TMTB Morning Wrap

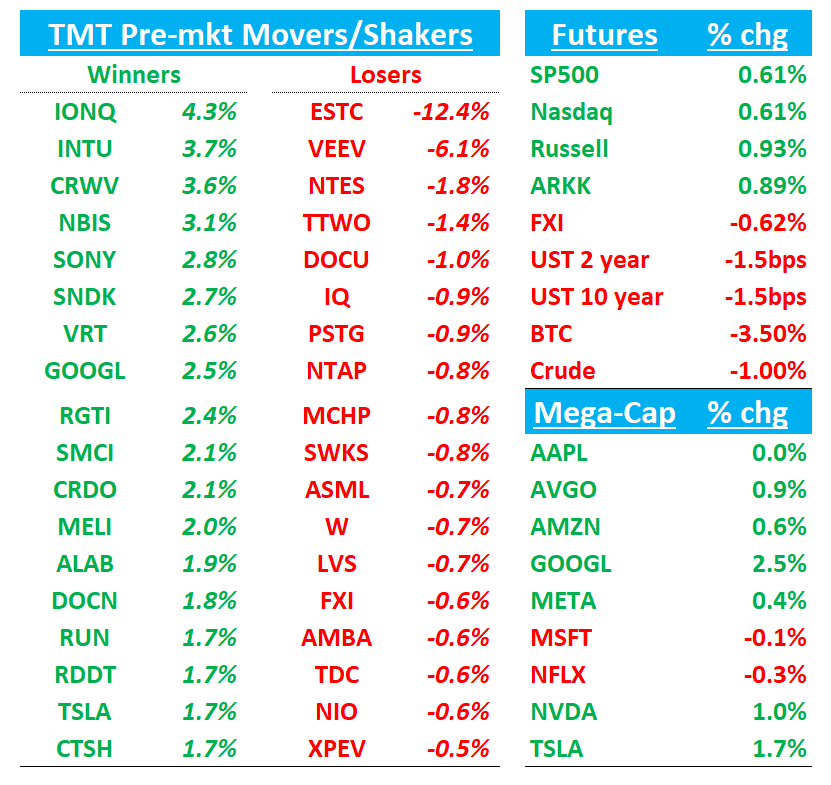

Good morning. QQQ +50bps as we got some positive news on the Fed front, which caused futures to go from down 50bps to +50bps:

Odds of a Fed Rate now 63% down from 30% overnight. Some good market color from readers on TMTB Chat over the last few days.

We began adding yesterday afternoon and doing some more this morning (more thoughts this weekend).

BTC -3.5% hovering around $84k after flirting with $80k this morning.

Let’s get to it…Earnings first, then move onto the usual,…

OpenAI: Altman Memo Forecasts ‘Rough Vibes’ Due to Resurgent Google

OpenAI CEO Sam Altman told colleagues last month that Google’s recent progress in artificial intelligence could “create some temporary economic headwinds for our company,” though he added that OpenAI would emerge ahead.

After OpenAI researchers heard that Google had created a new AI that appears to have leapfrogged OpenAI’s in the way it was developed, Altman said in the memo that “we know we have some work to do but we are catching up fast.” Still, he cautioned employees that “I expect the vibes out there to be rough for a bit.”

EARNINGS:

ESTC -14%: printed a solid beat-and-raise quarter on revenue, EPS and margins, but decelerating cloud growth, weak billings/FCF and a new focus on “sales‑led” metrics has stock down dd early

The #s / Key Takeaways:

F2Q26 revenue was $423.5M, +15.9% y/y (last q +19.5% y/y) vs Street $418.2M, +~14.4% y/y.

Elastic Cloud revenue was $205.7M, +21.8% y/y vs Street ~$202.7M, but growth decelerated from roughly mid‑20s last quarter and annual cloud growth stepped down to ~27% from ~31%.

Non‑GAAP EPS of $0.64 beat Street at $0.58 and guidance of $0.56–0.58; non‑GAAP OM was 16.5% vs Street 16.0%.

