TMTB Morning Wrap

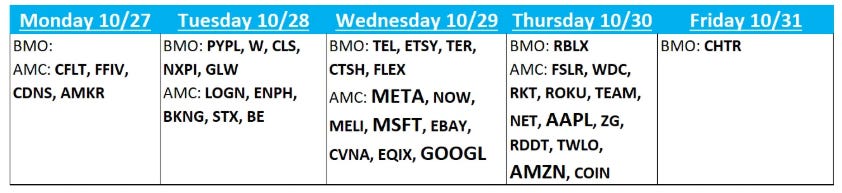

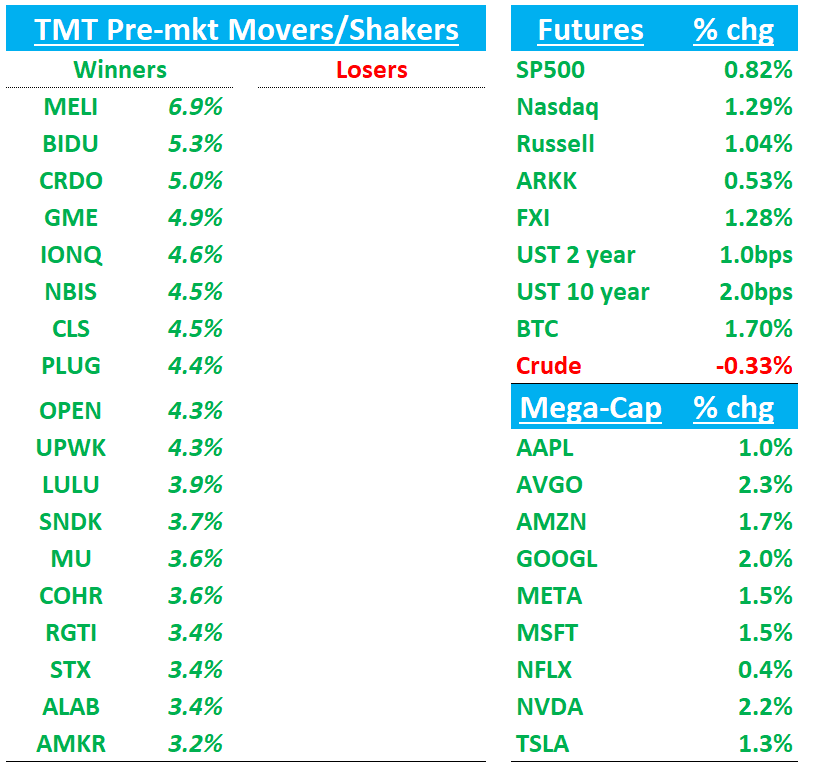

Good morning. Futures +1.3% as optimism around US and China closing in on a trade deal has stocks higher early with AI names outperforming early. We have a busy week of earnings with close to 50% of TMT market cap reporting, Fed meeting, and Jensen with a keynote at GTC in DC tomorrow at noon. Going to be a fun one - we’ll be here to cover it all.

Stocks up across the board in Asia on Monday: TPX +1.7%, NKY +2.46%, Hang Seng +1.05%, HSCEI +1.1%, SHCOMP +1.18%, Shenzhen +1.26%, Taiwan TAIEX +1.68%, Korea KOSPI +2.57%. Memory stocks particularly strong with some limit up: Kioxia +11%, Phison +10%, Nanya +9.6%, Hynix +7.5%, Samsung +2.5%.

BTC +1.7%

Let’s get to it…

Macro: US, China Tee Up Sweeping Trade Deal for Trump, Xi to Finish

Top trade negotiators for the US and China said they came to terms on a range of contentious points, setting the table for leaders Donald Trump and Xi Jinping to finalize a deal and ease trade tensions that have rattled global markets.

After two days of talks in Malaysia wrapped up Sunday, a Chinese official said the two sides reached a preliminary consensus on topics including export controls, fentanyl and shipping levies.

US Treasury Secretary Scott Bessent, speaking later in an interview with CBS News, said Trump’s threat of 100% tariffs on Chinese goods “is effectively off the table” and he expected the Asian nation to make “substantial” soybean purchases as well as offer a deferral on sweeping rare earth controls. The US wouldn’t change its export controls directed at China, he added.

