TMTB Morning Wrap

Good morning. Hope everyone had a great break.

Futures -1% to start December as BTC -6% (Some attributing fall to BoJ teasing a December hike, which spiked 2yr yields/yen and caused Nikkei -2%). Overall, Asia saw mixed price action on Monday: TPX -1.19%, NKY -1.89%, Hang Seng +0.67%, HSCEI +0.47%, SHCOMP +0.65%, Shenzhen +1.02%, Taiwan TAIEX -1.03%, Korea KOSPI -0.16%. US Yields up 2-4bps across the curve.

AMZN’s Reinvent begins today in Vegas as investors looking for updates on Trn3 timeline, performance and/or customer adoption and potential AMD announcement, as well as more details on Project Rainer.

Powell has a speech at Standford tonight. Trump saying a Powell replacement announcement could arrive soon (most think Hassett in the lead to get the nod). This week, we get earnings from CRDO, MDB, OKTA, GTLB, MRVL, CRWD, CRM, SNOW, and HPE among others

Let’s get to it…

Black Friday Numbers:

Adobe Analytics says U.S. online Black Friday sales hit a record $11.8B, up 9.1% YoY, with another $5.5B expected Saturday and $5.9B Sunday, and Cyber Monday projected at $14.2B.

Mastercard SpendingPulse shows total retail ex autos up 4.1% and ecommerce up 10.4% vs 2024.

Salesforce pegs Black Friday spend at about $18B, up 3% YoY, with average prices up ~7% and order volumes down ~1%, pointing to higher spend driven more by price than units.

SHOP: Oppenheimer Says BFCM Growth Solid but Slightly Below Street as Weekend Pace Eases

Oppenheimer flags Shopify’s $6.2B Black Friday result (+25% y/y, +22% ex-FX) as strong, but says weekend trends softened enough to put 4Q GMV a touch below the Street’s ~28% bogey. Live Globe data points to ~23% growth through Sunday, leaving Monday—which typically drives ~27% of BFCM—key for bridging the gap. OpCo notes Shopify entered the weekend slightly behind expectations and Sat/Sun pacing disappointed some investors.

DASH +4%: Alred Lin (Sequoia Capital Managing Partner) makes $100M buy

SNPS +8%: NVDA invests $2B, announces strategic partnership

PR:

This expanded partnership will integrate the strengths of NVIDIA’s AI and accelerated computing with Synopsys’ market-leading engineering solutions to deliver capabilities enabling R&D teams to design, simulate and verify intelligent products with greater precision, speed and at lower cost. In addition, NVIDIA invested $2 billion in Synopsys common stock at a purchase price of $414.79 per share.

Multi-year collaboration spans NVIDIA CUDA accelerated computing, agentic and physical AI, and Omniverse digital twins to achieve simulation speed and scale previously unattainable through traditional CPU computing – opening new market opportunities across engineering. To further adoption of GPU-accelerated engineering solutions, the companies will collaborate in engineering and marketing activities.

OpenAI: Code suggests that OpenAI may be close to introducing ads for ChatGPT

The truly free ride for ChatGPT might soon come to a close as OpenAI could be nearing the introduction of ads. As first discovered by Tibor Blaho on X, a beta version of ChatGPT’s Android app includes lines of code that heavily reference ads. According to the post, the 1.2025.329 beta version includes mentions of “ads feature,” “search ad” and “bazaar content.” While this isn’t a version that’s available to the public yet, it could be an indication that OpenAI is ready to open the ad floodgates.\

