TMTB Morning Wrap

Good morning. Futures -20bps slightly red this morning after yesterday’s big down day. So far, I’m giving the benefit of the doubt the market despite price action past week and expect these two levels to hold, but as always, need to stay on our toes:

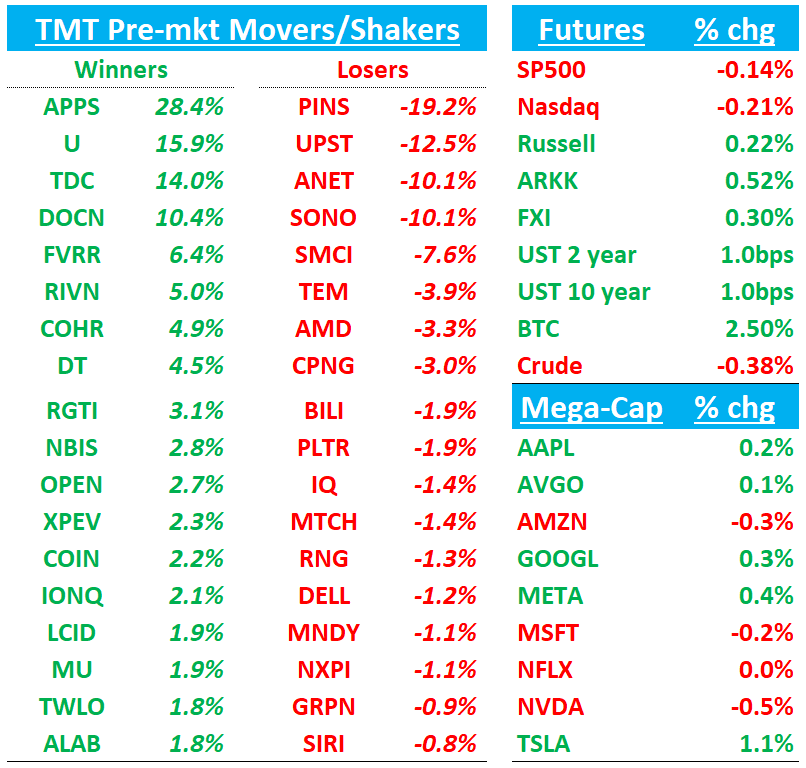

Asia saw mixed price action on Wednesday: TPX -1.26%, NKY -2.5%, Hang Seng -0.07%, HSCEI -0.11%, SHCOMP +0.23%, Shenzhen +0.45%, Taiwan TAIEX -1.42%, Korea KOSPI -2.85% although some AI stocks rallied to finish the day stronger in Korea (Hynix -1% after being down -9% at one point). Nintendo +6% post their print

BTC +2%

We’ll hit earnings first then move onto the usual…

AMD -2.5%: clean beat/raise with record DC and Client strength, an above‑Street Q4 revenue guide, and management leaning into AI GPUs/rack‑scale in ’26

We thought #s were good enough here meeting heightened buyside expectations. The reality is the name is crowded so not surprising to see stock down a few ppts especially given risk off environment yesterday. Overall - we thought the co. needed to do on a q which we frankly don’t think was a big deal for AMD as most investors are focused on 2H’26 and beyond when mi4xx ramps. We continue to think r/r skews favorably to the up.

The call went fine - Lisa talked up LT DC GPU trends: “will generate well over $100B in revenue over the next few years)” & “I think we’re dimensioning the supply chain in such a way that we would have ample supply to have multiple customers at similar scale as we go into the ‘27, ‘28 time-frame” while also trying not to front-run next week’s analyst day. In the 10-Q this morning: purchase commitments for 2026 are up 3.4x from prior filing, to $3.96bn from $1.15bn

The pushback I hear from people this morning is that stock is crowded among specialists/generalists (fair), GMs a tad light (fair) Q4 DC GPU guide slightly weaker (irrelevant in our view), and that post the analyst day we have a bit of a vacuum that AMD needs to bridge before 2H’26 (fair point although a ramping CPU server cycle should help bridge).

