.

Management guided July revenue to roughly $29 bn (16 % y/y, +14 % vs Street) and EPS to $2.25 (Street $2.11).

Management expects ISG margins to dip in Q2, reflecting strength in lower-margin AI shipments and sub seasonal performance in traditional server/storage segments.

FY 26 revenue was kept at $101-105 bn, but the EPS range nudged up to $9.40 (from $9.30) despite tariff headwinds, thanks to cost control and lower share count. ISG is expected to grow “high-teens” on $15 bn-plus AI shipments; CSG should rise low-mid single-digits as PC refresh gathers pace.

ISG margins are expected to trend down but improve sequentially into 2H on mix benefit from seasonal strength in storage.

Key takeaways:

AI flywheel keeps accelerating. Orders were 7× last quarter; shipments are guided to $7 bn next quarter, and pipeline sits well north of $30 bn.

Macro tone from management was cautiously constructive: February–March IT spending improved, but April saw a hiccup in North-America enterprise orders; guidance assumes that pause persists through summer.

Margins High-density AI racks dilute gross margin, and traditional servers/storage softened in April, but mgmt says opex discipline and greater storage IP mix should let margins recover in 2H.

Tariffs largely neutral—and maybe a share gainer. Dell’s U.S.-bound systems are already outside China, so the new sectoral duties mostly show up in peers’ pricing, not Dell’s cost stack. Management sees deflationary component costs outweighing any residual tariff drag.

Commercial PC refresh is real. Windows 11 migrations and early AI-PC demand pushed commercial units high-single-digits; management expects the trend to run all year. Consumer remains weak and promotional.

Bull vs. Bear Debate:

Bulls argue that the record $14 bn AI backlog, Dell’s supply-chain edge as NVDA’s Blackwell enters volume, and limited tariff exposure make FY 26 guidance look intentionally conservative especially given better Q2 guide. They also point to accelerating free-cash yield and the PC share-gain opportunity as rivals hike prices.

Bears counter that near-term profitability is hostage to mix: every billion of low-margin AI racks drags group gross margin ~20 bp, while consumer PCs and traditional servers already show macro fatigue. They also worry that AI attach revenue (storage, services, networking) is still out on the horizon, so valuation—now above Dell’s long-term 10× P/E band—rests on flawless execution and a benign macro backdrop. Bears will also say mgmt didn’t sound great on the call

MRVL: Numbers inline - print doesn’t settle any debates around Trn 3 / Trn 4

JPM recaps the 3 things that were confirmed on the call with regards to AI ASIC: 1) CEO confirmed they’ve secured 3nm CoWoS wafer and packaging for Trainium 3 production in 2026, meaning Amazon has approved orders and the project’s scale is understood 2) He explicitly confirmed work on Microsoft’s Maia 3, aligning with prior reports: “we are already engaged with this same customer on the architecture for the follow-on generation.” 3) He used similar phrasing to describe early work on Trainium 4, suggesting active architectural collaboration is underway. He also reiterated that AI revs should keep compounding through FY27 and beyond

Issue here is that CEO has lost a bunch of credibility and Asia noise continues (AI Chip said opposite a few days ago). Listening to him speak on the call, my read is he’s not being totally forthright. But if you take him at face value, this means they reserved 3nm wafer and packaging capacity for Trn 3 although bears will say a 3 nm follow on project doesn’t necessarily mean Trn 3, and could be a follow-on to Trn 2

Other Key takeaways

Numbers were clean: revenue and EPS landed a hair above consensus, while gross margin was essentially in-line; the July-quarter guide right in line with street as well

AI remains the flywheel: custom silicon, 800 G optics and early 1.6 T DSPs drove >60 % y/y top-line growth, and AI now sits near mid-40 % of total revenue—with management calling 50 % “not too distant.”

Cyclical pockets are mending: carrier and enterprise networking posted a fifth straight sequential uptick and are guided higher again; consumer gets a seasonal bounce; Auto/Industrial stays soft.

