TMTB Morning Wrap

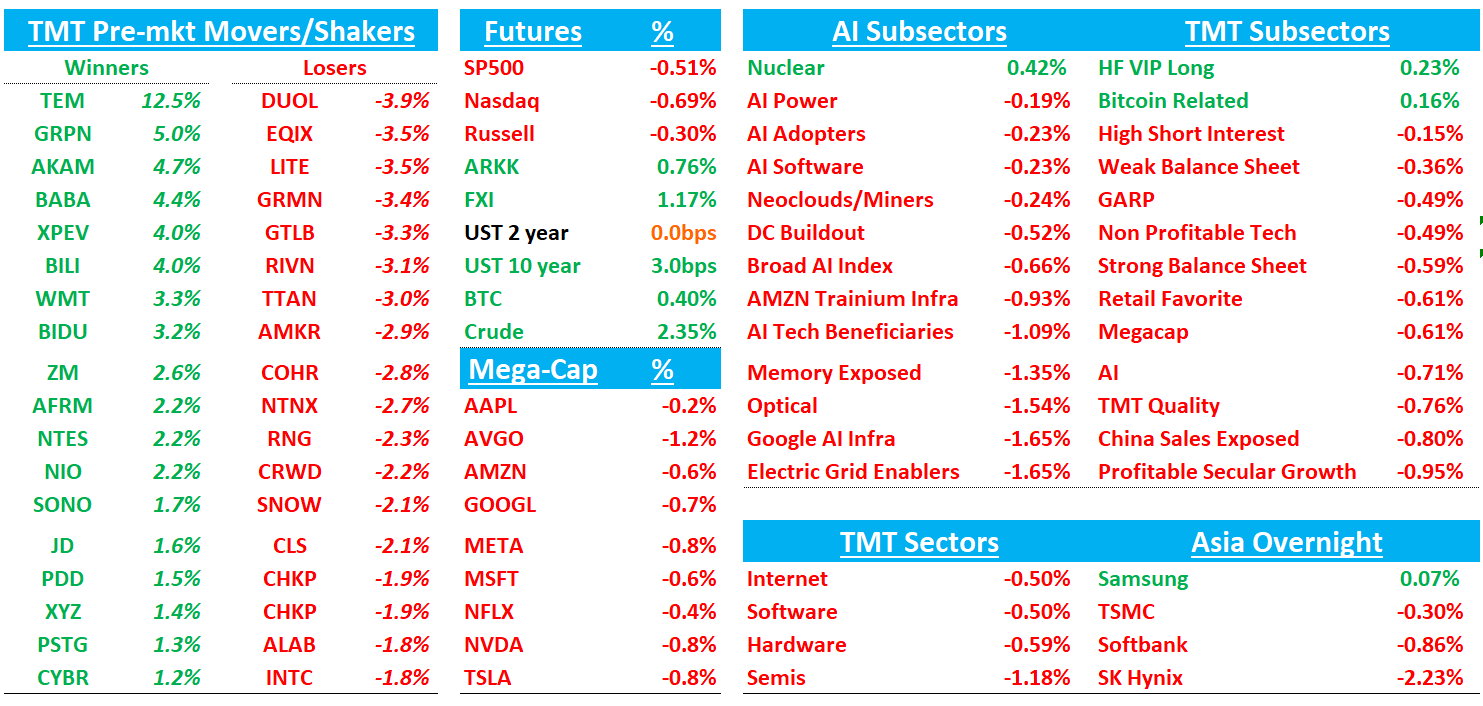

Good morning. Futures -66bps off early mainly driven by the criminal investigation launched into Powell. The other piece off macro news was Trump’s call Friday night for credit card industry to cap interest rates at 10%.

Outside of that, stocks in Asia mainly saw gains with particular strength in China: Hang Seng +1.44%, HSCEI +1.9%, SHCOMP +1.09%, Shenzhen +2.05%, Taiwan TAIEX +0.92%, Korea KOSPI +0.84%. BTC flat at $90k. Long end of the curve is rising 3-5bps. Fed expectations have been shifting slightly in hawkish direction with market only expecting a 42% chance of a cut in April.

A firehose of news/sell-side action this morning so lots to get to…

GOOGL/SHOP: Google teams up with Walmart and other retailers to enable shopping within Gemini AI chatbot

AP:

Google said Sunday that it is expanding the shopping features in its AI chatbot by teaming up with Walmart, Shopify, Wayfair and other big retailers to turn the Gemini app into a virtual merchant as well as an assistant.

An instant checkout function will allow customers to make purchases from some businesses and through a range of payment providers without leaving the Gemini chat they used to find products, according to Walmart and Google.

Google’s new AI shopping feature works this way: if a customer asks what gear to get for a winter ski trip, for example, Gemini will return items from a participating retailers’ inventory.

SHOP: Baird/Keybanc positive on Agentic Commerce Optionality

KeyBanc says Shopify’s UCP announcements meaningfully expand its agentic commerce footprint by adding new merchant on-ramps via deep integrations with Google Search/Gemini, OpenAI, and ChatGPT, all managed through Shopify Admin and Agentic Storefronts. The firm highlights the new Agentic Plan opening Shopify Catalog to non-Shopify merchants as incremental funnel expansion, reinforcing Shopify’s position as a core enabler for merchants navigating agentic workflows. Baird echoes a mostly positive read, arguing the updates support Shopify’s role as the checkout layer and help protect market share as merchant inventory increasingly surfaces across multiple AI agents. Net, both firms frame the announcements as strengthening Shopify’s strategic relevance in agentic commerce, with potential upside to merchant acquisition and engagement.

GOOGL: Google introduces personalised ads into AI shopping tools

Google is introducing new personalised advertising into its AI shopping tools, as it seeks to make money from the hundreds of millions of people who use its chatbot for free and gain market share from rival OpenAI. Advertisers will be able to present exclusive offers to shoppers who are preparing to buy an item through Google’s AI mode, which is powered by its Gemini model, the Alphabet-owned tech group announced on Sunday

AFRM / UPST / SOFI / XYZ / PYPL: Mizuho Flags Upside from Potential 10% APR Cap

Mizuho says President Trump’s call for a one-year 10% cap on credit card APRs could have meaningful positive implications for BNPL and personal loan providers, particularly AFRM, UPST, SOFI, XYZ, and PYPL. The firm notes a cap would materially reduce traditional credit card economics and likely push lenders to tighten standards for lower-FICO consumers, redirecting demand toward alternative credit products. With U.S. credit card balances at ~$1.2T and over 50% of consumers below a 745 FICO threshold, Mizuho sees a potential volume tailwind for BNPL and personal loan platforms, translating into revenue upside assuming disciplined underwriting. While not yet formal policy, the firm views the proposal as a constructive readthrough for alternative lenders with exposure to lower-FICO borrowers.

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.