The #s:

Q3’25: Revenue $9.246B, +36% y/y (last q +31.7% y/y) vs Street $8.743B, +~28.2%, EPS $1.20 vs Street $1.17, Non‑GAAP GM 54.0% in line, Datacenter +34% q/q led by Instinct MI350 and EPYC Turin; Client +10% q/q; Gaming +16% q/q; Embedded +4% q/q

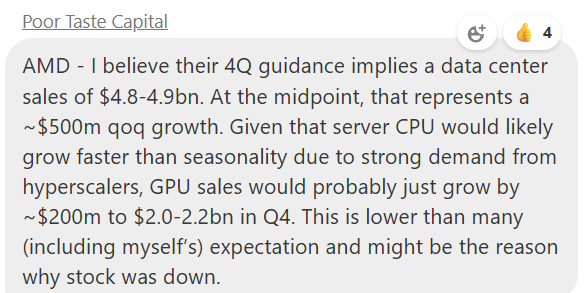

Q4’25 guide: Revenue $9.6B (+/‑ $300M), +25.4% y/y vs Street $9.19B, +~20.2%, GM 54.5% (in line); implied EPS $1.31–$1.33 vs Street ~$1.31, with the small EPS shortfall vs some models driven by higher opex. Guide excludes MI308 China.

Bull vs. Bear Debate:

Bulls argue AMD is executing across both CPU and AI GPU and heading into a multi-year cycle of both, with EPYC Turin accelerating (now ~half of EPYC mix) and a robust secular pull from AI/agentic workloads that expand general‑purpose compute. They expect MI355 to build into MI450/Helios in 2H’26 with rack‑scale differentiation, and view the OpenAI partnership as a durable multi‑gen pipeline that catalyzes other hyperscale/sovereign deals. Several models see DC‑GPU potentially reaching ~$16B in ’26 and $30B+ in ’27, supporting >$10 2027 EPS if CPU share gains persist and GM holds mid‑50s. On this view, bulls argue for ~25–30x 2027 EPS given the visibility to multi‑year AI capacity adds and software traction, implying a $300+ stock on $12 on CY27 EPS in a base case and $400+ on $15 of EPS and 30x in a bull case, while arguing downside limited given AMD rarely has traded below 20x, especially when both the CPU and GPU businesses are inflecting up.

Bears focus on execution risk in shifting from add‑in GPUs to rack‑scale systems, the software moat versus CUDA, and customer concentration (OpenAI, who has committed more then $1T in spending) amid uncertain deployment/power timelines. They also point to higher opex and only in‑line GM that can cap near‑term EPS leverage, plus regulatory/licensing uncertainty (no MI308 China in guide) and a slow Embedded recovery while saying DC GPU guide in Q4 was disappointing. Some Uber-bears will compare the stock to ORCL and say ORCL has given back most of its OAI fueled pop while AMD hasn’t and the stock remains crowded with plenty of tourists involved.

PINS -19%: Solid user/engagement and an EBITDA beat, but UCAN softness and tariff headwinds kept revenue merely in‑line and the 4Q guide below buy‑side hopes, shifting the near‑term narrative to “prove it” on US growth

The #s:

3Q Revenue $1,049M, +17% y/y (last q +17% y/y) vs Street $1,049M, +~17%; Adj. EBITDA $306M (29.2%) vs Street $298M (28.4%); Non‑GAAP EPS $0.38 vs Street $0.41. Global MAUs reached 600M vs Street 589M; international revenue (EU +41% y/y; RoW +66% y/y) was the bright spot.

4Q revenue guide $1,313–$1,338M (+14–16% y/y) vs Street ~$1,339M (~+16%); 4Q EBITDA $533–$558M vs Street ~$552M.

Key Takeaways:

Management cited pockets of moderating spend from large US retailers navigating tariff‑related margin pressure; a new tariff on home furnishings is embedded in the 4Q revenue outlook (mgmt framed ~1‑pt impact). Asia‑based e‑commerce spend in the US was down y/y (partial q/q recovery).

International monetization is accelerating and diversifying the mix. Europe +41% y/y and RoW +66% y/y, aided by a hybrid GTM (direct + resellers) and rising Shopping penetration; international remains under‑monetized vs user share, implying multi‑year ARPU runway.

