TMTB Morning Wrap

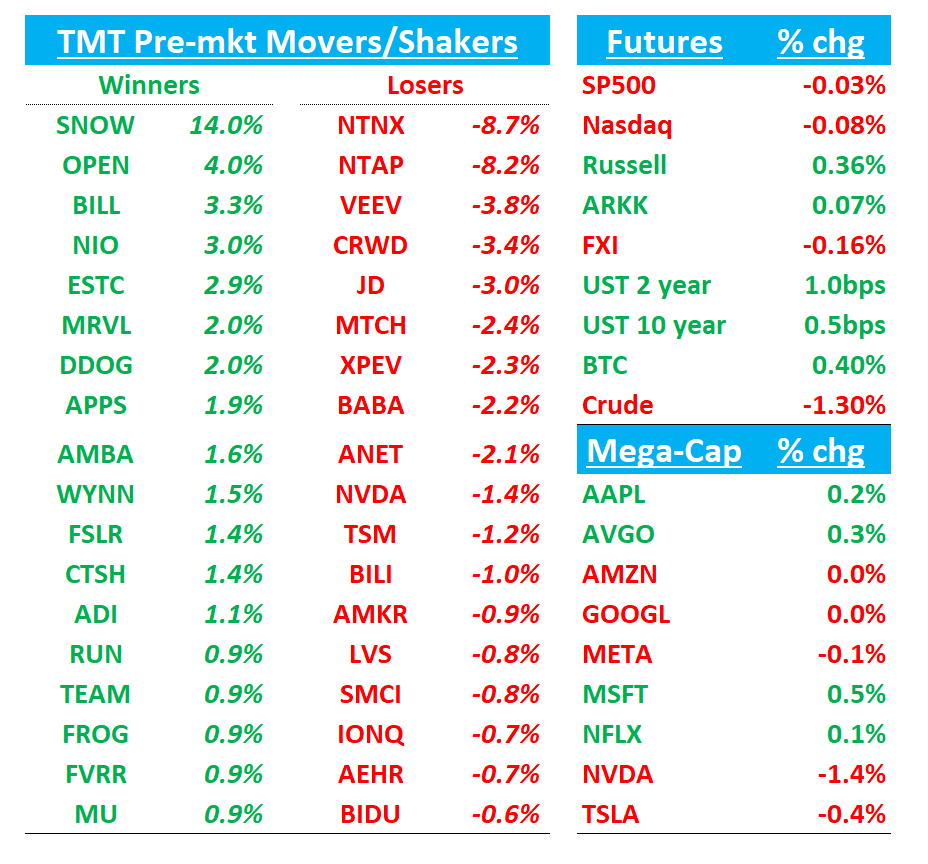

Futures down small with QQQs -5bps and IWM +50bps. NVDA and SNOW bull cases remains intact although SNOW had more fireworks, and both results continue to support the AI Trade/Supercycle.. Outside of earnings, relatively slow news day. We’ll hit NVDA SNOW CRWD NTAP PSTG and then Research/News.

Let’s get to it…

NVDA -1%: Q2/Q3 roughly in line (Q3 guide of $54B), but Jensen sounds bulled up on call implying 50% CAGR as China revs all optionality. Bull case intact.

We said in our preview that debating between a $53B and $55B guide misses the forest for the trees, and Jensen did a great job on the call confirming why: a possible 50% CAGR throughout the rest of the decade as Blackwell and Rubin AI factory platforms “will be scaling into $3 Trillion to $4 Trillion.”

When you look at the #s ex-china growth, the quarter and guide look even better: Q2 was +15% q/q, a $6B step up and the guide implies $54B, +19% q/q or an $8B step up.

Doing some quick math assuming a 50% CAGR, you can get to $300B in revs in FY26/CY27, which implies something close to $7 EPS even before assuming any China revenue. China can add another 50c-$1 (we’re of the view Trump/China want a deal for chips to go through). Bulls will say $10+ is possible in EPS power in CY27.

The risk/reward here looks great: 25x $7 in EPS is $175 right where stock is right now. 30x $7.5 = $225, or 30% upside.

We think there is a good argument the multiple should be higher than 30x given some of NVDA’s largest customers have effectively telegraphed multi-hundred billion dollar purchase orders spread over several years - something virtually unheard of in semis. Combined with Jensen giving a 50% CAGR soft guide through the rest of the decade, and fears of peak capex should still in rear-view for the time being.

Key quotes:

50% CAGR:

If we were able to address it with competitive products and if it's $50 billion this year, you would expect it to grow, say, 50% per year as the rest of the world's AI market is growing as well.

Blackwell and Rubin AI factory platforms will be scaling into the $3 trillion to $4 trillion global AI factory buildout through the end of the decade

Networking:

Choosing the right networking, you're basically paying -- you'll get a return on it like you can't believe because the AI factory, a gigawatt as I mentioned before, could be $50 billion. And so the ability to improve the efficiency of that factory by tens of percents is -- results in $10 billion, $20 billion worth of effective benefit.

On China:

"The China market, I've estimated, to be about $50 billion of opportunity for us this year…"I think the you know, the opportunity for us to bring Blackwell to the China market is a real possibility. And so we just have to keep advocating the the sensibility of and the importance of American tech companies to be able to to, lead and win the AI race. And help make the American tech stack the global standard."

“We have not included H20 in our Q3 outlook… if geopolitical issues subside, we should ship $2 billion to $5 billion in H20 revenue in Q3

“However, if more interest arrives, more licenses arrives, again, we can also still build additional H20 and ship more as well.”

SNOW +14%: Beat/raise with re-accel as AI engagement continues to build

SNOW follows MDB as the latest infra sw stock to beat big with 4th straight beat. Rev beat was 2nd biggest beat Since Q1’23. Product growth accelerated 4ppts to 31.5% on a 4ppts easier comp. The comps continue to get easy going forward for 3 quarters so bulls will pencil in something close to 35% product growth exiting FY26. Similar print and go fwd set up to MDB with similar “AI winner” narrative although SNOW already more well-liked among investors, which is why stock isn’t up more.

Bulls will see the re‑acceleration to 32% as evidence the core analytics motion has re‑strengthened and that NRR stabilization (125%) plus 33% RPO growth set a base for sustained high‑20s growth. They point to record $1M+ adds, Azure +40% y/y (tightened MSFT alignment), and an innovation drumbeat (Snowflake Intelligence, Cortex AI SQL, OpenFlow, Gen2 warehouses, Postgres, Spark Connect) that expands workloads while reducing friction. AI engagement is broad (50% of new logos, 6.1k weekly users, 25% of use-cases), suggesting AI becomes a consumption tailwind layered on top of a strong core. Guidance was raised by more than the beat and is viewed as conservative, leaving room for continued “beat‑and‑raise.” Bulls will say there isn’t much growing 30% in software and given that scarcity value stock should trade at 15x-20x multiple, implying $250+.

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.