TMTB Morning Wrap

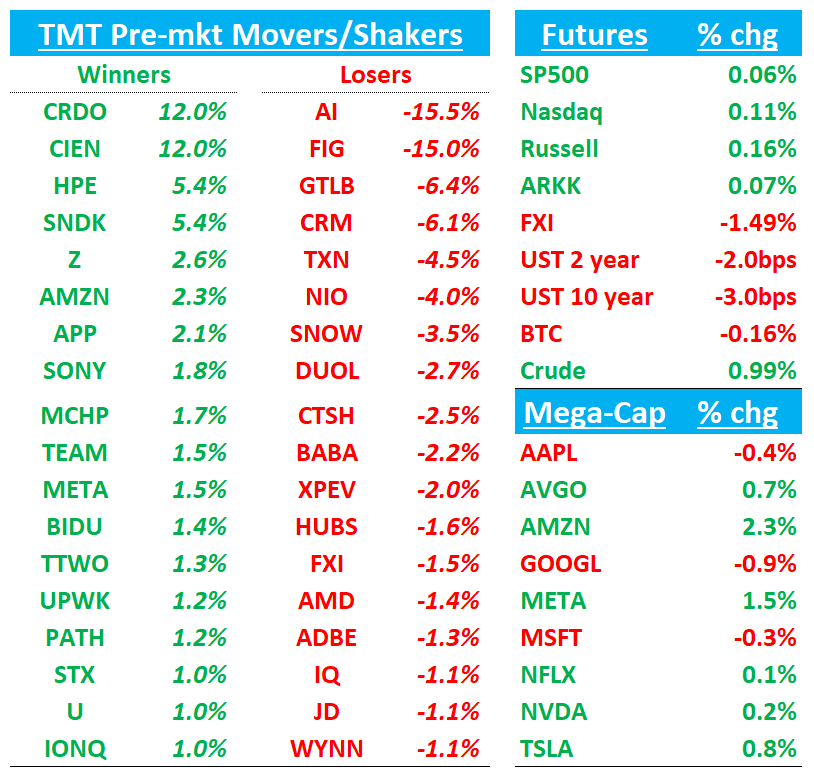

Futures flattish to start the day as global markets mainly in the green with lower global long bond yields helping sentiment ahead of NFP tomorrow. BTC -1.5%. China -1.5%. Yields ticking slightly lower.

We’ll cover CRM CRDO GTLB HPE first, then move onto Tech research, where Semianalysis and Barclays were both talking up 20% AWS exit growth rate by the end of ‘25 which has AMZN +2.3%.

Lots to get to it, so let’s get to it…

EARNINGS

CRM -7%: clean beat on Q2 (rev/EPS/CRPO/margin), but Q3 cRPO of 9% y/y a touch below buyside and q3 rev guide below street; “agentic”/Data Cloud momentum still early; FY26 margin/FCF raised, buyback up another $20B

Sentiment has been mixed as of late, but I hear more apathy than anything on CRM, and more so after this print — tough to see what gets bulls more excited here near/medium term and results did nothing to shake off bear concerns that core biz is a single digit grower for the foreseeable future.

Key takeaways

Q2 Revenue $10.236B vs Street ~$10.14B; EPS $2.91 vs $2.78; non-GAAP OM 34.3% vs 33.8%; CRPO $29.4B vs $29.16B. Billings light vs Street.

FY26 outlook raised where it matters: OM to 34.1%, OCF growth to 12–13%, FCF growth to 12–13%; revenue $41.1–41.3B (~8.5–9% y/y).

Q3 guide: revenue $10.24–10.29B (8% cc), EPS $2.84–2.86, CRPO slightly >10% reported (>9% cc); implied OM ~34%.

AI/consumption traction: Data Cloud + AI ARR ~$1.2B (+120% y/y); 6k paid Agentforce deals (12.5k total); 60% q/q increase in customers moving from pilot to production; 40% of Agentforce bookings are expansions. Flex credits now ~80% of new Agentforce bookings.

Macro/demand: overall stable; SMB/mid-market outperformed; US/Netherlands/Switzerland strong; UK/Japan “measured.” Marketing & Commerce remains soft. FX now a $300M tailwind to FY26. (No tariff-specific impacts cited.)

Capital return / M&A: returned $2.6B in Q2; buyback authorization +$20B (now $50B total). INFA now expected close Q4 FY26 or early FY27; not in guidance.

