TMTB Morning Wrap

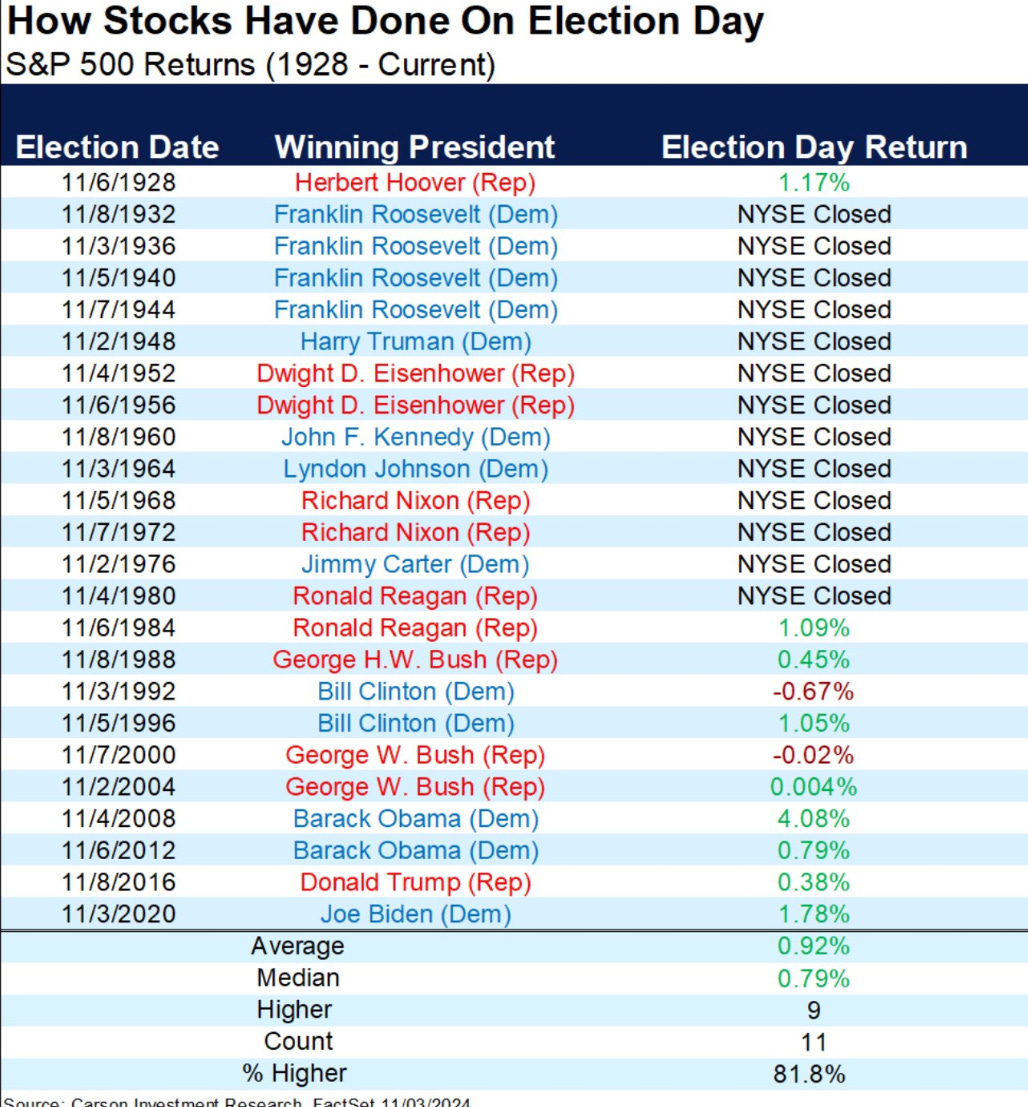

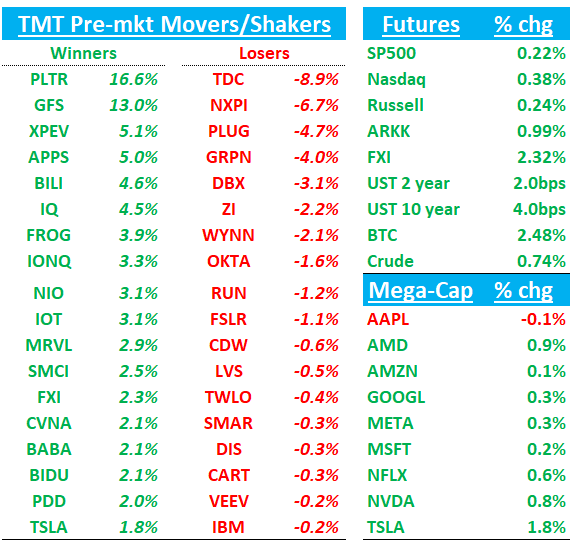

QQQs +40bps on election day as nate silver has election as 50/50 toss up and betting markets lean slightly trump. Treasuries are seeing modest pressure with yields slightly up. Crude continues to tick up. China +2% and BTC +2.5%

