TMTB Morning Wrap

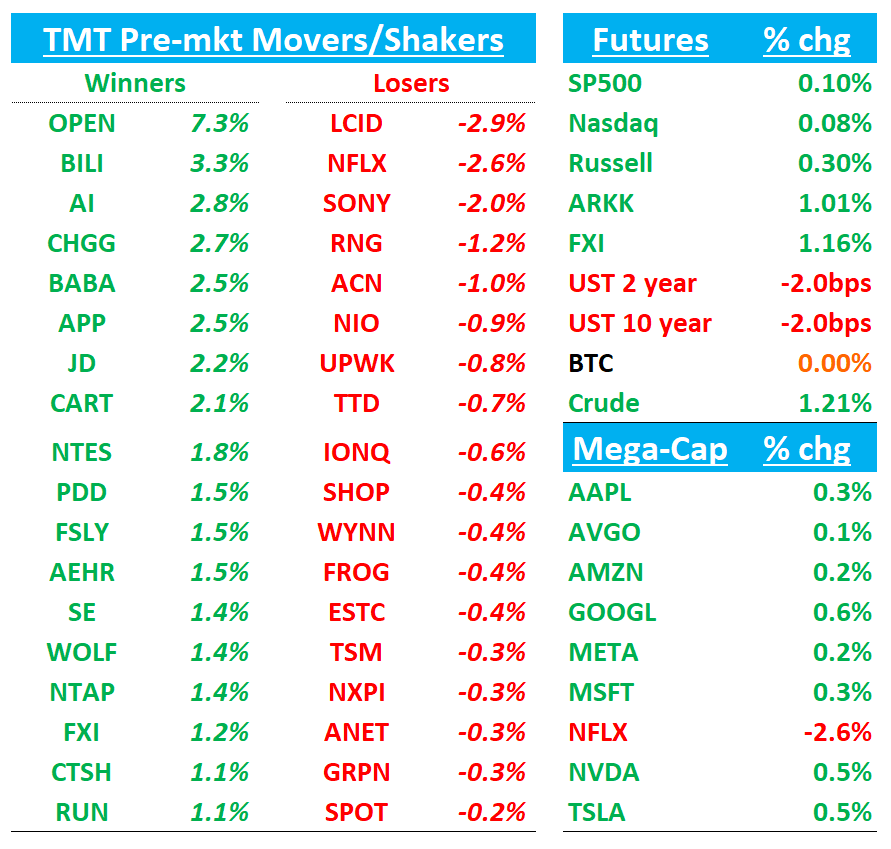

Good morning. QQQs +4bps on a slow Friday summer morning. NFLX results were ok, unlikely to change the narrative. The macro front is quiet with no major developments since the Thursday close other than Fed’s Waller speech post-close where he explicitly called for a 25bp cut at the upcoming July meeting. Fed expects still hover around 42bps worth of cuts for the rest of the year. Yields down 2bps to start the day. China +1%. BTC flat.

We’ll dive into NFLX first then the other good stuff…Happy Friday - let’s get to it…

NFLX: Ok quarter. Q2 revs a bit light of expectations but better Q3 guide. Q3 + FY Margin guide a bit light of bogeys. FY Raised.

Expectations high were higher going in and stock crowded, but there’s not much in this print to change narrative here although one could argue things came in a bit light of buyside expects. Buyside numbers maybe move a smidge lower - most still around $35 for 2026 - but all in all seems fine.

Main nit is engagement only up 1% with viewing slipping on a per member basis, but mgmt stressed that on an owner household basis engagement has held “relatively steady over the past two and half years” and “we’re glad to have held that normalized engagement level … and expect engagement growth in the second half given the slate.” (Squid Games 3, Wednesday, Stranger Things, Knives Out sequel)

Main debate here still how much upside left in the stock: 35x $35-$36 = ~$1225-$1260, right around where stock is trading. Need to go out to ‘27 for 35x $40 = $1400 to pencil in upside to the stock.

The Numbers:

Q2 Revs $11.08 vs street at $11.06B and EPS of 7.19 vs street at 7.08…top line a bit light of bogeys

Q3 Revenue guide 17% in Q3 above bogeys of 15.5% and street at 14.8%, driven by growth in members, pricing, and ad revs.

Q3 Operating margin guide of 31% vs street at 31.35%

FY operating margin guide of 29.5% (30% FXN) vs street at 29.7%, less than buyside at 30%+

FY Revenue Guide $44.8-$45.2B up from $44B

Kept language around doubling ad revenue in 2025

Bull vs Bear Debate:

Bull case here remains the same as ever: It’s Netflix. Their unmatched scale lets it layer new money‑makers—price hikes, paid‑sharing fees, and a fast‑growing ad tier—on top of a 270 M‑plus subscriber base. With content spend held near $18B, these levers are already lifting operating margin toward 30 % and driving FCF growth. Management still expects ad revenue to roughly double in 2025 and sees AI tools trimming production costs and enhancing personalization, giving the model further operating leverage. If the deep 2H slate reignites viewing hours, bulls argue earnings can compound at 30% justifying a multiple they hope can inch towards 40x.

Bears will point to engagement only rising 1% and limited head-room for future ARPU gains with increasing competition from YouTube and short-form content while pointing to valuation being full.

TMTB: We don’t find the set up interesting either way.

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.