TMTB Morning Wrap

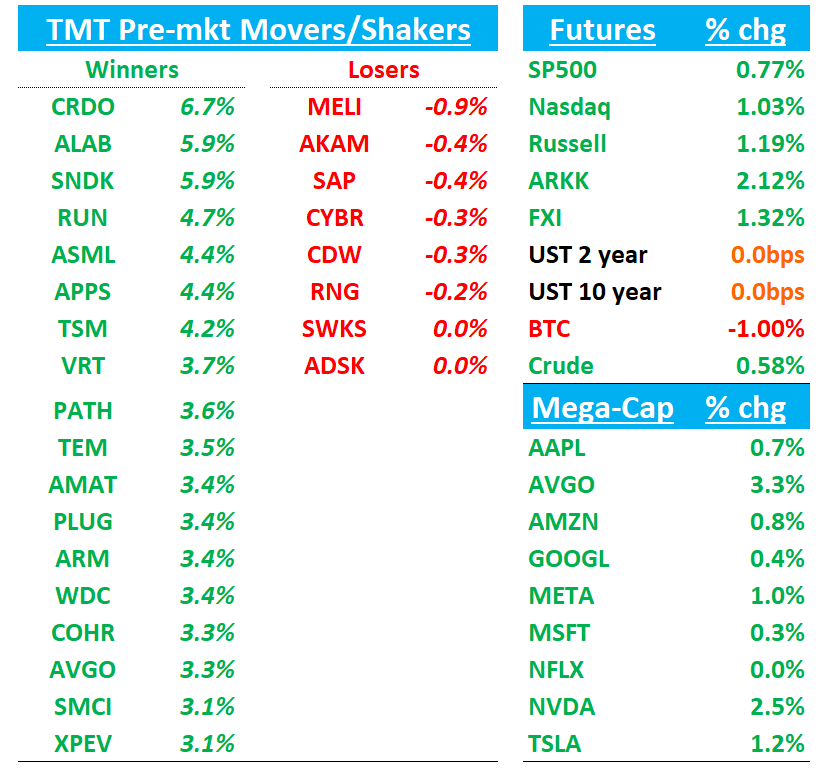

Futures bid this morning with QQQs +1% as Asia was strong over night (HSTECH +250bps; Semis +3%; NKY +2%; KOSPI +2.5%). Memory names strong overnight with Hynix/Kioxia +3% and Samsung +4% bouncing back nicely to new ATHs. AI names up nicely in pre-market. BTC -1% weakness continues. Yields flattish.

ORCL AI World continues today (financial analyst mtg tomorrow), CRM investor day today, and HPE analyst day in the afternoon.

Lots to get to so let’s get to it…

OpenAI makes five-year business plan to meet $1tn spending pledges

OpenAI is working on new revenue lines, debt partnerships and further fundraising as part of a five-year plan to make good on the more than $1tn in spending it has pledged to create world-leading artificial intelligence. OpenAI is planning on deals to serve governments and businesses with more bespoke products, creating more income from new shopping tools, and new sales from its video creation service Sora and AI agents, said multiple people familiar with the start-up’s efforts. These people said it is exploring “creative” plans to raise new debt that can help it build out its AI infrastructure, while considering becoming a supplier of computing resources via its data centre initiative Stargate.

TMTB: I think right calc for ARPU is using $9.1B (after backing out API revs), which comes out to ~$19 per paying ChatGPT user.

NVDA: HSBC Upgraded to Buy at $320 Target as Expanding AI GPU TAM Drives FY27 Upside

The firm upgrades NVIDIA to Buy (from Hold) with a $320 price target (from $200), citing rising FY27 GPU allocation and stronger visibility into CoWoS supply momentum. The report highlights upside to FY27 datacenter revenue estimates—now the Street’s highest—at $351B, roughly 36% above consensus, as AI GPU demand broadens beyond core hyperscalers. Analysts note easing China uncertainty and renewed CoWoS wafer ramping at TSMC, which could lift FY27 EPS to about $8.75. They also see upside from large AI gigawatt-scale infrastructure commitments from Stargate and OpenAI, which could potentially double NVIDIA’s FY27 datacenter revenue base.

AI: BlackRock and Nvidia in $40bn data centre takeover to power AI growth

An investment consortium that includes BlackRock, Nvidia, xAI and Microsoft has struck a $40bn takeover of one of the world’s largest data centre operators, as it launches an initiative to underwrite the infrastructure for artificial intelligence. The investment consortium, which also includes BlackRock’s affiliate Global Infrastructure Partners and Abu Dhabi fund MGX, will acquire Texas-based Aligned Data Centers from Macquarie Asset Management, in its first deal since the partnership was formed a year ago. The investment group has earmarked $30bn in equity and a further $70bn in debt financing to buy and build data centre companies.