New products/positioning: Agentforce/“agentic enterprise” is the organizing principle; FedRAMP High for government; Slack-first, agent-first ITSM to launch at Dreamforce

Callback highlights:

12.5k Agentforce deals since launch; pricing models now include pre-commit (shows in cRPO) and PAYG (does not hit cRPO). Flex credits roll into cRPO.

No evidence yet of headcount reductions at customers using agents (first signs likely in Service), but CRM expects wallet share can still rise.

Bull vs Bear Debate

Bulls see a reacceleration path as “agentic” use-cases scale: Agentforce + Data Cloud ARR growing ~120% y/y, rising pilot-to-production (+60% q/q), and consumption tooling (Flex Credits, PAYG) that lowers adoption friction. Multicloud still strong (70%+ of top 100 wins include 5+ clouds), and FY26 OM/FCF raises reinforce durable profit expansion. Re: Agentforce, bulls argue CRM is building a structurally advantaged front‑office platform for the “agentic enterprise,” with Data Cloud as the control plane and Agentforce as the monetization layer—an architecture that should extend (not replace) SaaS seats while expanding use per customer via consumption (flex credits/PAYG) and multi‑cloud attach. Management continues to frame Data Cloud + MuleSoft (+ Informatica post‑close) as the AI foundation that drives accuracy and usage across Sales. The callback clarified PAYG Agentforce does not show in cRPO (flex credits do), attrition stable ~8.5%, and that the beat wasn’t flowed through largely due to one‑time license/PS strength. Bulls read this as solid core execution , setting up FY27 re‑acceleration as AI deployment scales and new products (e.g., Slack‑first ITSM) arrive. On valuation, at ~16x CY26 EV/FCF bulls argue CRM can sustain ~10–12% top-line with mid-30s OM and deserves ~20x EV/FCF as AI ramps—implying upside toward the low-to-mid $300s on CY26–27 FCF of ~$15–16B.

Bears contend that, despite the rhetoric, top‑line hasn’t inflected, and cRPO remains ~10% with Q3 implying a slight deceleration cc; the guide “beat‑but‑no‑raise” pattern and reliance on non‑recurring license/PS for upside fuel skepticism that AI is bending the curve near‑term. They worry agentic workflows cannibalize seats/PS and push the model toward consumption, which may mask demand (PAYG not in cRPO) and introduce volatility—and note management still did not raise FY26 cc subscription growth. Bears also highlight product‑level softness (Marketing & Commerce slowing), Europe/UK/Japan more measured, and the risk that a Slack‑first ITSM push meets a well‑entrenched competitor set. More broadly, skeptics argue that competitive intensity (Microsoft 365/Dynamics + Copilot, ServiceNow in ITSM, best‑of‑breed data/analytics) and enterprise AI adoption friction (data readiness, governance, ROI proof) could cap re‑acceleration for longer. Bears think growth stays ~8–9%, meaning only ~14–16x EV/FCF at most, which means we likely get a rangebound stock until something changes the growth narrative…

As I said above, unexciting for us either way here…

CRDO +12%: Another clean beat/raise and lifted its FY26 growth outlook to ~+120% y/y, with hyperscaler diversification improving, gross margin holding ~65–68%, and Q2 guidance ahead of the Street.

Expectations had risen and buyside was expecting a HSD beat but CRDO managed to blow the doors off again with a mid teens beat. Customer diversification going down. Tone on the call was very positive. Three pillar bull case still very much intact here.

Key takeaways

Q1 revenue $223.1M vs ~$190M Street; non‑GAAP GM 67.6% vs ~65% Street; non‑GAAP EPS ~0.53 vs 0.35. Q2 guide $230–$240M and 64–66% GM also ahead.

FY26 outlook stepped up: Management now expects ~+120% y/y FY26 growth (from “~85%” prior per sell‑side), and ~40% non‑GAAP net margin as scale and mix improve.

Hyperscaler diversification improved materially: Q1 top three customers were 35% / 33% / 20% (vs prior concentration >60% at the largest), with two new hyperscalers ramping in FY26 and a fourth expected to be ≥10% of FY26 revenue.

AEC momentum expanding in scope: AECs are being used beyond intra‑rack to rack‑to‑rack (lengths up to 7m) driven by cluster densification, reliability and power benefits; management cites “up to 1,000× more reliable” than optics and ~½ the power.

Optical DSP/LRO business is on track to double in FY26; 1.6T roadmap moves to 3nm for power, with management saying 1.6T adoption will take time (supply on lasers is tight industry‑wide) but does not derail their optical growth plan.

