TMTB Morning Wrap

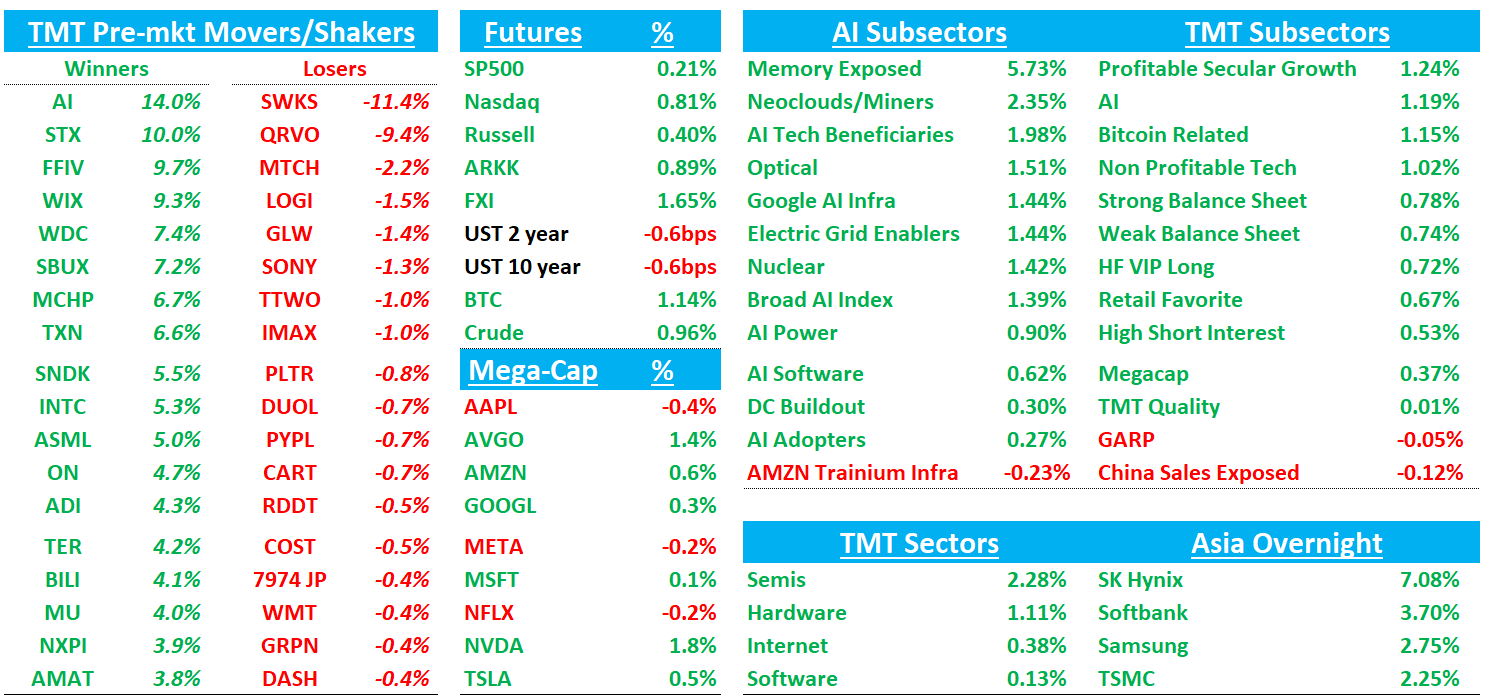

Good morning. Futures +85bps on the back of positive earnings from STX, ASML, and TXN. The ACCel era living up to its name as AI vibes continue to be strong to start the year. Asia mixed: TPX -0.79%, NKY +0.05%, Hang Seng +2.58%, HSCEI +2.89%, SHCOMP +0.27%, Shenzhen -0.01%, Taiwan TAIEX +1.5%, Korea KOSPI +1.69%. Yields/BTC are flattish.

We’ll hit up earnings first, then dive into the usual.

EARNINGS

STX +9%: Clean beat and raise upside driven by nearline/data center strength, constructive pricing, and operating leverage with the call the standout as mgmt commentary around demand and pricing v constructive

The #s:

Revenue $2.83B, +22% y/y (last q +21% y/y) vs Street $2.74B, +~18% y/y

EPS $3.11 vs Street $2.83; Non‑GAAP GM 42.2% vs 40.8%; Non‑GAAP OM 31.9% vs 29.6%.

Exabytes 190EB, +26% y/y vs Street 190EB (in-line) with DC remaining the core driver.

FQ3 (MarQ) guide midpoint: Revenue $2.90B, +~34% y/y vs Street $2.78B, +~29% y/y; EPS $3.40 vs Street $2.98; OM approaching mid‑30%s vs Street 30.4%

Key Takeaways:

Management described an “exceptionally strong” DC environment and expects DC demand to more than offset typical March seasonality in Edge IoT; enterprise OEM markets are seeing slight improvement in traditional server units plus incremental storage-server demand tied to AI workloads

Management reiterated nearline capacity fully allocated through CY26, with plans to start accepting 1H27 orders and long-term agreements providing strengthening visibility through CY27, with customers already discussing CY28 needs

Management reiterated revenue per TB remains relatively stable and called out a modest sequential increase in $/TB with that trend expected to continue. Commentary in the discussion around long-term agreements points to flat-to-slightly-up pricing on renewals—an important change vs prior cycles and a key driver of multiple expansion if it persists.

