TMTB Morning Wrap

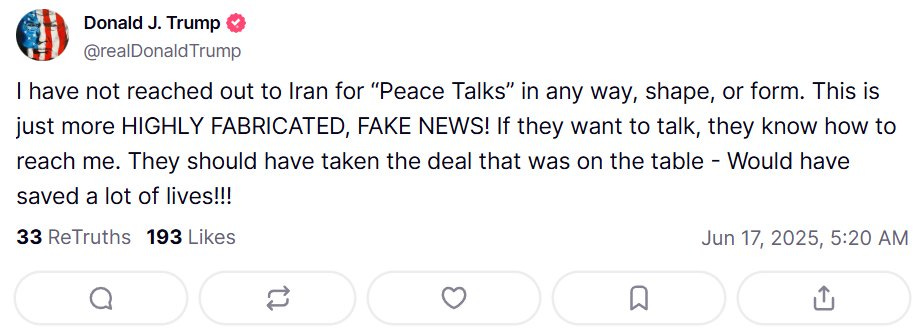

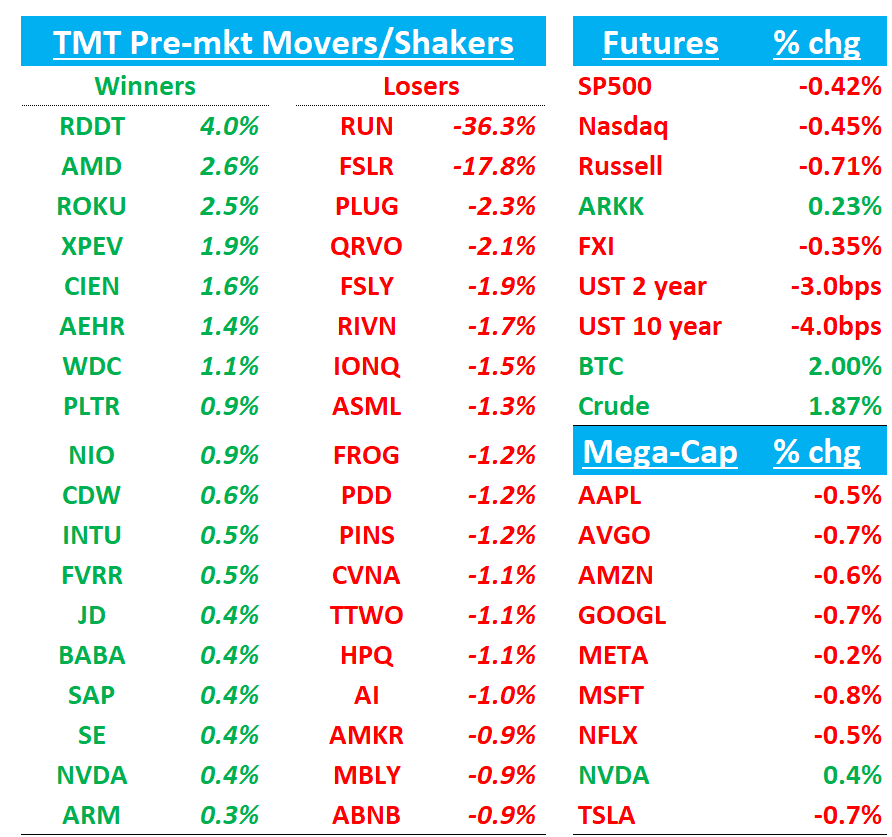

QQQs -45bps as Israel vs. Iran continues…

BTC -3%; yields ticking down slightly. AMD +2.5% following through on yesterday’s big move. RDDT +4% also up early as our write-up talked up narrative flip as data improves. Solar stocks all down heavy on Senate not changing much of the EV cuts.

Lots to get to, so let’s get to it…

RDDT +4%: TMT Breakout (hey, that’s us!) says short script has flipped 180 since last month as AI Overviews/AI Mode drive data improvement - link

RDDT mgmt at Cannes today - meetings going on right now with Citi/investors. Will be interesting to hear if tone changes from last round of meetings with sell-side in late May, which was right around the time GOOGL AI Overview/AI mode change and data inflected…

NVDA: Barclays Raises PT to $200 on Supply Chain Strength, Sees $2B July Upside

Barclays raised its price target on NVDA to $200 from $170 and reiterated an Overweight rating after supply chain checks post-Q1 suggest ~$2B upside to July revenue vs. Street estimates. The firm raised its Compute segment forecast to $37B (from $35.6B) despite Blackwell wafer output in June coming in at 30,000—below its prior 40,000 expectation. Still, utilization remains strong, and agentic AI demand is driving positive sentiment into 2H25. With 30% q/q growth in Blackwell capacity and better-than-expected usage rates, Barclays has increased confidence in the October quarter outlook.

ROKU: Loop Upgrades to Buy, PT to $100 on AMZN Ad Partnership Upside

Loop Capital upgraded ROKU to Buy from Hold and raised its price target to $100 from $80, citing the newly announced Amazon ad partnership as a meaningful catalyst. The firm expects the collaboration—linking Roku’s user base with Amazon’s DSP and shopping data across an estimated 80M CTV households—to begin positively impacting Roku’s financials starting in 2025. Loop sees the deal reinforcing Roku’s position as the leading TV OS in the U.S., combining its scale with Amazon’s retail targeting engine.

THIRD PARTY DATA ROUNDUP

AFRM: M-sci says data suggest accelerating growth, particularly in travel and retail

SPOT: M-sci saying Net add momentum continues in Europe

META: Yipit out saying initial estimate is 13% vs street at 15%, calling out street mismodeling fx

META: ISI Sees $10B+ Ad Opportunity in WhatsApp Updates, Reiterates Outperform

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.