F3Q26 guide: revenue $437–439M, +15% y/y vs Street ~$431M, OM ~17.5% vs 16.8–16.9% Street; FY26 revenue raised to $1.715–1.721B, +16% y/y vs Street ~$1.70B with OM kept at ~16.25% and EPS guide lifted to $2.40–2.46 vs Street $2.35.

On callback, mgmt said 1H ACV growth accelerated vs last year and that, combined with a seasonally stronger 2H, underpins confidence in the raised FY26 guide; sales‑force realignment from last year is “paying off.”…management reiterated that large cloud deals follow an S‑curve—it takes 2–3 quarters to build data pipelines before peak consumption—so the big commitments signed in F1–F2 should support better cloud growth in 2H, even if revenue lags bookings.

Cloud growth slowed again, keeping the core debate alive.

Elastic Cloud revenue grew +21.8% y/y, modestly above Street, but decelerated from roughly mid‑20s growth last quarter and from +30% constant‑currency the prior quarter, despite easier comps and general optimism around consumption names. Annual cloud growth also stepped down to ~27% from ~31%.Sales‑led subscription revenue (all sales‑driven cloud + self‑managed, excluding SMB self‑serve) grew +18% y/y (17% cc) and now represents ~82% of total revenue. Management is now guiding this metric: +17% y/y for F3Q26 and +18% y/y for FY26, which is ~200bps above the 15% “baseline” medium‑term growth discussed at Analyst Day. They repeatedly stress that this is the key internal KPI that drives the model and that sales reps are not incented on cloud vs. self‑managed.

The company closed 30+ $1M+ ACV deals, with five >$10M TCV and two >$20M—a new record—spread across AI, security and observability. RPO grew +19% y/y (CRPO +17%), outpacing revenue and highlighting multi‑year commitments, helped by a standout $26M CISA next‑gen SIEM cloud deal and several eight‑figure security/AI wins. This is the heart of the bull narrative: big, strategic platform deals landing across core use cases.

Management says AI is positively impacting all areas of the business.O ver 2,450 Elastic Cloud customers are now using the platform for gen‑AI, with >370 in the >$100K cohort (~23% of that base) and AI users showing materially higher expansion vs non‑AI users. New features like Agent Builder, a managed inference service on NVIDIA GPUs, the DiskBBQ vector algorithm, and the Jina AI acquisition deepen Elastic’s positioning as a “context engineering” and vector search platform. Bears counter that despite this AI activity, total and cloud growth remain stuck in the low‑mid‑20s rather than inflecting.

Macro/ Demand: Management repeatedly described a strong demand environment, with healthy consumption from both AI‑native and traditional customers across search, observability and security, and robust pipelines across geos. The U.S. government shutdown cost roughly ~1pt of Q2 growth via delayed public‑sector renewals and some services revenue, but these are expected to close in F3Q and are not seen as lost business.

Bull vs. Bear Debate:

Bulls see Elastic as one of the few real‑business AI winners with a differentiated search + vector + security/observability platform that is now starting to show up in large enterprise commitments. They point to the string of big wins this quarter—30+ $1M+ deals, five $10M+ TCV, two $20M+ TCV, including landmark security and CISA SIEM‑as‑a‑service deals—as evidence that Elastic can be a consolidator across search, logging, and security, displacing legacy tools and capturing larger standard platform footprints. RPO/CRPO growth outpacing revenue and strong ACV growth in 1H support the idea that revenue is “under‑earning” the true demand trend as cloud consumption ramps with its usual lag. On AI, bulls argue Elastic has a real moat: it owns the data plane, has deep search and context‑engineering IP (vector database, managed inference, DiskBBQ, Agent Builder, Jina AI), and is already embedded in thousands of customer apps across search, observability and security. The AI cohort shows materially higher expansion than non‑AI users and is still in the early innings of deployment; as those workloads scale from POCs to production, bulls expect durable mid‑teens to high‑teens growth even if macro stays choppy. Combined with mid‑teens operating margins and high‑teens FCF margins plus an active buyback, the story screens as a “Rule‑of‑40 with AI upside” at a still‑reasonable multiple. At 4-5x Revs, bulls see little downside to valuation and think this should trade closer to 7x, which gives you $120+