Management highlighted Mozaic 3 qualification progress (now across major U.S. CSPs) and plans to begin Mozaic 4 ramp shortly, while continuing to message a longer areal-density roadmap (including 7TB/disk demonstrated in labs). This supports the bull view that cost/TB falls while $/TB holds up

190EB shipped (+26% y/y) was in-line vs Street, but management emphasized shipping exabyte growth while keeping overall unit capacity relatively flat, driven by higher average capacity per drive (areal density) and disciplined supply

On Agentic AI:

Among the most promising of these is Agentic AI, which relies on persistent access to large volumes of historic data… With the deployment of AI agents at the edge… we believe the stage is set for a sustained and meaningful increase in data generated and stored that will support inferencing, continuous training, and also maintain model integrity.”

Hard drives are essential to these architectures, anchoring the mass capacity data tier that stores the vast majority of exabytes, from storing the checkpoint data sets used to train and maintain model integrity to supporting vector databases that provide the context necessary for accurate inference results and Agentic AI performance.

Bull vs Bear Debate:

The bull argument is that STX has crossed into a structurally better HDD cycle: a rational market structure, limited unit output growth, and customers increasingly buying on exabytes/$ per TB rather than units. In that construct, management’s commentary that nearline is allocated through CY26 and that demand discussions extend into CY27/CY28 is interpreted as unusually strong visibility for what has historically been a very cyclical business. Bulls also see the “flat-to-up $/TB” messaging as the key inflection: if price per TB can hold steady (or rise modestly) while areal density drives cost per TB down, the margin model changes meaningfully.

This quarter, bulls will point to three specifics: (1) the beat and raise with March profitability implied to step up again, (2) management explicitly calling out stable revenue per TB and a modest sequential increase expected to continue, and (3) continued HAMR execution (qualification/ramp progress and the roadmap messaging) which supports the “cost-down accelerator” narrative.

Bulls will say slap a 20x multiple on $30 of CY EPS gets you to $600 as its obvious demand is stronger for longer and this cycle is unique vs. prior cycles so premium multiple warranted. We find it hard to disagree.

Bears argue that—despite the strong print—HDDs remain cyclical and highly exposed to data-center build rates, enterprise refresh cycles, and the pricing behavior of the industry over time. In the bear view, today’s “tight supply” and strong pricing backdrop can loosen if either demand normalizes (AI spend digestion, delayed datacenter builds) or if the industry over-responds on supply. Bears also focus on substitution risk at the margin (SSD/flash, tiering changes) and execution risk in the HAMR transition: even if HAMR is progressing, the risk is that yields/cost downs or customer transitions don’t play out cleanly enough to sustain the very high incremental margin implied by near-term guidance. This quarter specifically, bears can concede the upside but still flag: (1 exabytes were in-line (not a big beat), so the “how long can pricing/GM outperform?” question remains; (2 the March guide implies extremely high incremental profitability, which bears may view as hard to repeat; and 3) will say these are cyclicals and should not trade at 20x

TXN +7%’s Q4 roughly in line on revenue with a margin beat, but Q1 guide better than seasonal and buyside driven by improving orders/turns and strength in Data Center

Overall, CEO sounded v bullish on industrial recovery and DC strength saying linearity strengthened each month of Dec q and order rates better than expected.

Key #s / Takeaways

4Q revenue was $4.423B, +10.4% y/y vs Street ~$4.43B (+~10.5%), but 1Q guidance midpoint $4.50B (+2% q/q) , +10.6% y/y vs Street ~$4.42B (+~8.7%).

4Q gross margin 55.9% vs Street ~54.9%. Q1 implied GM 56-57% vs street at 55%Management expects low-single-digit price declines (~2–3%) again in 2026 and said 1Q pricing is typically down due to annual negotiations—important against a backdrop of some competitors talking about price increases

Management recast end markets to break out Data Center, and called out ~70% y/y growth (and continued sequential growth).. The company described improving orders and backlog/linearity in industrial, but also emphasized the market is still real-time / turns-driven and flagged uncertainty around sustainability (industrial still materially below prior peak levels).

Mgmt highlighted backlog building (Oct→Dec) and lead times below 13 weeks (many parts ~6 weeks) with turns business running higher

Bull vs. Bear Debate

Bulls will argue this quarter’s most important development is that guidance behavior changed: 1Q is typically seasonally down for TXN, yet management guided up sequentially at the midpoint, and explicitly attributed it to orders strengthening through the quarter, backlog/linearity improving, and turns running higher, which is the inflection bulls were hoping for. The fact that management also called Data Center up ~70% y/y and continuing to grow sequentially reinforces a second bull pillar: TXN is increasingly exposed to AI/data-center spend through power and signal-chain content, giving the model an incremental growth vector beyond classic industrial/auto cycles. Even with price erosion, TXN delivered a 4Q gross margin that screened above Street, and it is nearing the end of a multi-year elevated CapEx cycle while receiving policy tailwinds (ITC and direct funding). That combination—improving demand + stabilizing utilization + CapEx downshift—supports a multi-year FCF/share step-up, which is what ultimately matters for analog investors and TXN’s premium multiple

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.