Scale‑up (PCIe) angle emerging: PCIe retimer family gaining traction; design wins expected CY25 with production revenue in CY26—broadening the TAM across 200G‑per‑lane scale‑up interconnects irrespective of whether customers choose NVLink Fusion / scale‑up Ethernet / UALink / PCIe.

Margins/opex discipline: Q1 non‑GAAP OM 43.1% with opex up only mid‑single digits q/q; company still frames the long‑term GM model ~60%, but near‑term GM runs mid‑60s with mix.

Q2 guidance “based on the current tariff regime, which remains fluid”; demand backdrop underpinned by AI infra investments at hyperscalers.

Bull vs. Bear Debate

Bulls think CRDO sits on the right side of multiple secular shifts. First, AEC is winning sockets intra‑rack and increasingly rack‑to‑rack as clusters densify; management highlighted deployments up to 7 meters, citing ~1,000x higher reliability and ~50% lower power versus optical—benefits that directly translate to AI cluster uptime and opex. The view: as clusters scale, reliability and power trump legacy “optics everywhere” assumptions, expanding copper TAM rather than cannibalizing it. Second, bulls see optical DSP/LRO as the next pillar: optical revenue is on track to double in FY26, Credo is pushing 3nm 200G/lane DSP to meet 1.6T power envelopes, and LRO offers a credible half‑retimed alternative as port speeds rise—an option hyperscalers are evaluating at 800G now and likely valuing even more at 1.6T. Third, bulls like the scale‑up (GPU‑to‑GPU) card. Credo’s PCIe retimer program is winning engagements, with design wins expected in CY25 and production revenue in CY26; bulls see this as a second engine that is protocol‑agnostic as the market debates PCIe Gen6/7, NVLink Fusion, and scale‑up Ethernet/UALink—all of which ride on a 200G/lane SerDes that Credo already builds around The quarter supported that narrative: two new hyperscalers ramping in FY26, the fourth to ≥10% revenue, GM mid‑60s with operating leverage, and optics on track to double—all while customer concentration continues to ease. Bulls argue CRDO merits a premium multiple given scarcity value and growth durability

Not much for bears to hang on to after this print, but more longer-term skeptics focus on competition (MRVL/AVGO targeting AEC/DSP sockets; Astera Labs ramping 100G‑lane AEC in 2026), lumpiness/concentration risk with hyperscalers, and the possibility that CPO/optical solutions compress the AEC window faster than bulls expect. They also flag valuation risk after the run and execution dependencies (e.g., 3nm optical ramp, PCIe retimer productization). In this quarter, bears point to Q2 GM step‑down vs Q1, product‑mix volatility and the reminder that ramps aren’t linear customer‑by‑customer. Valuation also remains in the stratosphere.

GTLB: Strong FQ2 beat on revenue/EPS/OM and robust FCF, but maintained FY revenue guide and a below‑Street Q3 revenue guide amid GTM changes, SMB softness, and CFO transition

Expectations had crept up into the print at GTLB printed a solid Q2, but we left the call confused as to why the Q3 guide was so weak - bulls will explain it away saying they are keeping the guide conservative given CFO and GTM changes. Other than that, we thought numbers were find and mgmt did an ok job on the call talking up potential AI tailwinds. We think stock likely rangebound below $50 for now and given GTM changes a show me story — r/r at $44/45 doesn’t sound that interesting either way…

Key takeaways

Revenue of $236M (+29% y/y, an acceleration from 26%) beat by ~4%; FY revenue reiterated at $936–$942M while FY OM raised to ~14.3–14.4%. Mgmt cited strong linearity (record month‑1 bookings) and a higher self‑managed mix as one‑time helps to Q2.

2H set‑up / guidance: Q3 revenue guidance $238–239M is just below Street, with OM ~13–13.4% in line or slightly above; FY revenue guide unchanged “to account for GTM changes” and incremental SMB softness.

cRPO +31% y/y and RPO +32% y/y underscore multi‑quarter visibility; NRR 121% (‑1 pt q/q) stays healthy but continues to drift lower, keeping the “durability” debate alive.

Management flagged budget pressure in SMB (~8% of revenue) and expects pressure to persist through year‑end; enterprise demand tied to platform consolidation remains constructive. No material tariff commentary was provided.

Pricing is expected to be a headwind in FY27 (more dollars from pricing but less incremental add), with growth also driven by seats and product adoption;

Duo usage is up ~6x YTD (off a small base); GitLab plans to evolve from seat‑only to hybrid seat + usage pricing as Duo Agent Platform approaches GA by year‑end (quality bar gating launch). Partnerships span Anthropic, OpenAI, Google, Amazon, Cursor.