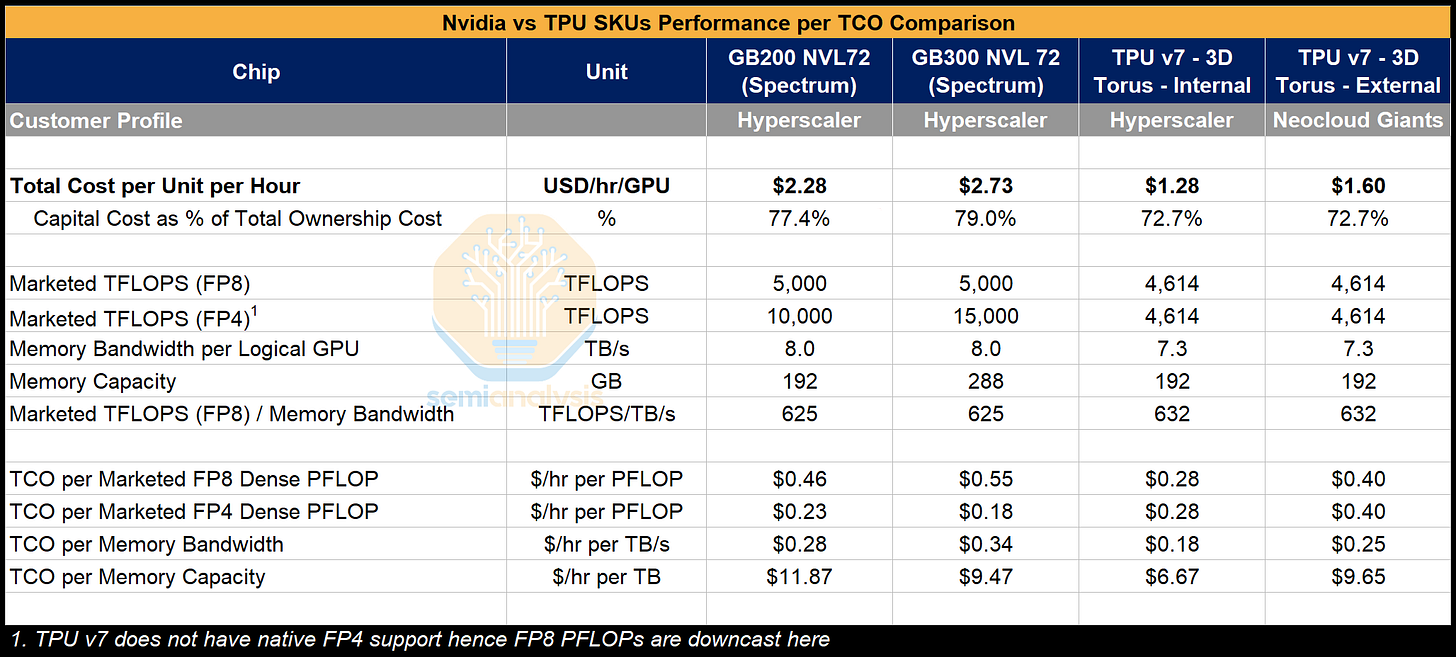

NVDA/GOOGL: Big story Friday was the Semianalysis piece which talked up GOOGL’s TPUv7 performance vs. NVDA (lower TCO), but ended up more positive on Rubin/Rubin Vera vs. TPUv8.

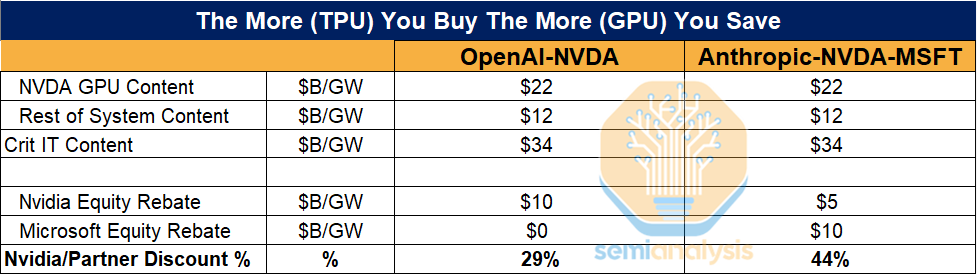

Another key table was the below showing OAI getting a discount on GPUs given TPU competition

GOOGL: Morgan Stanley Says Rising TPU Supply Checks Hint at Emerging 1P TPU Sales Strategy

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.