TMTB Morning Wrap

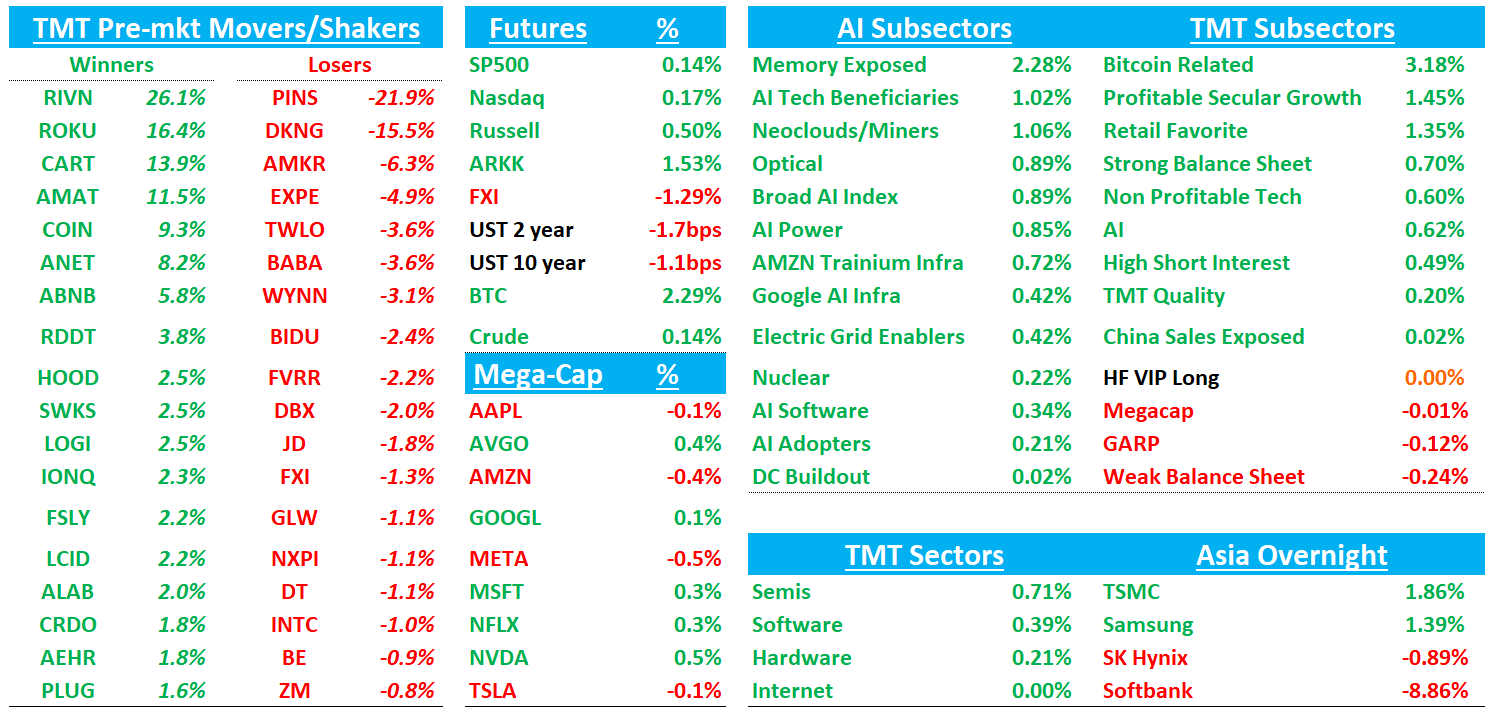

Good morning. QQQs flattish after an inline CPI. Asia followed US red overnight: TPX -1.63%, NKY -1.21%, Hang Seng -1.72%, HSCEI -1.55%, SHCOMP -1.26%, Shenzhen -1.05%, Korea KOSPI -0.28%. Softbank -9%. BTC +2%. Yields are up 2bps across the curve.

Some solid earnings overnight from ANET, AMAT, ROKU, CART and ABNB — we’ll dive into those and mroe below and then get to the usual. Have a great Friday!