China rhetoric largely consistent; Li Chenggang said they reached a “preliminary consensus” and will next go through their respective internal approval processes (Reuters)

MSFT: Guggenheim Upgrades to Buy, Calls Microsoft the “Obvious and Not-So-Obvious” AI Winner

Guggenheim upgraded Microsoft to Buy with a $586 price target, about 12% upside, highlighting both its clear and under-appreciated leverage to AI adoption. The firm says Azure remains the “obvious” AI beneficiary given its recurring cloud model and strong consumption trends, while M365 represents the “not so obvious” upside through direct AI monetization in Office via Copilot. Guggenheim believes Microsoft’s dual monopolies in Azure and Office create a durable growth runway, and sees the company well-positioned to outperform consensus after a very strong FQ4. The firm also notes that while valuation isn’t cheap, leadership execution and visibility into AI-driven profit expansion justify the premium. Risks include potential Azure deceleration, slower-than-expected Copilot monetization, or margin pressure from infrastructure build-out.

BKNG: Truist Upgrades to Buy, Sees Multiple Growth Drivers Ahead

Truist raised Booking Holdings to Buy from Hold and lifted its price target to $5,750 (from $5,630), pointing to an improved risk/reward setup after the recent pullback. The firm says the long-term travel backdrop in Asia, combined with “steady” global GDP growth, supports sustained earnings expansion. Truist believes investor worries about AI-related disruption are overstated and argues that Booking still has “several avenues of near- and long-term earnings growth.” The firm adds that the stock’s valuation has become more compelling relative to its growth outlook.

BKNG: Hearing M-sci says accelerating volume MTD vs Sept.

MEMORY

MU: Citi Lifts PT to $275, Says DRAM Prices Seeing ‘Statue of Liberty’ Surge on AI Demand

Citi reaffirmed its Buy rating on Micron and boosted its price target to $275 (from $240), citing the strongest DRAM pricing spike since the 1990s. The firm projects 4Q25 DRAM prices up ~25% QoQ, driven by tight supply and surging AI-related demand, with spot pricing up nearly 50% in the past two weeks. Citi expects Micron sales to rise roughly 20% QoQ, as historical data shows a ~21% sales increase when DRAM prices climb above 20%. The firm’s new FY26 EPS forecast of $23.36 sits about 40% above consensus, reflecting confidence in continued pricing strength and the company’s outsized leverage to AI infrastructure trends.

Samsung launches aggressive price-cut strategy to catch up in HBM competition - Digitimes

Memory leader Samsung Electronics is fixated on reclaiming its dominance, reportedly launching a 30% price cut strategy in an attempt to catch up after delays in its 12-layer HBM3E certification.

With HBM4 expected to emerge in 2026, Samsung is anticipated to maintain its aggressive pricing edge, with initial quotes about 6-8% lower than those of SK Hynix.

Memory: TrendForce revised upward DRAM contract price forecast for Q4 2025

The upward revision reflects the effect of additional orders from CSPs, which have driven DRAM prices to rise by more than 20% quarter-on-quarter. Specifically, the blended ASP for PC DRAM has been raised from the previous 3–8% to 18–23%, while server DRAM has been revised from 5–10% to 15–20%. For mobile DRAM, both LPDDR5 and LPDDR4 have been adjusted upward — from 8–13% and 15–20% respectively, to 20–25% and 18–23%. Overall, conventional DRAM has been revised from 8–13% to 18–23%, and the blended ASP for HBM has also been raised from 13–18% to 23–28%

SNOW: Reaffirms Guidance After Unauthorized Exec Comments Surface on Instagram - link to instagram

SNOW CRO Mike Gannon was interviewed by IG account theschoolofhardknockz and stated that SNOW “will exit this year at just over $4.5B and get to $10B in a couple of years.” These numbers roughly inline with the street.

Snowflake reaffirmed its Q3 and FY26 revenue outlook after an executive gave an unapproved interview on Instagram, where remarks were made about the company’s future results. The company clarified that the individual was not authorized to disclose financial information and urged investors not to rely on those statements. Snowflake reiterated that its official guidance, last issued on August 27, 2025, remains unchanged and that Q3 results will be released as planned. The firm emphasized that its corporate disclosure policy and guidance philosophy continue to apply without modification.

TSM: Needham Raises PT to $360 on N3 Upside and Higher 2026 CapEx

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.