TMTB Morning Wrap

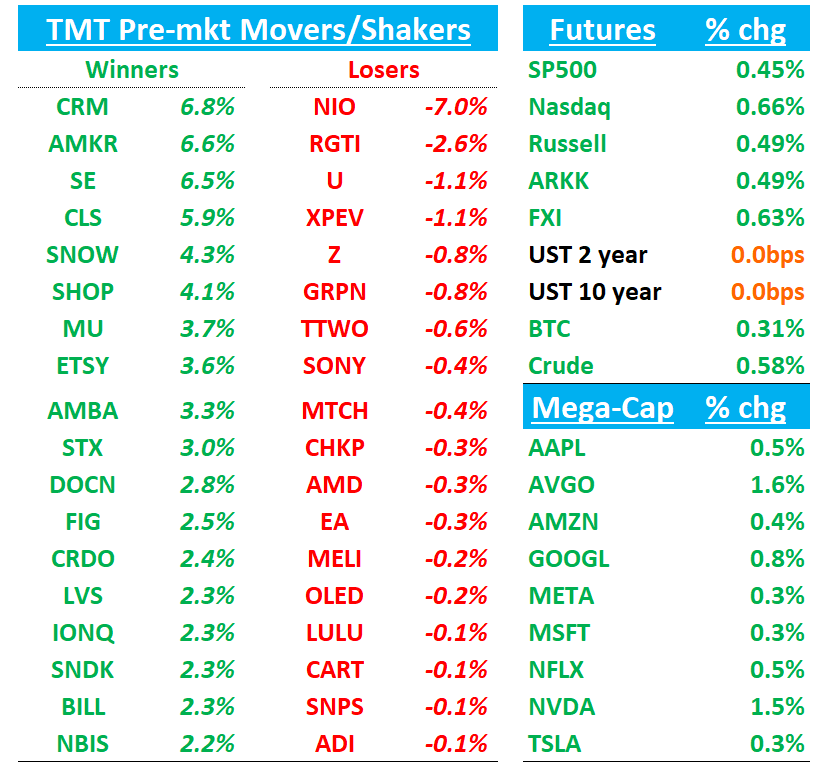

Futures +70bps as memory/AI driving names higher int he pre…Remember ORCL key presentation at 12:45 est today

First TSM, CRM, HPE recaps, then News/Research.

Running a little late but lots of important stuff so lets get straight to it….

TSM +2%: Down the fairway: 3Q beat on margins/eps; 4Q guide in-line but margins better; FY25 growth raised, capex narrowed

Overall solid print with no big surprises as mgmt sounded very positive on AI demand although some bulls likely hoping for a bit more on the Q4 top line guide. Nothing to change bulls minds here - all AI roads lead to TSM and we think this continues to be a must own and one of the best “sleep well at night” AI plays.

“Recent developments in AI market continue to be very positive. The explosive growth in token volume demonstrates increasing consumer AI model adoption, which means more and more computation is needed, leading to more leading-edge silicon demand. Our conviction in the AI megatrend is strengthening. AI demand is stronger than we thought three months ago”

Another clean print: net income NT$452.3B (+14% QoQ/+39% YoY) vs BBG NT$405B; GM 59.5% and OpM 50.6% both ahead (2-3ppts), with 9M capex at ~$29.4B.

Q4 sales guided between USD32.2-33.4bn, +4.2% ahead of street at the midpoint (cons at $31.5bn). Q4 Gross margins were guided to be between 59-61%, 3pp above consensus at the midpoint

FY25 outlook improved: revenue growth lifted to the mid-30% range (from 30%); capex tightened to $40–42B (from $38–42B); overseas fabs seen diluting GM by ~1–2% in FY25 and 2–3% early/3–4% later thereafter.

Key Takeaways:

Management tone stayed very bullish on AI—demand stronger than three months ago, CoWoS and broader AI supply chain still tight, China restrictions not seen derailing the AI trajectory—and reiterated revenue should outgrow capex. TSMC sees no issue around pull-ins which has been a concern for some.

