TMTB Morning Wrap

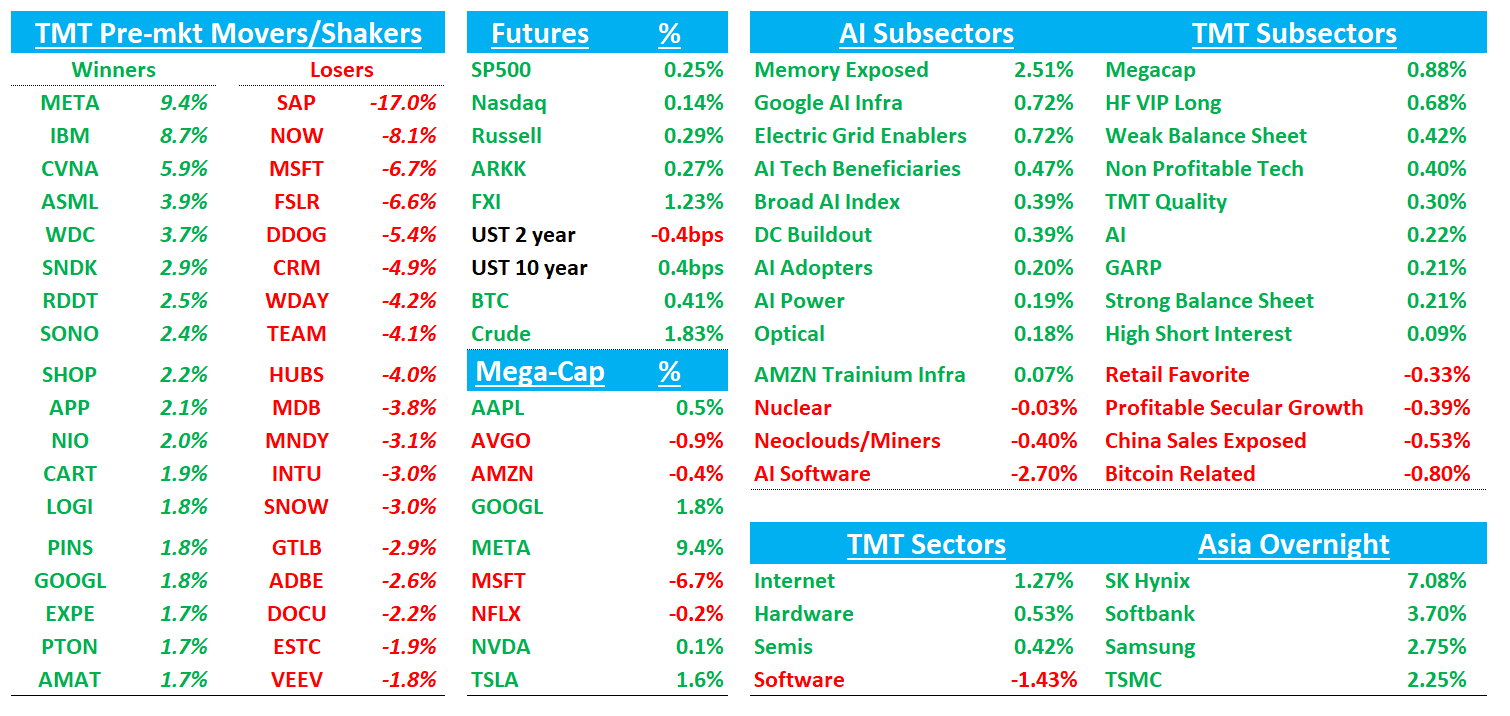

Good morning. Futures +10% after a busy day of earnings. The Great SW Bull Market of 2026 has now officially ended after a glorious 3-4 days, confirmed with today’s weaker MSFT, NOW, and SAP prints. META +9% put up a much better top line print alleviating fears about whether all that spend is driving improving ROI. MSFT -7% whiffed on the Azure bogeys and shift to internal priority for GPUs not giving bulls confidence of a big step up in Azure revs. NOW -10% organic revs were weaker. SAP -16% missed CCB estimates. Samsung -2% earnings solid (was up but got faded a bit). TSLA +2% the usual big picture talk on the call although Auto GMs surprised to the upside. CLS -3% solid with a big capex guide.

TheInformation reporting OAI getting funding from NVDA, MSFT, AMZN.

Asia generally in the green: TPX +0.28%, NKY +0.03%, Hang Seng +0.51%, HSCEI +0.42%, SHCOMP +0.16%, Shenzhen -0.49%, Taiwan TAIEX -0.82%, Korea KOSPI +0.98%. The poor man’s gold BTC -1.6%

Lots to get to, so let’s get to it…We’ll hit earnings first then the usual…

META +9% delivered a clean 4Q beat + strong 1Q and implied ‘26 rev guide which outweighed another step-function higher FY26 opex/capex

The company guided 1Q revenue to a high end of $56.6B (crushing expectations of ~$53B). That’s 33.5% vs expects of 25% (4% fx tailwind). Opex guide ($169B high end) and Capex ($135B high end) came in above bogeys of ~$160B and ~$122.5-125B but investors focused on the massive top line beat. This is Tech after all and by guiding EBIT $’s up y/y, proving the ROI of every incremental dollar worth of spend. Pods leaned short this one going in so scrambling to cover. Hearing buyside EPS moving slightly up to ~$33-35 after the print (I’m closer to the high-end). Management confirmed that despite the massive infrastructure spend, they expect FY26 operating income to exceed 2025. That implies rev growth of around 25% at the midpoint vs street at 18%. Said FRL would peak in 2026. Path forward looks clearer now with opex/capex guide out of the way and a low bar for Avocado. Accelerating rev growth goes a long way to improve the narrative.