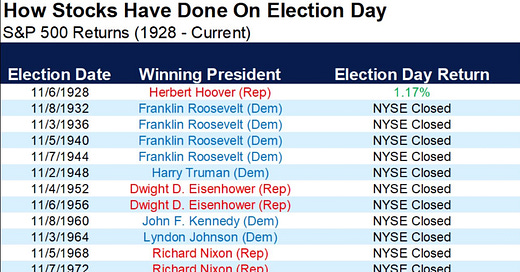

Here’s how market has fared during previous election days:

We’ll hit up earnings recaps for PLTR, NXPI, GFS, ALAB, MQ first the move onto Research/News today…Let’s get to it...

PLTR +16% with a 4% beat to revs accelerating 3% on a 4 ppt tougher comp and big beat to Operating Profit. Rev guide for Q4 also better.

PTLR continues to fire on all cylinders. Beat and raise driven driven by two large government contract wins this year (MAVEN and TITAN).

Mgmt sounded bullish on the call. A few key points for the bulls:

said they “Eviscerated” this quarter due to GenAi strength, calling out wins in the market as products are production ready vs vague LLM prototyping saying its all about the app layer on top of LLMs.

US government revenue grew 40% Y/Y compared to 23% last quarter and 10% in 3Q last year. Strongest growth in 15 quarters.

Operating profit big beat with margins rising to 38%

Seeing strength in US Commercial business. Customer counts increased 77% y/y driven by momentum in AIP.

Seeing substantial deal cycle compression due to boot camp leverage. Expect favorable unit economics and continued higher throughput to drive business growth.

Bears will point to a few things: 1) commercial revs of $317M missed street at $330M, partly due to a reduction in revenue from a government-sponsored enterprise in the Middle East. 2) international continues to be weak with 2% growth, the slowest since Q3’22 with absolute dollars flat since Q4’22. 3) US commercial growth strong but decel’d to 59% from 70% last q. 4) Overall commercial rev growth slowed to 26% slowest since Q3’23. Finally, bears will point to valuation as they always do saying stock is trading at 70x FCF for a mid 20s top line grower.

Street pretty positive on the results as expected other than William Blair who sides with the Bear points above. MS takes their underweight rating away (moves to not rated) as: 'the company has marched toward a rare rule of 68 profile with revenue growth of 30% seemingly more sustainable and operating margins of 38%, suggesting that Palantir is emerging as a platform of choice in this stage of the GenAI cycle'

TMTB’s take: We have been big bulls on PLTR over the last year. While we continue to love the biz momentum, we recently stepped to the sidelines before the print as we are entering a period of tougher comps (17% —> 30%% over 5 quarters) after 7 quarters of easier comps which aided in topline showing rev acceleration. PLTR’s print surprised us with the magnitude of acceleration so we think stock deserves to be up. We think PLTR can still work higher if they continue to show accelerating revs like they did this quarter (3 ppts accel on a 4 ppts tougher comp), but this is a tougher set up than we’ve had over the past year when stock was up 150%. We are less confident about how stock does with growth likely decel’ing next year and valuation at nose-bleed levels. We typically dismiss valuation arguments when top line is acccel’ing in tech, but pay more attention when the opposite is more likely to happen. Still, we might be wrong if PLTR is able to continue to accel revs which might happen, but we feel ok staying on the sidelines for now and waiting for the next high quality set up.

PLTR F/Y GUIDANCE

- Guides ADJ operating profit $1.05B to $1.06B, saw $966M to $974M, EST $970.5M

- Guides ADJ free cash flow above $1B, saw $800M to $1B

- Guides US Commercial revenue above $687M

GUIDANCE: Q4

- Guides revenue $767M to $771M, EST $746.5M

- Guides ADJ operating profit $298M to $302M, EST $261.6M

RESULTS: Q3

- Revenue $725.5M, +30% y/y, EST $703.7M

- Operating profit $113.1M vs. $40.0M y/y, EST $87.3M

- EPS $6.00 vs. $3.00 y/y

- Cash and cash equivalents $768.7M, EST $831.4M

- ADJ operating profit $275.5M, +69% y/y, EST $236.1M

- ADJ EPS $0.10 vs. $7.00 y/y, EST $0.09

- ADJ EBITDA $283.6M, +65% y/y, EST $244M

- ADJ free cash flow $434.5M vs. $140.8M y/y

- ADJ operating margin 38% vs. 29% y/y, EST 34.5%

ALAB +23%: Blowout quarter as revs, GMs and EPS beat and company talks up multiple product cycles which haven’t started to ramp

Weirdly this stock is somewhat shorted (9% short interest) as some HFs hate thinking NVDA is designing out their core retimers in next gen GPU systems so likely some covering going out there.