No numeric 2026 capex/CoWoS update until the 4Q call. Roadmap remains on track: N2 volume in 2H25 with a faster 2026 ramp, N2P and A16 (SPR) targeted for 2H26, and accelerated Arizona plans including two advanced-packaging fabs plus an OSAT partner breaking ground earlier. Overall: beat on margins/EPS, guidance constructive (especially on GM), and a firm setup into 2026

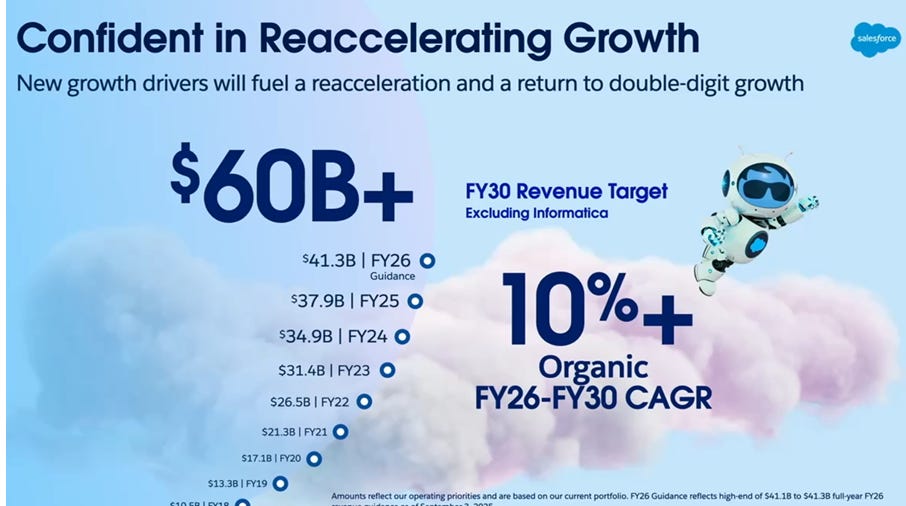

CRM +6%: Solid analyst day with 10% CAGR over next 4 years and 40% margin target (up from 34%). Strong commentary around AI traction, and a “50 by FY30” yardstick

Salesforce set FY30 revenue of $60B+ (ex-Informatica), implying 10%+ organic CAGR FY26–FY30, and introduced a “50 by FY30” framework (subscription & support CC growth + non-GAAP OpM = 50), which implies ~40% OpM by FY30 vs ~34% in FY26 guidance.

Management highlighted accelerating bookings/AOV–NNAOV trends with a 12–18 month path to revenue re-acceleration, disclosed $1.2B Data+AI ARR (+120% Y/Y) and $440M agentic AI ARR, and noted 12k+ Agentforce customers. They also announced a $7B buyback; targets exclude the pending $8B Informatica deal. Shares are +~6% pre-market on the update.

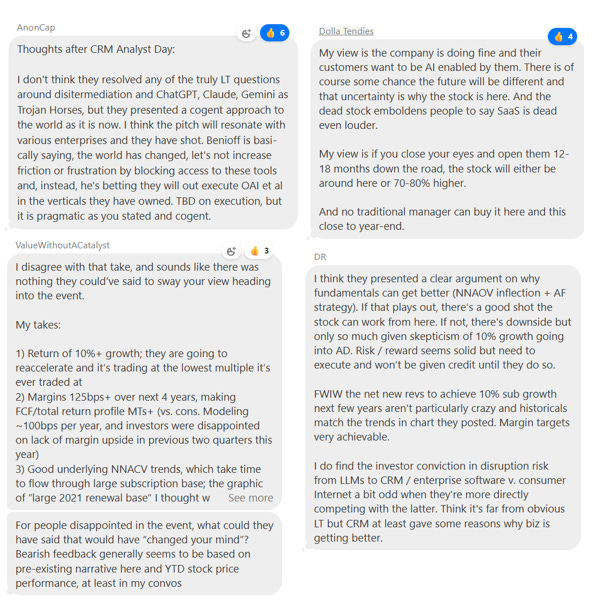

Some good back and forth in TMTB chat here

Sentiment was horrible heading in, so not surprising to see stock rally. Most feedback I had in conversations were similar to the above in the chat, with most investors I talked to blase about the stock (why is 10% growth exciting when semis and infra sw accelerating?) and some pushing back that its still a show me story as pushing out 12-18 months to get to double digits won’t last without execution. Yet most acknowledge sentiment horrible and valuation cheap so they execute on their plan and see further Agentforce traction, stock can work

