Lots of interesting stuff going on while I was out yesterday: More rumors of AAPL building out AI chip w AVGO +6% in 2026; M-sci calling out better RBLX +6% bookings; GM Cruise exiting robotaxi ambitions helping TSLA +6%/GOOGL; GOOGL +5% continuing to re-rate higher on AI Agents announcements and Yipit had a positive report on Waymo’s continuing share gains (hitting UBER-6% /LYFT-6% ); semis +3% finally getting a bid as Semi-analysis talked down limits of scaling laws.

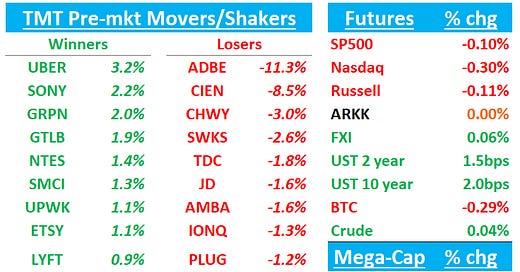

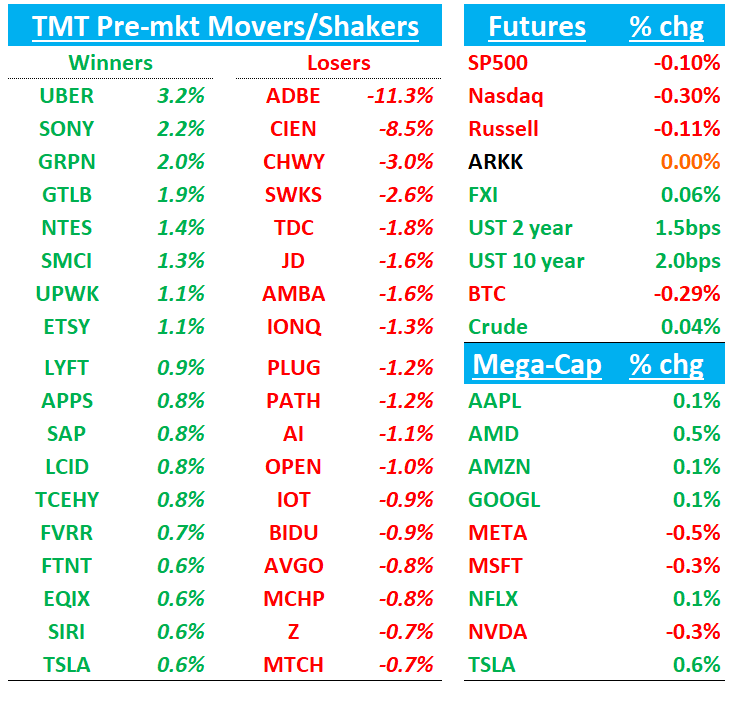

QQQs -35bps early today giving back some of yesterday’s gains. Barclays Day 2 TMT conf is today (agenda here) along with AVGO earnings post-close. BTC -1% hovering around $100k. Yields ticking up 2bps. ADBE -11% following ORCL and MDB misses. On macro front, we got a larger than expected hike from Brazil, larger than expected cut from SNB and 25bps cut from ECB.

Let’s get to it…

ADBE: Digital NNARR misses bogeys and guide lower than expected

Overall, #s worse than expected which will fuel bear concerns around AI ramp/competition (Open AI, Canva, Figma) slowing growth as we head into pricing tailwinds rolling off in 2H ‘25. GTM changes also create some disruption as we head into next year. Sentiment had sneakily crept up into the print, but will likely fall squarely in the funding short camp among HFs after this print. Stock doesn’t seem particularly cheap at 24x FY26 P/E for a low teens EPS grower with competitive/secular concerns.

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.