Bull vs Bear Debate

Bulls argue that the print confirms a bigger story: Marvell has locked in 3 nm capacity for Amazon’s Trainium 3, remains the incumbent on Trainium 2, and is already architecting Trainium 4, implying sticky, rising share even if AWS dual-sources. The same multi-generation dynamic appears to be unfolding with Microsoft’s Maia program. Add continued share leadership in 800 G/1.6 T optics and recovering networking demand, and bulls see FY-26/27 earnings power that is still under-appreciated with stock near valuation lows (17x FY27 P/E)

Bears counter that “securing wafers” does not prove Marvell owns the full Trainium 3 socket—AWS could split volumes—and note management’s gross-margin guide drifts below 60 %, reinforcing the view that custom ASIC hurts profitability. Skeptics also point to lukewarm Enterprise upside, lingering Auto/Industrial softness, and the lack of any new hyperscale design-win disclosures as signs that competitive pressure (particularly from Alchip) could cap upside until the June 17 “Future of Custom Silicon” event provides firmer proof.

Our view: The story here continues to be a bit too messy for us — trying to follow every single Asia supply chain check sounds like a fool’s errand. Stock seems destined to be rangebound until we get absolute confirmation on the Trn 3 / Trn 4, MSFT Maia debates. Maybe June 17th event provides more clarity.

NTAP -6%: Decent quarter but guide worse

The Numbers:

Revenue of $1.73 bn, vs street $1.723 bn and non-GAAP EPS of $1.93 versus $1.90 street.

Gross margin printed at 69.5 % (inline) and operating margin at 28.6 %, 60 bp above guidance.

Product GM slipped to 55.4 % as higher NAND prices and mix hurt, yet All-Flash ARR accelerated 14 % y/y to $4.1 bn, Public-Cloud revenue rose 22 % ex-Spot, and billings advanced 12 % y/y.

For July-quarter (F1Q-26) management forecasts $1.455-1.605 bn of revenue (mid-point $1.53 bn) and EPS of $1.48-1.58, both below consensus $1.60 bn / $1.65.

FY-26 revenue is guided to $6.625-6.875 bn (mid-point $6.75 bn) against Street $6.85-6.93 bn, while EPS of $7.60-7.90 inline with street

Key takeaways

Macro: Mgmt cited lengthening enterprise decision cycles in manufacturing-heavy Europe and persistent softness in U.S. public-sector IT budgets as the key reasons for a cautious start to FY-26. Tariffs are assumed to stay at the 10 % baseline, knocking 40-60 bp off gross margin; the bigger risk, according to mgmt, is customer hesitation in export-centric regions.

Mgmt framed the subdued guide as “prudence,” pointing to deal-cycle elongation in Europe, lingering U.S. federal budget inertia, and tariff-related uncertainty; they nonetheless highlighted a 5× year-on-year jump in AI-infrastructure wins and 150 AI deals closed.

Mix keeps shifting toward higher-margin engines—All-Flash arrays (AFA) and first-party cloud services—providing a cushion for gross/operating margins even as component costs and product mix weigh on product GMs.

Bull-vs-bear debate

The debate now hinges on whether a second-half re-acceleration materializes: bulls lean on AI demand, expanding cloud mix and disciplined opex; bears question the depth of macro weakness, product GM headwinds and NTAP’s ability to outgrow nimble rivals such as PSTG.

Bulls argue that All-Flash share gains (≈300 bp in CY-24 per IDC), an expanding cloud-software mix with 79 % gross margin, disciplined opex growth (~1 % vs. revenue 3 %), and a burgeoning AI pipeline position NTAP for upside as macro clouds clear. They also stress that the guide embeds tariff drag and Spot divestiture, setting a low bar.

Bears counter that another below-consensus guide underscores demand fragility; product GMs remain stuck mid-50 s and could face further NAND cost pressure; NTAP relies more than peers on Europe and U.S. federal spending; and valuation already discounts margin resilience while under-appreciating share threats from faster-growing competitors like Pure Storage.

ZS +5%: Clean beat/raise: revenue, billings, EPS, operating income and FCF all cleared Street, and FY-25 guidance was lifted by roughly the size of the beat. Some concern over weaker NRR and customer adds

The Numbers:

F3Q 25 revenue reached $678 m, about $12 m ahead of consensus, up 23 % YoY.

Billings printed $784.5 m, roughly 3 % above the Street and an acceleration to 25 % growth.

Non-GAAP operating margin of 21.6 % edged past the 21.2 % estimate, driving EPS to $0.84 versus $0.76.

Dollar-based NRR came in at 114 % (115 % prior quarter), ARR hit $2.9 bn (+23 %), RPO rose 31 % and FCF margin was 17.6 %, all comfortably ahead of street.