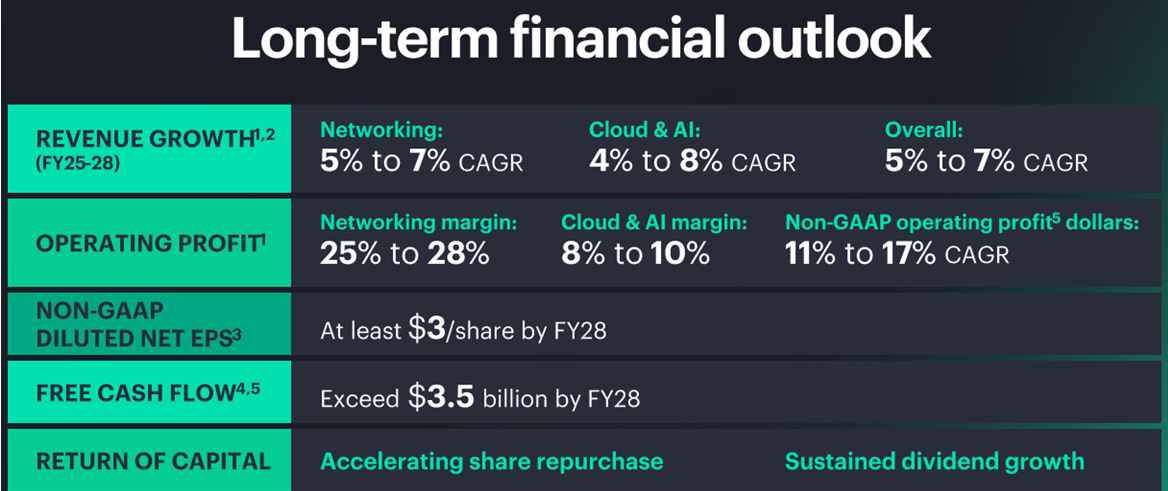

HPE -9%: Disappointing analyst day with no updates to synergies, $3 in FY28 instead of FY27 as bulls were hoping, and just in line revenue guide.

FY26 guide: Revenue +5–10% (vs. +6% FactSet); EPS $2.20–$2.40 (vs. $2.30–$2.40 GSe). Earnings skew to the back half as synergies ramp.

Mgmt clarified that they are guiding for taking share not losing. Their mix of biz is different than the tam since don’t have a lot of the ai data center white box business. That said they haven’t built that oppty into their numbers and think have good shot of winning there with being trying to be first at 1.6T and their unique liquid cooling tech.

Our take:

There was a lot of fast money into the stock and analyst day was disappointing and not a lot of pushback from bulls for stock being down. We fell asleep at the wheel on this name and didn’t trim before the analyst day despite the big run up and broke one of our rules of always trimming after a rally into a catalyst. We got involved at $21-22 and now we’re almost back to where we started. We still think r/r here at 22-23 very good ($2-3 down / $10+ up), esp with CPU server side of the biz likely doing better than expected, but now we’re without the analyst day catalyst ahead of us, which makes it a different set up than when we got involved as now stock more dependent on mgmt execution so we feel we are doing a bit of thesis creep. Conflicted here - small position but stock taking up space in the portfolio for other exciting things.

NEWS/RESEARCH

MU: Citi Raises PT to $240 on Strong AI-Driven DRAM Cycle; Margins to Rebound Toward 60%

Citi says DRAM is poised to become the next key component to secure long-term contracts across the AI supply chain, mirroring the trajectory seen with NVDA, AMD, and AVGO. The firm believes Micron will benefit from a tightening supply backdrop and sustainable DRAM pricing, helping gross margins climb back to 60% and peak EPS reach roughly $23 — nearly double the prior cycle high of $12. Citi lifts its FY26–FY28 sales and EPS forecasts, now modeling FY26 EPS of $21.05 and FY27 of $20.31.

MU: UBS Raises PT to $245 as DRAM Shortages Deepen; EPS Power Seen Near $30

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.