Product/customer mix improving: Ultimate = 53% of ARR (8/10 top deals), Dedicated ARR ~$50M (+92% y/y), SaaS +39% y/y and now ~30% of revenue.

GTM reset underway: New CRO (Ian Steward) driving new‑logo “hunters” motion plus post‑sales adoption; PLG and marketing brought under a new CP&M (Manav Khurana). Mgmt cites a 6–9 month enterprise rep ramp and expects benefits to start in FY27.

Leadership change: CFO Brian Robins departing (to Snowflake); James Shen to serve as interim CFO; search in process.

Bull vs Bear Debate

Bulls point to evidence that growth is still primarily seat‑driven rather than a one‑off price cycle—management disclosed that >70% of FY26 growth is from paid seat adds and <10% from the Premium price increase, with accelerating double‑digit paid seat growth over the last four quarters. That eases fears that AI will compress developer seats near‑term. They also highlight the platform mix shifting upmarket: Ultimate is 53% of ARR, 8 of the top 10 Q2 deals included Ultimate, and Dedicated has reached ~$50M ARR (+92% y/y)—all datapoints consistent with larger, multi‑product standardizations. Bulls further argue that AI is a demand tailwind for GitLab’s workflow “orchestration” layer rather than a substitute. Management’s survey of ~400 customers indicated 91% expect AI‑native dev tools to increase their use of GitLab in the next 24 months and 78% expect to increase developer headcount—suggesting more code and change to manage, not less. On product strategy, the Duo Agent Platform (moving to seat + usage monetization) and broad agentic integrations (Anthropic, OpenAI, Google, Amazon, Cursor) expand the revenue model beyond seats while keeping GitLab neutral across clouds and models. With a ~90% gross margin business now generating meaningful operating leverage and FCF, bulls see a credible path to compound at 20%+ while expanding margins. Bulls will say throw a 9x EV/Sales multiple and you get close to $70+ stock with strategic bids helping support downside.

Bears worry the competitive backdrop is intensifying—Microsoft/GitHub’s distribution, new AI coding assistants (e.g., Cursor, Amazon Q) and hyperscalers’ suites could compress win rates and pricing, especially if enterprises view “good‑enough” coding + a lighter DevOps stack as sufficient. Bears will also worry about long-term seat and risk and wonder why NRR continues to drive down (121% vs 126% a year ago). Bears will also wonder why CFO is leaving and say software investors hate GTM changes which means the stock is now likely range bound and a show me story.

HPE +5% beat on both revenue and EPS on AI systems and Networking strength (with one month of Juniper), raised FY25 EPS/revenue-growth guidance, guided FQ4 EPS above Street but revenue roughly in line to slightly light, and flagged margin improvement into Q4 while trimming FY25 FCF to ~$700M on Juniper-related cash costs

We continue to like the set up here heading into Oct analyst day and think there is room for HPE to re-rate higher as pro-forma company significantly more weighted to networking than standalone.

Key takeaways

Top/bottom line beat (rev $9.136B, EPS $0.44) on stronger AI systems ($1.6B) and Networking (+54% y/y), with Juniper contributing $480M revenue in the month.

Net new AI orders $2.1B; AI backlog $3.7B; pipeline “multiples” of backlog. However, mgmt guided >30% q/q decline in FQ4 AI revenue after the large Q3 shipment.

Mix drag in Q3, improvement in Q4: Q3 GM 29.9% (28.3% ex‑JNPR); OPM 8.5% (8.1% ex‑JNPR). Q4 guide calls for GM mid‑30% and OPM upper‑11%, helped by better server mix and Juniper accretion.

Guidance: EPS above Street; revenue in line/slightly below: FQ4 EPS $0.56–$0.60 vs Street $0.56; revenue $9.7–$10.1B vs Street $10.1B. FY25 raised to +14–16% cc and $1.88–$1.92 EPS.

Q3 server OM 6.4% (AI mix + one large deal), but mgmt expects ~10% server OM in Q4 as pricing discipline holds and mix tilts toward enterprise/sovereign AI.

New Networking segment (HPE IE + Juniper) was nearly 50% of HPE non‑GAAP OP in Q3; Q4 Networking OM in the low‑20% range with full‑quarter Juniper. Wi‑Fi 7 orders up triple‑digits q/q; data‑center switching and PTX routing strong.