Company launched Top‑of‑Search ads (beta in all monetized markets) with +29% CTR vs standard; where‑to‑buy links and local inventory ads shorten the path to purchase; Pinterest Assistant (beta) puts voice multimodal search in foreground.

P+ campaigns deliver +24% higher conversion lift and +12% faster monthly spend growth among adopters; ROAS bidding now powers ~22% of lower‑funnel retail revenue. These are helping win more performance budgets (5–10% SoW with some large advertisers) even as UCAN macro weighs.

AI investments to be monetized, but CoR growth to track revenue in ’26. Mgmt expects diminishing returns from prior infra optimization and CoR to grow more in line with the business next year, partially offset by AI features that monetize immediately; they stress cost‑efficient model usage (incl. open‑source)

Bull vs. Bear Debate

Bulls (not many right now) main sticking point after today will be on valuation as stock trading at <13x CY 26 EPS for what is likely at least mid teens growth and argue Pinterest’s unique high‑intent, visual shopping surface (100% logged‑in, 1P signals; ~80B queries with visual growth +44% y/y) is steadily translating into performance budget share gains as automation (Performance+, ROAS bidding) improves outcomes (+24% conversion lift, rising SoW with top advertisers). International is under‑monetized yet accelerating (EU +41%/RoW +66% y/y), Shopping formats are scaling (Top‑of‑Search; where‑to‑buy; local inventory), and Assistant/multimodal should deepen commercial engagement. The near‑term UCAN tariff pressure is transitory, setting up re‑acceleration into ’26 as comparables ease and AI surfaces monetize. On upside, bulls think PINS can sustain ~16–19% ’25–’27 revenue CAGR with ~33%+ . EBITDA margin, deserving ~18–20x ’27E EV/Adj. EBITDA, which = to $45+ depending on execution.

Bears counter that UCAN growth is structurally challenged: revenue is more concentrated in large US retailers now facing tariff‑driven margin compression; Asia‑based e‑commerce spend is softer; and competition for agentic shopping (big models inside search/chat apps) could disintermediate discovery. Pricing is pressured by mix (international) even as impressions surge; CoR is set to grow more in line with revenue in ’26 with diminishing infra optimization benefits, which may cap near‑term margin expansion. They see a risk that touted AI/Shopping features won’t move reported revenue fast enough to re‑rate the multiple while 4Q decelerates again.

Our view: Downside does appear limited here and r/r skewed to the up, but we are also believers in the following:

ALAB +2%: Another broad beat-and-raise—Q3 revenue/EPS and margins topped the Street, Gen‑6 now >20% of revenue, and Q4 guidance + commentary reinforced the AI scale‑up narrative (Scorpio/X) with clear UALink timing and solid Taurus momentum.

The #s:

Q3 (Sep‑25): Revenue $230.6M, +103.9% y/y (last q +149.7% y/y) vs Street $206.8M; EPS $0.49 vs Street $0.39; Non‑GAAP GM 76.4% vs Street 75.2%.

Q4 (Dec‑25) guide: Revenue $245–$253M (mdpt $249M), +~77% y/y vs Street $217M; EPS ~$0.51 vs Street $0.42; Non‑GAAP GM ~75% vs Street ~74%.

Key Takeaways:

Aries (Gen‑5/6) and Taurus (400G AEC) grew; Scorpio P ramped, and X is shipping pre‑production with volume deployments through 2026; Gen‑6 >20% of Q3 revenue (higher dollar content).

Mgmt reiterated Scorpio X‑Series as the “anchor socket” in next‑gen AI racks; engaged with 10+ AI platform providers. Export‑IP constraints in China are driving demand for PCIe‑based scale‑up (lack of 200G IP), which inflates GPU counts per cluster and increases ALAB content.

UALink solutions targeted for 2H26 availability with 2027 revenue; positioned as additive to PCIe scale‑up. 400G AEC drives Q4; 800G expansion in 2026 broadens customer base and volumes

Bull vs. Bear Debate

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.