FY25 revenue to $2.660 bn (Street $2.650 bn) and lifted billings to ~$3.187 bn

Q4 revenue guide of ~$706 m is mildly below street but implies another 25 % billings jump on easier comps.

Key takeaways

Demand still resilient: management again saw “no macro slowdown,” billings grew 28 % and new-logo ACV rose ~40 % YoY.

Little tariff risk: management sees no direct or indirect impact from current U.S. tariff proposals; savings-driven ROI pitch continues to resonate even in uncertain macro conditions.

Account-based selling is expanding wallet-share; emerging pillars (Zero-Trust Everywhere, Data Security Everywhere, Agentic Ops) now exceed $1 bn ARR and are growing faster than the core.

Metrics to watch: NRR slipped to 114 % and net-new customer adds remain soft

Announced $675 m Red Canary deal to accelerate an AI-driven SOC strategy and named ex-Alteryx CFO Kevin Rubin

Bull vs. Bear debate

Bulls argue that the beat-and-raise proves the sales transformation is gaining traction: unscheduled billings and larger initial lands show customers adopting more pillars up-front; emerging cloud-security, data-protection and AI-SecOps products are growing >30 % and already 20 % of ARR; platform breadth plus a $96 bn TAM underpin management’s path to $5 bn ARR by FY-28. They also note that ZS is the lone off-cycle cyber name to avoid April softness, highlighting defensible share in SSE/SASE and limited exposure to tariff risk.

Bears counter that growth is increasingly driven by selling bigger bundles to existing customers, masking sluggish net-new logos and a second sequential tick-down in NRR. Margin expansion could pause as new products (DSPM, GenAI, MDR) carry lower early-scale gross margins, and the pivot from billings to ARR in FY-26 may expose decelerating growth. Street still embeds ~20 % FY-26 revenue growth; with a new CFO likely to guide conservatively, that bar may come down, creating an overhang. Bears also flag intensifying competition from Netskope, Cloudflare and PANW as enterprises weigh consolidated SASE suites.

Gets a downgrade at Piper…

Piper Sandler downgraded Zscaler to Neutral from Overweight with a price target of $260, up from $235. The company topped fiscal Q3 metrics and the back half of the year billings ramp appears "less daunting" given the quarterly performance, but the recent run in shares "have us mulling upside from here," the analyst tells investors in a research note. The firm highlights Zscaler's integrating an acquisition, pending guidance for the coming fiscal year and looming Fed uncertainty. As such, it believes investors should not chase the shares and look for more compelling entry points

ESTC: Misses Cloud revs and and guides to 12% vs street at 14% for FY26. Management attributed the conservative guide to continued caution around US Federal Civilian agency weakness and assumed broader consumption headwinds in 2H

MCHP: Positively pre-announces with over a month left in the quarter

Microchip raised the midpoint of its June quarter guidance and now sees revenue of $1.045-1.070B vs prior $1.025-1.070B and adjusted EPS of $0.22-0.26 vs the prior $0.18-0.26.

PR:

"With almost two months of the quarter behind us, our business is performing better than we expected at the time of our May 8, 2025 earnings conference call. Our bookings activity for the month of May is tracking to be higher than any month in the last two years. We are gaining confidence in the recovery of our business as we execute on our strategic initiatives, reduce inventory levels and make progress towards our long-term business model."

RESEARCH/NEWS

U: Jefferies upgrades to Buy

Jefferies upgraded Unity to Buy with a new price target of $29 (from $22), citing early signs of accelerating growth driven by its improved Vector ad model. The firm sees early signs of U’s Vector ad targeting model improving returns for customers — they cite U saying Vector provides a 15-20% lift in both app installs and inapp purchases, which jives with what they are hearing from their AdTech survey. Jefferies cites potential for at least high-single-digit revenue growth in FY26, supported by upcoming product upgrades and stronger management execution. Jefferies highlighted renewed momentum in the Create segment, cost discipline following restructuring, and higher incremental EBITDA margins, especially in Grow. They also noted improved confidence in Unity’s leadership team and view the current valuation as attractive given the margin leverage potential.

THIRD PARTY DATA ROUNDUP

AMZN: Yipit continues to track 3-4ppts above street, calling out improved May growth

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.