TMTB Morning Wrap

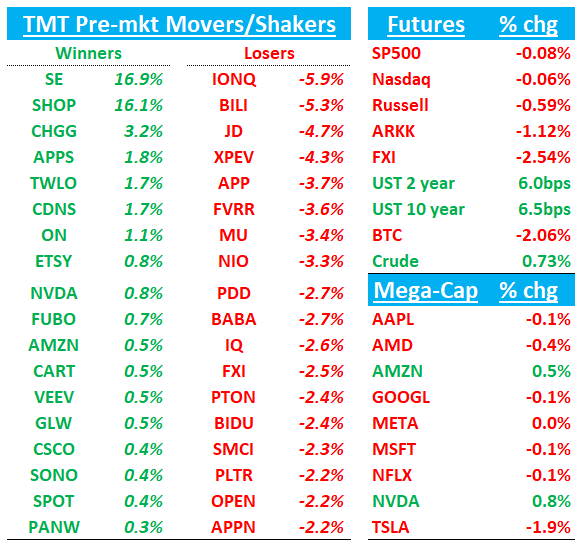

Futures flat as we’re seeing some stocks that have rallied post-Trump take a bit of a breather pre-market — TSLA (-1.5%), ARKK - (1%), COIN (-3%), PLTR (-2%), APP (-4%) — to name a few. We’ll see if that causes some laggards over the last week like META and NVDA to get a bid today. BTC hit $90k overnight but has since pulled back to $86k. Treasuries are falling with 2 and 10 year both +6-7bps. Not many macro headlines since last night other than UK wage growth cooling (WSJ reporting this could leave door open to BOE earing) and more talk of Trump's cabinet pointing to him to taking a tough stance on China/Immigration while hiring crypto friendly officials.

In Tech, SHOP +15% and SE +13% put up nice beats while MU -3% getting hit as Edgewater/Cowen neg on DRAM. NVDA +1% up a bit ahead of Jensen talking with Masa from Softbank at 8pm est. tonight - two of the biggest AI bulls sitting together. Let’s get to it…

SHOP +16%: Looks clean across the board with Rev/GMV beat and implied EBIT guide well above street

Sentiment had been a bit subdued on this one for a while although 3p data had pointed to a beat — EBIT guide above will goes a long way to support bull’s view that operating leverage still has plenty of room to run. 5ppts accel on revs gives confidence to bulls revs could accelerate close to 30% as we head into the new year as comps continue to get easier.

Call starting now…

SHOP RESULTS: Q3

- Revenue $2.16B, +26% y/y, EST $2.12B

- Monthly recurring revenue $175M, EST $173.6M

- Merchant Solutions revenue $1.55B, +26% y/y, EST $1.52B

- Subscription revenue $610M, +26% y/y, EST $599M

- Gross merchandise volume $69.72B, +24% y/y, EST $67.78B

- COMMENTARY AND CONTEXT

- Guides Q4 Rev. Growing at Mid-to-High-Twenties Percentage (street at 23%)

- Guides Q4 Free Cash Flow Margin Similar to Q4 2023

- Guides Q4 Opex as Percentage of Revenue 32% to 33% (implies EBIT Of ~$550M)

- Guides Q4 Gross Profit up at A Y/Y Rate Similar to Q3 (street expecting flat)

SE +13%: Very solid with Rev beat driven by e-comm. EBITDA well above street despite slight miss to ecomm EBITDA.

Reiterated guide of mid 20s y/y GMV growth for the full year and now expects Free Fire full year bookings to grow 30% y/y

Call ongoing…

SE RESULTS: Q3

- EPS $0.24, EST $0.24

- Net income $153.3M, EST $128.6M

- Revenue $4.33B, EST $4.07B

- E-commerce revenue $3.18B, EST $2.99B

- Digital entertainment revenue $497.8M, EST $474.7M

- Digital Financial Services revenue $615.7M, EST $547.3M

- ADJ EBITDA $521.3M, EST $480.9M

- Digital Entertainment ADJ EBITDA $314.4M, EST $296.6M

- E-commerce ADJ EBITDA $34.4M, EST $44.4M

- Digital Financial Services ADJ EBITDA $187.9M, EST $169.5M

MU -3%: Edgewater sees softening outlook in 2025 / Cowen Cautious

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.