TMTB Morning Wrap

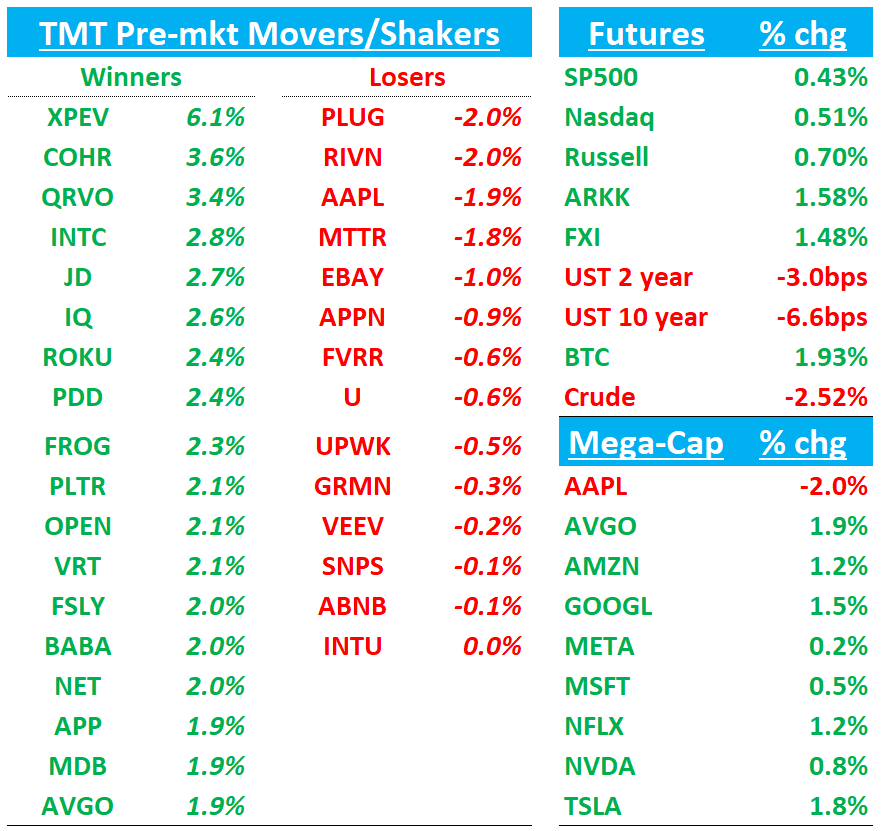

QQQs +50bps as yields are moving lower across the curve today with 10 year down 7bps and 2 year down 3bps. Lots of Trump news yesterday; key ones include: No tariffs on Day 1 (WSJ), but said he plans to impose previously threatened tariffs of as much as 25% on Mexico and Canady by Feb 1. VK knowledge put it well this morning “Remember, if tariffs are just a negotiating tactic, which is the best-case scenario, they need to remain a credible threat, which means Trump will never disavow them or acknowledge a “softer” approach to their implementation.”

On Tiktok, signed an EC instructing attorney general to delay enforcement of the ban for 75 days and suggested the US gov’t should be a half owner of Tiktok’s U.S biz in return for keeping the app alive and said: “If we make a TikTok deal and China doesn’t approve it, we could maybe put tariffs on China.” Alive and kicking still…

Tiktok’s CEO was at the inauguration, as well as Sunday, Zuck, Bezos, Altman, Musk and Cook.

What a difference 4 years makes…

BTC +2% after some crazy meme-coin mania over the weekend as Trump launched his own (Reuters)

We get NFLX tonight (bogeys below) to kick off earnings season…

Lots to get to this morning…

AAPL: Gets a couple downgrades from Jefferies to Sell and Loop to Hold / MS removes from top pick / JPM out negative as well

Jefferies cuts AAPL to Underperform from Hold, target to $200.75 from $211.84. Cites rich valuation at 32x FY25E PE and 15% above DCF value, consensus estimates too high despite recent cuts, muted AI smartphone adoption including Apple Intelligence, and potential iPhone packaging delays. Sees near-term risks in Q1 results/Q2 guide (sees AAPL to miss rev growth guide of 5% in Q1 and guide only to low single digit rev growth in Q2, below street), mid-term headwinds from iPhone 17 sales and limited Apple Intelligence traction through 2025. Jefferies sees 13% downside to shares.

Loop downgrades Apple as supply chain checks point to lower demand: Loop cuts AAPL to Hold from Buy, $230 target. Supply chain checks indicate iPhone demand drop starting in March quarter, significantly worsening in June/September. Analyst's previous bullish structural thesis may play out but not within next nine months

JPM trims AAPL target to $260 from $265, keeps Overweight rating ahead of Q1 results. JPM is more concerned about outlook than quarter, highlighting ongoing China share erosion as product cycle peaks and local subsidies target lower-tier phones. Notes AI features showing weak adoption, suggesting flat unit sales ahead, though sees limited downside given replacement rates at trough levels. Flags strengthening USD as additional near-term challenge

STX/AAPL: MS replaces AAPL with STX as top pick

MS maintains its Overweight rating on Apple with a $273 target, backing the thesis of accelerating device upgrades, stronger gross margins, and steady Services growth. However, MS sees STX offering greater outperformance potential over 3-6 months, with more upside to target despite Apple's recent weakness, driving STX's selection as Top Pick in IT Hardware coverage."

Counterpoint says AAPL'S IPHONE SALES IN CHINA DROP 18% YOY IN HOLIDAY QUARTER. Apple's iPhone sales in China fell 18.2% during the December quarter, slipping to third place in the market, according to Counterpoint Research. Huawei reclaimed the top spot, driven by a 15.5% YoY surge, thanks to its Mate 70 series and mid-range Nova 13 lineup. Apple's new AI-enabled iPhones struggled to maintain momentum, as key features remain unavailable in China while the company seeks a local partner for AI infrastructure. Globally, iPhone sales dipped 5% for the period. China's smartphone market saw its first quarterly decline in 2024 after steady growth earlier in the year.

NFLX Bogeys:(Lots of moving pieces given fx and lack of net add disclosure in 2025)

Q4 Sub Adds: ~13M vs street 9.2M

Q4 Revenue Growth FXN: 17-18% vs street at 17%

Q4 Revenue Growth Reported: 15%

Q4 EBIT: $2.2B, 22% margins in line with guide

Q1 Sub Adds: Street is at 5M but NFLX has said they will stop reporting net adds in 2025

Q1 Revenue Growth FXN: 16%

Q1 Revenue Growth Reported: 13% vs street at 13.5%

FY 25 Revenue Reported guide: miss on fx: 9-11% vs street at 13% (c/c 14% vs 13%)

FY25 Operating Margin: 100bps expansion vs 2024

3P Roundup:

CHWY: Uptick at Yip in weekly data

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.