Hybrid Cloud/Storage quietly strong: Fourth straight quarter of y/y growth; Alletra MP storage again triple‑digit y/y and hybrid‑cloud OM expanded to 5.9%.

ARR scale and quality improving: Reported ARR $3.1B (+75% y/y; +40% organic), with software/services now >81% of ARR mix; ~2,000 GreenLake customers added (≈44k total).

Macro/demand: “Demand was strong… no material pull‑in”; networking market recovery continues; NAM enterprise softness not material—weakness concentrated in U.S. Fed/agencies, offset by strength in defense/security and international mix (58% ex‑U.S.).

Cash/FCF & capital structure: Q3 FCF $719M (deal costs and higher net interest included); FY25 FCF cut to ~$700M (from $1B prior) due to Juniper closing costs; Q4 OI&E –$180–$200M, diluted shares ~1.44B on Juniper SBC.

Bull vs. Bear Debate:

Bulls see HPE pivoting to a structurally better mix: Networking (now nearly half of OP) with full‑quarter Juniper accretion and $600M synergy opportunity over three years; normalizing 10%+ server margins in traditional compute; and a growing AI opportunity (enterprise/sovereign now >50% of cumulative AI orders) with backlog $3.7B and pipeline “multiples” of that. This all means a higher multiple than HPE traded at on a standalone basis. They also point to ARR scaling ($3.1B, software/services >81% of mix) and four consecutive quarters of Hybrid Cloud growth/OM expansion as evidence of improving quality of earnings. On valuation, bulls think that $3 of EPS in possible in CY27, throw 11-12x on that and you get a ~$35 stock. With stock in the low 20s, and downside 9x $2+ = $18, r/r skews heavily to the upside at $22/23.

Bears argue AI systems are inherently lumpy and margin‑dilutive versus traditional servers (Q4 AI guide >30% q/q down), with one‑off megadeals driving volatility and limited visibility into the quality of backlog. They worry HPE’s Networking integration must execute flawlessly amid intense competition (Cisco/Arista and Dell/Supermicro on AI infrastructure), while Q4 OI&E –$180–$200M, higher share count (≈1.44B), and the FY25 FCF cut to ~$700M reflect financial drag from the Juniper deal near term.

TECH/RESEARCH

AVGO Bogeys

Q3 Revs: $15.9B vs street at $15.8B

Q3 EPS: $6.75+ vs street at $6.7

Q3 AI Revs: $5.25B vs street at $5.1B

Q4 Revs: $17.25B vs street at $17.05B

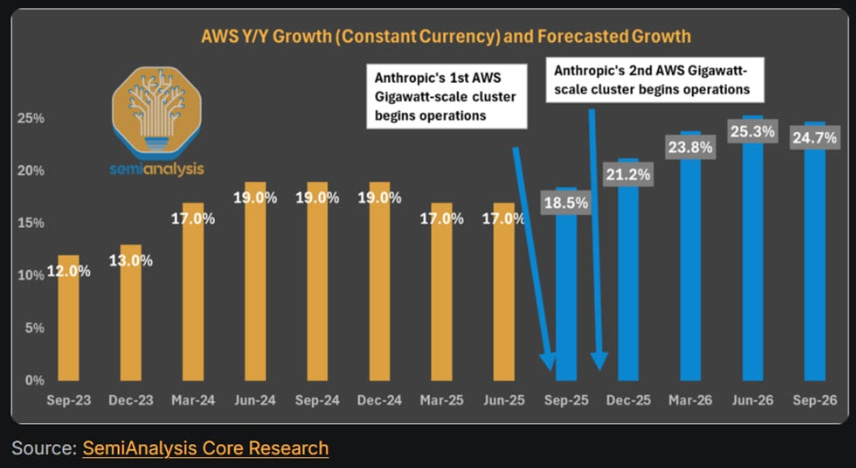

AMZN: SemiAnalysis Calls for AWS AI Resurgence on Anthropic Multi-GW Trainium Buildout

Note - this has been circulating for a couple weeks but went out to broader audience today…

SA saying ‘25 exit growth rate could be 20%+ vs street at mid 18s driven by Anthropic multi GW campuses. SA highlights that AWS is racing to finish over 1.3GW of datacenter capacity for Anthropic, which has quintupled revenue this year to a $5B run-rate. While Trainium2 still trails Nvidia chips in raw specs, SemiAnalysis says its memory bandwidth per TCO advantage makes it a strong fit for Anthropic’s reinforcement-learning roadmap, with the startup increasingly influencing Amazon’s silicon direction. The y think mid 20s AWS growth by June

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.