TMTB Morning Wrap

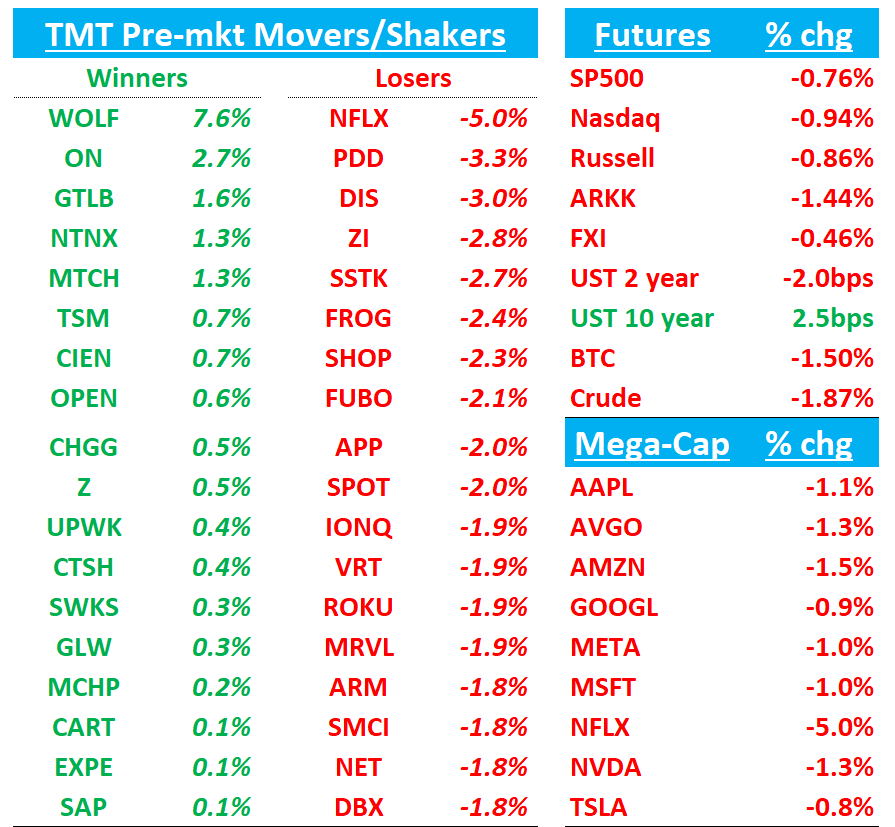

QQQs -1% to start the day as Trump calls for tariffs on foreign made movies. BTC -1.5%. China -50bps. Yields mixed with the 10 year up 2bps while the 2 year is down slightly.

Another big week of earnings. NOW analyst day starts today - 4:30pm est.

We’ll hit Tech News/Research first then get to some macro news flow near the end…

Let’s get to it…

NFLX: Trump calls for tariffs on foreign made movies

NFLX has been up 11 straight days so this news likely ends this nice little streak. What does this to the internet tariff safe haven trade? Do we see a reversal in all names (DUOL, CART, RBLX, SPOT, DASH, CART, MELI)? My feeling (not high conviction) is that we might get knee jerk move down initially, but NFLX $’s will shift into these names as the tariff/China safe haven trade narrows even further…

Lots of unanswered questions…

The Hollywood Reporter: Trump’s 100% Tariff on Movies: 8 Key Questions the Industry Is Now Pondering and Dreading

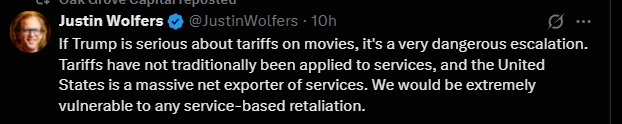

Does this make retaliatory tariffs on services more likely?

AMZN: Jeff Bezos will sell 25M shares in stock (about 50% worth of 1D’s volume) over the next year

AMZN 10-Q: “On March 4, 2025, Jeffrey Bezos, our founder and Executive Chair, adopted a trading plan intended to satisfy Rule 10b5-1(c) to sell up to 25,000,000 shares of Amazon.com, Inc. common stock over a period ending on May 29, 2026, subject to certain conditions.”

We’ve seen him have a limit in the past for where he wants to sell, which has typically capped the stock short-term, but we don’t know that limit yet until first filing…

NVDA: Jefferies lowers GB200 #s

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.