Bears focus on the lack of visible acceleration in the reported numbers, especially cloud revenue and net expansion, despite a year of intense AI product and marketing push. Elastic Cloud growth decelerated again to ~22% y/y (CC ~22%) from ~30% cc last quarter, and annual cloud growth stepped down to ~27% from ~31%, at a time when other usage‑based names are showing re‑acceleration. TTM NRR is stuck at ~112% for the 6th straight quarter, and investors still can’t clearly see the AI cohort inflection in total revenue. Skeptics see management’s pivot to “sales‑led subscription revenue” and downplaying of cloud metrics as evidence that cloud growth is structurally capped by self‑managed deployments, efficiency features and price sensitivity, not just temporary noise. The second big bear point is quality of growth and forward visibility. Billings missed materially and slowed to low‑single‑digit growth, with working‑capital usage driving a much weaker FCF outcome than expected; bears worry that this is not just timing but a sign that revenue will slow toward low‑teens and that consumption is being propped up by pricing and large one‑off deals. Some also question whether the heavy reliance on a handful of large consolidation/AI deals increases volatility and competitive risk against hyperscalers and specialist vendors in logging and security.

INTU +3% put up a clean beat on revenue/EPS with broad-based strength (especially GBS and Credit Karma), reiterated FY26 guidance, and framed Q2’s below‑Street EPS as deliberate reinvestment while leaning hard into the AI/agentic and OpenAI partnership narrative.

The #s / Key Takeaways:

F1Q26: Revenue $3.885B, +18% y/y (last q +20% y/y) vs Street ~$3.76B, +~14–15% y/y; non‑GAAP EPS $3.34 vs Street ~$3.09; non‑GAAP OM 32.4% vs ~31.1%.

GBS grew 18% (20% ex‑Mailchimp) with online ecosystem +21% (25% ex‑Mailchimp) and QBO Advanced + IES ~40%; Consumer grew 21%, led by Credit Karma +27% and TurboTax +6%.Q2 guide: revenue +14–15% y/y, ~2% above Street, but EPS $3.63–3.68 is ~5% below Street on heavier tax‑season and AI/brand spend; FY26 revenue/EPS growth guide of 12–13% / 14–15% is unchanged and broadly in line with consensus.

Management characterized SMB/consumer macro as stable (profits/cash flow up, payroll hours up, payments TPV +29%/18% ex‑bill pay) and emphasized AI agents, Intuit Enterprise Suite, and the new OpenAI deal as key multi‑year growth drivers, with no notable commentary on tariffs.

Re‑acceleration in core SMB and consumer engines. GBS revenue grew 18% y/y (20% ex‑Mailchimp), with online ecosystem +21% (25% ex‑Mailchimp) and online accounting +25%; mid‑market (QBO Advanced + IES) grew ~40%. Consumer revenue was +21% with Credit Karma +27% (broad‑based across personal loans, cards, insurance) and TurboTax Live revenue +51%, signaling momentum heading into tax season.

Macro: From their data across ~100M consumers and 10M+ businesses, management sees “stability” with profits and cash flows “stable and up,” payroll hours worked up, and online payments TPV +29% (18% ex‑bill pay), in line with recent quarters. Certain sectors (IT services, construction, manufacturing) are “up quite nicely” while real estate and lending are down modestly, but overall Intuit’s offerings are described as “must‑have,” historically becoming more critical in tougher macro.

AI / agentic execution is becoming tangible. 2.8M customers now use Intuit’s virtual AI agents; the accounting agent saves customers up to 12 hours/month, the payments agent gets them paid five days faster, and new payroll and sales‑tax agents further automate workflows. QuickBooks Live customer growth was 61% y/y, and management reiterated that “done‑for‑you” AI+HI experiences will “eventually do everything for our customers,” consolidating tech stacks and driving ARPC.

Bull vs. Bear Debate:

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.