MSFT/DCs: UK data centre start-up Nscale strikes $14bn Microsoft deal in push for IPO

Nvidia-backed cloud provider Nscale has struck a deal with Microsoft worth up to $14bn, in a boost to the UK-based start-up’s hopes of launching a successful initial public offering as soon as next year. The companies announced on Wednesday that Nscale will deploy about 104,000 of the latest Nvidia GB300 chips for Microsoft at a facility in Texas over the next 12-18 months. Nscale will also deliver another 12,600 graphics processing units (GPUs) for Microsoft at the Start Campus data centre in Portugal.

RDDT: Truist Sees Multiple Near-Term Catalysts; Raises PT to $260, Reiterates Buy

Truist says it sees several catalysts over the next 12–18 months that could drive Reddit’s stock higher, including stronger 3Q/4Q results, the rollout of unified Search and Answers, and expansion into international markets. The firm also highlights new lower-funnel ad formats, automation tools, and growing B2B monetization through Reddit Pro and Reddit “Max.” Truist adds that data-licensing deals continue to scale and support visibility into FY26 estimates. With these drivers, the firm lifts its price target to $260 while maintaining a Buy rating, noting results are likely to land toward the high end of expectations this quarter.

RDDT: Piper Flags Faster Feed User Growth; Maintains Positive Tone on Ad Trends

Piper Sandler notes that Reddit user growth rose +2% m/m in September, led mainly by a +14M increase in Conversation users versus +1M in Feed, marking accelerating y/y growth for Feed engagement in both the U.S. and international markets. The firm also points out interface tweaks to Reddit’s desktop layout, with greater focus on Search functionality and scrolling persistence. Piper also notes their data points to a US DAU number in line with street and higher than buyside.

Macro: China, Betting It Can Win a Trade War, Is Playing Hardball With Trump

WSJ:

In its trade standoff with Washington, Beijing thinks it has found America’s Achilles’ heel: President Trump’s fixation on the stock market. China is holding a firm line because of its conviction, the people said, that an escalating trade war will tank markets, as it did in April after Trump announced his so-called Liberation Day tariffs, prompting Beijing to hit back.

China expects that the prospect of another market meltdown ultimately will force Trump to negotiate at an expected summit with Xi late this month, the people said

ASML +4%: Solid Orders and Upbeat 4Q Guide, 2026 Outlook Still Cautious

ASML delivered mixed 3Q25 results with revenue slightly below street though EBIT of roughly €2.5B came in 2% above expectations. The standout was bookings: €5.4B in total, steady quarter-over-quarter and matching consensus, but with €3.6B in EUV orders that sharply topped the €2.2B expected. Pace above the ~€2B run-rate needed to meet 2026 Street forecasts. Management guided to a stronger 4Q25 in line with normal seasonal patterns and reiterated that 2026 sales should not fall below 2025 levels. However, ASML cautioned that China revenue will drop meaningfully beginning in 2026, even as it continues preparing for long-term growth:

“we expect China customer demand, and therefore our China total net sales in 2026 to decline significantly compared to our very strong business there in 2024 and 2025”

APH: BofA Upgrades to Buy, PT Raised to $150 on Sustained AI Interconnect Demand

BofA upgrades Amphenol to Buy from Neutral, lifting its price objective to $150 from $100, citing accelerating AI-related interconnect demand and strong organic growth momentum. The firm highlights upside to FY26–27 estimates driven by higher rack volume, new architectures, and data center buildouts, with reduced risk from co-packaged optics and incremental content from CCS and fiber participation. BofA now models estimates 20% higher than street with AI revenue growth of +79% and +45% y/y in FY26 and FY27, supported by ongoing M&A and stronger adoption of optical interconnect solutions. Outside of AI, the firm models double-digit organic growth through FY27, citing resilient demand across industrial, auto, and military end-markets. BofA calls APH’s execution and product positioning “best-in-class,” noting the company remains a key beneficiary of expanding AI infrastructure cycles.

ALAB: Roth Stays Constructive Post-OCP, Sees Strong UALink Ramp Ahead

Roth says meetings with ALAB management at the OCP Global Summit reinforced confidence in the company’s growing role in AI infrastructure, with expanding content across hyperscalers and steady traction among key customers. While recent stock weakness likely reflects competitive Ethernet-based scale-up announcements from Broadcom and others, Roth notes that major partners like AMD remain committed to UALink-based architectures. The firm highlights visibility into PCIe switch and retimer ramps, citing Aries and Scorpio-P as near-term growth drivers and pointing to the upcoming Scorpio-X as a “multiple-higher ASP” opportunity supporting large-scale XPU clusters on AMD’s Helios roadmap. Roth expects ALAB’s differentiated PCIe/UALink solutions to hold meaningful share even as Ethernet alternatives emerge, and reiterates its Buy rating.

AMZN: Amazon is planning a new wave of layoffs, sources say

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.