TMTB Morning Wrap

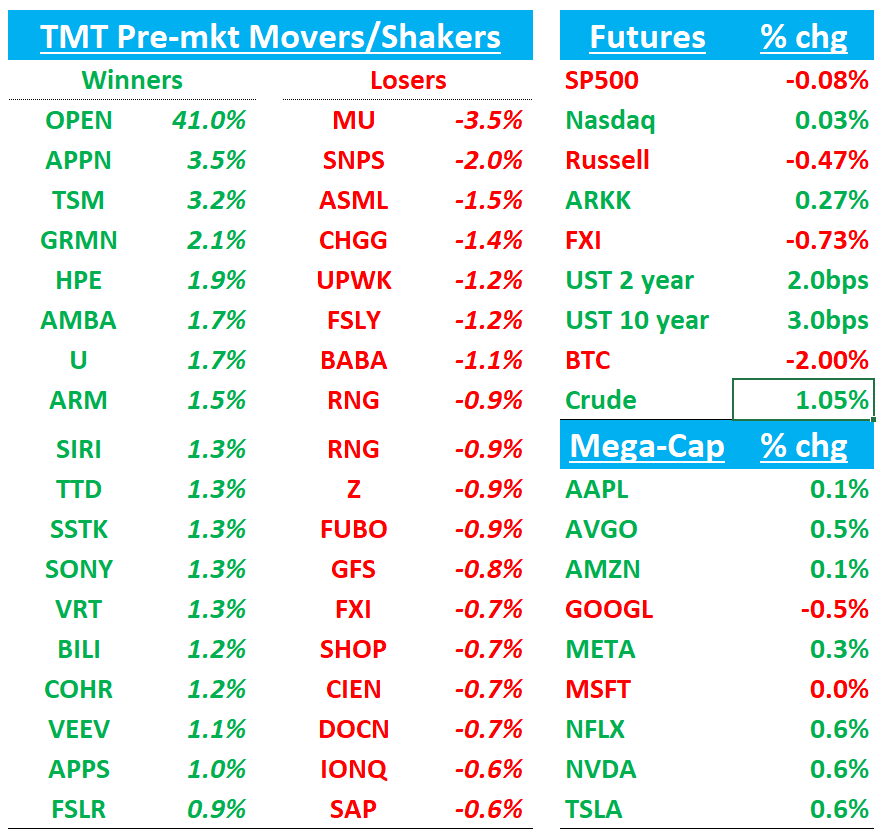

QQQs flattish as TSM #s much better than already high expectations, which should help semi supply chain today, except MU which is getting hit as GS downgraded Hynix in Asia calling out potential HBM weakness in ‘26, which follows a similar note by Edgewater earlier in the week.

BTC -2%. Yields ticking up 2-4bps across the curve. China -75bbs.

We’ll hit TSM first, then get to News/Research.

Let’s get to it…

TSM: Very solid numbers with Q3 guide +8% q/q vs buyside expects of 5% and ‘25 rev growth seen at 30% vs expects of high 20s.

Expectations were high but this was better than expected. Bulls will point out the +30% full year guide implies Q4 down 10% q/q vs typical seasonality of +7-8% — co. on the call said this was conservative:

So a lot of you is calculating our reported numbers so that you can easily see that our fourth quarter is decreasing. We take into the consideration of the possible impact of tariff and a lot of other uncertainties. So we become more conservative. That's our current attitude..

GM guide of 55.5-57.5% is a bit light vs expectations of 57%. FX headwinds (NT$ appreciation) and overseas‑fab dilution pulled 2Q GM down 20 bp q/q and left the 3Q mid‑point ~50 bps light.

Capex guide reiterated at $38-$42B and they said they aren’t seeing any pull in activity.

Key quotes from the call:

“AI demand is getting stronger and stronger”…“We maintain a mid‑40 % five‑year CAGR for AI accelerator revenue, reflecting broad‑based demand across hyperscale and sovereign AI projects.”

“We expect strong growth momentum for CoWoS demand in 2026, with the gap between supply and demand narrowing as new lines come online.

We haven’t seen any order changes related to new tariffs, but we will continue to monitor customer behavior closely.”

I like your comment on that we have to share our value because of very tight in N3 capacity. It will be continued for a couple of years, very tight. And in fact, N5 also very tight. The demand is high because of a lot of AI product still in the 4-nanometer technology node. And they will transition to 3 nanometer probably in the next two years. So in meanwhile, N5 are still very tight in capacity. N3, even tighter

Going forward, it's too early to talk about future years' CapEx, but I can share with you, a company of our size, it's unlikely that you see CapEx dollar amount suddenly drop a lot in any given year. That's all I can share with you

NFLX Bogeys are for 1% beat to revs (+17 vs street at +16%) with slight upside to margins and a slight raise to FY OM guide…Q3 rev bogey 15.5% vs street at 14.8%…remember they no longer report subs…

Hynix/MU: GS Downgrades SK Hynix to Neutral, Sees HBM Risk into 2026

Stock was down 9% overnight…HBM concerns in 2026 becoming a theme - recall Edgewater note from earlier in the week on MU, which has now become a fast money short…

Goldman Sachs lowers SK Hynix to Neutral from Buy and trims the price target to W310,000, implying just 5% upside, citing concern over a potential HBM pricing decline in 2026 as competition intensifies and buyer power consolidates. While GS remains constructive on HBM and DRAM demand in 2025 and has raised near-term estimates, they now expect company OP for 2026 to come in 19% below consensus, which Goldman believes already assumes a bullish HBM outlook. They flag the stock’s significant outperformance (+138% since Jan '22 vs. +9% KOSPI) and note that shares are now trading at 1.8x P/B, above the historical average, making the risk/reward more balanced. To become more positive again, GS would need to see upside in HBM and DRAM fundamentals as well as a reset in Street expectations.

On the other hand, hearing some investors L Samsung / S MU+Hynix… we pointed out the Sammy chart a couple days, continues to break out…

U: MS Flags Early Signs of Structural Ad Recovery, Sees Room for Upside

Morgan Stanley highlights improving ad performance at Unity, citing recent customer feedback suggesting a “no less than” 15–20% lift in installs and purchases, and argues that these gains reflect structural changes following 18 months of platform overhaul. MS believes the uplift is being driven by three key developments: the full rollout of Unity’s Vector model in May after a year of development; the July integration of game engine data into ad targeting, which MS sees as a unique advantage; and accelerating adoption of Unity 6, which is expected to enhance monetization across both Create and Grow segments. While acknowledging lingering investor doubt, MS reiterates its bullish stance and suggests Unity’s network assets remain underappreciated, calling out a $40 bull case based on 10% annualized growth in ad revenue and a 10x EBITDA multiple.

Nvidia chief vows to ‘accelerate recovery’ of China sales as H20 chip ban lifted - FinancialTimes

Huang told a press conference in the Chinese capital on Wednesday that the company had not yet received export licences from Washington to restart shipments of its H20 product, but he expected them “to come through very shortly”.

“Some of what we wrote off is hard to recover, but what we put on reserve will not be scrapped permanently,” he said on Wednesday.

The company would make a final decision about whether it needed to restart production of its previous Hopper generation, of which the H20 was part, once customer orders came through, he said. “The customers’ old orders have been cancelled. Their demands may have changed. We have to start the supply chain,” he added, noting that the process takes nine months.

CRWW: HSBC Starts at Reduce on Commoditization Risk, Street-Low $32 PT

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.