My range here is 25x $34/$35 gets you $850+ on the upside and 20x $33 = $~650 on the downside with skew to the upside if they can ever get their fronter model working.

The #s:

4Q25 Revenue $59.893B, +24% y/y vs Street $58.416B, +~21%; GAAP EPS $8.88 vs Street $8.19; GAAP OM 41.3% vs 41.0%.

Ad impressions +18% y/y (Street ~+12%) while price per ad +6% y/y (Street ~+9%),

1Q26 rev guide $53.5B–$56.5B, +26–34% y/y (22–30% FX-neutral) vs Street ~$51.3B, +~21% y/y, with management explicitly flagging FX tailwinds and EU product changes as key swing factors for the rest of the year’s growth.

Quick note here on the top line #s: Oxford DP, the new 3p provider in town next to M-sci/Yipit nailed the Q4 and above street Q1 guide (ex fx). We think they’re the best 3p firm in the internet/ad space — no reports just modeled KPIs in a dashboard with <24hr lag. E-mail Makay.redd@oxford-dp.com and mention TMTB for a 1-month free trial.

Key Takeaways;

Mgmt described strong/broad-based demand, and the 1Q outlook is “underpinned” by demand continuing into the start of the year. But they also guided investor expectations that full-year growth should step down from 1Q levels due to 1) FX tailwinds fading, 2) tougher comps/lapping a strong macro + prior ad-performance benefits, and 3) the EU “less personalized ads” rollout later in 1Q.

They emphasized that 2025 ad-performance investments paid off (ROI-stack-ranked), and that the 2026 budgeting process funded a “similar set” of investments across ranking/recs and model capacity-efficiency to support continued growth.

Bull vs. Bear Debate

Bulls will argue the quarter reinforces the core “META playbook”: when product + ads ranking improves, revenue growth can re-accelerate quickly, and the guide implies exactly that. Mgmt repeatedly pointed to measurable AI-driven improvements in recommendation quality, ad efficiency, and conversion lift, and they framed the 2026 plan as stacking similarly ROI-validated initiatives (plus bigger model/inference capacity-efficiency work). Bulls will say this points evidence the AI flywheel is still early, and the company is “earning the right” to reinvest at scale. Bulls will also emphasize the strategic optionality: management’s “personal superintelligence” framing suggests a multi-product future (Meta AI, agentic commerce, messaging-based business AIs, new media formats), where the ad machine funds the build-out but the upside is not fully captured in today’s estimates. Lastly, bulls will say Threads and Whatsapp monetization will help sustain revenue growth in mid 20s or higher.

Bears will argue this quarter sharpened the key risk: META is committing to extraordinary capex/opex into AI and other long-duration bets while the market still lacks a clean mapping from spend. The company offered guardrails, but bears will note those guardrails are phrased around operating income (not FCF), and the capex range plus cloud spend comments implicitly acknowledge execution variability and a longer payback timeline. The “pause in buybacks” and openness to alternative financing structures also feed a narrative that the investment cycle is big enough to reshape capital returns. Bears will also harp that META remains the other fronter model providers despite massive capex spend. Regarding growth, bears will point to mgmt saying 1Q may represent peak growth for the year as FX tailwinds fade, comps get harder, and EU product changes create headwinds. Bears will say a mid 20s multiple is aggressive for a company spending so much trying to play AI “catch up”

Good threads here and here in TMTB Chat

MSFT -7%: Weaker Dec Azure and March Q guide given capacity constraints disappoints bulls who were hoping for a 4-handle.

Expectations had moved up here given UBS’s Karl Keirstead’s Fairwater note and Semianalysis both pointing to 40%+ growth, but Dec Azure # came in at 38% cc while the guide stayed at 37%. Commercial bookings +228% cc. Commercial RPO +110% with 45% driven by OAI. Capex $37.5B vs expects of $35B. Guided for Windows OEM and devices revenue to drop a low-teens % Y/Y in FQ3, and cautioned soaring memory prices could weigh on Windows OEM and server software sales.

On the call, management acknowledged Azure growth could have been >40% if all incremental capacity was pointed at commercial Azure, but they chose to direct capacity to first‑party (Copilots, etc.) and R&D too.

My sense here is frustration from investors given MSFT’s lack of execution with GPUs and now reprioritizing some of those towards internal spend instead of Azure, which gives fuel to bears who now say we won’t get large Azure accel bulls were hoping will happen in 2H. On the call back mgmt emphasized constrained capacity will continue to be prioritized toward first‑party offerings and R&D, implying Azure is unlikely to show “unusual jumps” from here. The stock had already been sitting between a rock and hard place in regards to the narrative: OAI exposure (emphasized by 45% RPO coming from them) and SaaS/co-pilot worries. This print does nothing to shake that. Bulls want to point to the multiple sitting close to mid-teens at around $450 as reasons to hang in there for the June re-accel. Our take:

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.