Let’s get to it…

ANET +8%: Beat & Raise, AI Target Doubles to $3.25B, Q1 30% y/y growth guide, FY26 Growth Guide Moves to 25% and will be viewed as v conservative. Some nits/concerns around margins although co maintained GM outlook vs. CSCO’s -ve margin surprise

Key quote re: AMD: “Today when we look at our deployments, we see about 20%, maybe a little more 20% to 25% where AMD is becoming the preferred accelerator of choice” vs deployments essentially 99% NVDA based a year ago”

The #s / Key Takeaways:

Q4 Revenue $2.488B, +28.9% y/y (last q +27.5% y/y) vs Street $2.384B, +~23.5% y/y; Non‑GAAP EPS $0.82 vs $0.76 with GM/OM modestly above Street.

1Q26 guide was notably better than expected: Revenue ~$2.60B, +29.7% y/y vs Street $2.46B, +~22.7% y/y, with GM 62–63% and OM ~46%.

FY26 outlook was raised early to ~25% growth (~$11.25B) vs Street ~$10.88B (+~20.8%), and the AI center networking goal was raised to $3.25B (from $2.75B).

Deferred revenue ended at ~$5.4B (product-heavy), with management attributing the build to new products, new customers, new use cases (AI) and especially customer-specific acceptance clauses that can extend 6–18 months.

Mgmt reiterated scale-up Ethernet is tied to standards/spec timing, with broader production more 2027 than 2026, while scale-out/scale-across and DCI/routing spines (e.g., flagship chassis) appear nearer-term.

Mgmt disclosed FY25 customer concentration (two >10% customers, likely ORCL and either Anthropic or OpenAI) and said it expects one, potentially two additional >10% customers in FY26.

Mgmt described memory pricing as worsening sharply (order-of-magnitude type language) and suggested it may pursue a one-time price increase on selected memory‑intensive SKUs if spot pricing stays elevated. The key offset is that they maintained the FY26 GM framework (62–64%) and implied planning/purchase commitments help cushion the blow.

Bull vs. Bear Debate

Bulls think that ANET is increasingly the “pure-play” way to own the buildout of Ethernet-based AI networking, across both back-end GPU fabrics and the broader front-end networking attached to AI workloads without taking direct accelerator risk. From this perspective, the quarter reinforced the idea that Arista is not just participating in AI capex, but that it is gaining strategic scope: the co raised the FY26 AI center networking target to $3.25B and discussed expanding engagement across multiple model builders, cloud titans, and specialty/neo-cloud providers. Bulls also argue that the company’s software and operational tooling (telemetry/visibility/automation) becomes more valuable as AI clusters scale, supporting both differentiation and durable margins even as hardware speeds move from 800G toward 1.6T.

Bulls also highlight that Arista’s “beat and raise” came despite a more challenging cost/supply environment (notably memory) and complicated revenue timing from acceptance clauses. The raised FY26 growth outlook is viewed as conservative relative to what demand could support especially if new >10% customers materialize and if the mix of AI plus campus continues to scale.

Bears think that ANET is executing extremely well, but the stock’s narrative and valuation are increasingly tied to a concentrated, lumpy set of very large AI-driven customers where timing is hard to predict and competition is intense. Bears worry that the company is benefitting from an unusually strong phase of hyperscaler and AI-specialty buildouts, but that networking spend can be delayed (power constraints, data center build timing, GPU delivery timing) and that acceptance clauses can shift revenue recognition across quarters. Bears also shout out concerns on CPO/OCS fears. In addition, some bears will point to the emerging cost/availability debate. Mgmt’s language around memory costs worsening materially and the possibility of a one-time SKU-level price increase introduces risk. Meanwhile, competitive dynamics remain a persistent overhang especially as the market transitions to new architectures (scale-up standards, 1.6T roadmaps, optics strategies).

AMAT: massive beat/raise as guiding >20% CY26 semi equipment growth (2H‑weighted), with cleanroom constraints setting up a strong 2027

Crowded long (semi caps sit just behind Memory/Optical in the investor pecking order) but AMAT delivered putting up the goods putting up a stronger guide than buyside were expecting. Didn’t hear many nits here.

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.