Beat was driven by strong PCIe 5 demand from an expanding customer base including NVIDIA's GPU and ASIC platforms. The company revealed it's already sampling PCIe 6 in NVIDIA's Blackwell platforms across multiple SKUs. The company is executing well on three new product lines: 1) Taurus AEC networking 2) ARES SCM 3)Scorpio fabric switching (adding ~$2B annual TAM opportunity…it’s in pre-production volumes and should contribute more than 10% of sales next year)

Co guided to 13% sequential revenue growth for Q4, citing sustained demand for PCIe retimers across a growing customer base. Beyond basic PCIe 6 content gains, the company is increasing dollar content through new PCIe switch/fabric solutions in NVIDIA Blackwell GPU and other XPU platforms.

Street largely raising PT’s to $100+ and print helps bulls cement their belief in $2+ of EPS power.

GFS +11% with a nice beat on revs and EPS

Investor will like this given the mixed data points in semis outside AI and positioning leaned short heading into the print. Call coming up and key will be commentary around end market demand.

Q3 Revenue $1.739bn in line with street (Guide $1.7-$1.75bn)

Q3 Gross Margin 24.7% in line with the street (Guide 24%)

Q3 Adj EPS $0.41 vs. Street est. $0.31 (Guide $0.28-$0.38)

Q4 Revenue GUIDE $1.8bn - $1.85bn vs. street est. $1.803bn

Q4 Gross Margin GUIDE 25% vs. Street est. 24.7%

Q4 EPS GUIDE $0.39 - $0.51 in line with street

Mgmt commentary:

"In the third quarter, the GF team continued to execute next generation opportunities with our customers, by securing key design wins across our growing portfolio of essential chip technologies,” said Dr. Thomas Caulfield, President and CEO of GF. "We delivered consistent financial results at the upper end of the guidance ranges we provided in our August earnings release, and as we continue to navigate the ongoing uncertainties facing our industry, we remain on-track to deliver approximately a threefold increase in our year-over-year Non-IFRS adjusted free cash flow generation by the end of 2024."

NXPI -6% as guide worse than buyside whispers. Inline revs and slight beat to GM. Industrial down seq but all other end mkts up seq

Guide a bit worse than expected as investors looking for LSD/MSD miss vs street; instead was closer to 8%. Call this morning. Celanese miss (chemical co with auto exposure) not helping

Q3 Revenue $3.25bn vs Street est $3.255bn

Q3 Non GAAP EPS $3.45 vs. in line with street (Guide $3.21to $3.63)

Q4 Revenue GUIDE $3.0.bn-$3.2bn St est. $3.371bn

Q4 Non GAAP GM GUIDE 56%-58% vs Street est. 58.6%

Q4 Non GAAP EPS GUIDE $2.93. to $3.33 vs. St est. $3.62

Automotive (56% of revenue) met expectations with 6% sequential growth (-3% YoY), aligning with guidance. However, Industrial & IoT (17% of revenue) significantly underperformed, dropping 9% sequentially (-7% YoY) versus expected low-single-digit growth. Mobile (13% of revenue) performed in-line with expectations, while Communications Infrastructure & Other (14% of revenue) outperformed with 4% sequential improvement, though still down 19% YoY.

PR:

“While we experienced some strength against our expectations in the Communication Infrastructure, Mobile and Automotive end markets, we were confronted with increasing macro related weakness in the Industrial & IoT market. Our guidance for the fourth quarter reflects broader macro weakness especially in Europe and the Americas.”

MQ -40% on significant guide down of Q4 GP and uncertainty regarding ‘5 outlook

Two key headwinds impacting Marqeta's outlook:

Primary factor (80% of Q4 impact) stems from ongoing elevated regulatory scrutiny around bank partnerships, leading to implementation delays. While this isn't new - H1 already saw extended timeframes - Q3/Q4 expectations for normalization didn't materialize as hoped. IManagement indicates current timeframes are stable heading into Q4, and they're onboarding new banking partners to address backlog by Q1 end. While visibility remains limited, Q4/2025 assumptions appear reasonable based on current conditions.

Secondary factor (20% of Q4 impact) relates to select customers internalizing certain functions. This appears contained and potentially industry-wide rather than company-specific, though it may resurface periodically.

New Fy Guidance:

Net revenue growth is expected to be -26% (previously -24% to -27%)

Gross profit growth is expected to be 6% (previously 7% to 9%)

Adjusted EBITDA margin is expected to be 5% (3% to 5% previously)

News/Research

3P Roundup:

CVNA: Hearing 3p showing a bit of a decel to mid 50s rev growth in the latest week, still tracking well above street for Q4

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.