TMTB Morning Wrap

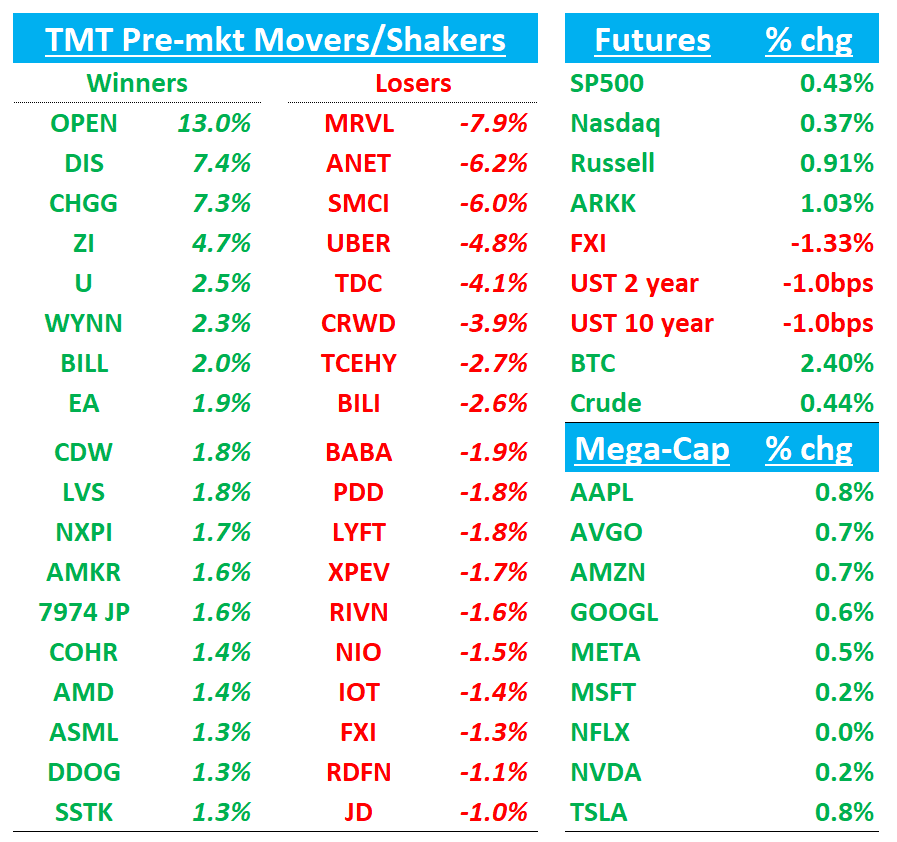

QQQs +30bps have sold off this morning despite being +1%+ on reports that China and US will hold their first confirmed trade talks this weekend in Switzerland. Bessent said the meeting will focus on de-escalation rather than reaching a deal and said current tariff rates are unsustainable (translation: will be a long slog). Fed meeting today. Yields slightly down. BTC +2.4%. China -1.4%.

Lots to get through this morning so sending this out for now, but likely some more to come. We’ll start with earnings (UBER, DIS, AMD, ANET) then move onto News/Research/3p…

Let’s get to it.

UBER -5%: Mixed Print — Soft Q1, But Solid Q2 Guide

Underwhelming Q1, missing expectations largely due to softness in Mobility. However, the Q2 guide looks solid, calling for sequentially flat growth in cc and better EBITDA. Elevations had crept up into the print given better AV news and change in perception in UBER as the platform winner so mobility miss should weigh today. Not a perfect print, but Q2 guide should alleviate the fears stemming from Q1 mobility miss - will need to wait to the call to see what drove the miss.

Says trips in Intl markets have been stronger than in the US but have not seen any consumer slowdown or tradedowns yet. On the call, lots of blame on passing through lower insurance costs in the US affecting gross bookings but doesn’t impact mobility profitability/ebitda

Q1 Highlights:

Gross Bookings: $42.8B (+18% FXN) vs. buyside ~$43.5B and guidance range of $42.0-43.5B

Mobility: $21.2B (+20% cc) vs. Street $21.5B

Delivery: $20.4B (+18% cc) vs. Street $20.3B

EBITDA: $1.87B vs. buyside ~$1.89B (guidance $1.79-1.89B)

Free Cash Flow: $2.25B vs. Street $1.86B

Q2 Outlook:

Gross Bookings Guidance: $45.75-47.25B (+16-20% cc) vs. buyside ~$46B (high-end)

EBITDA Guidance: $2.02-2.12B vs. buyside ~$2.05-2.10B (high-end)

DIS: Big FY EPS Raise, but Sports Drives the Upside

Stronger-than-expected Q and raised its full-year EPS guidance, though mainly coming from strength in Sports — not the higher-multiple Experiences and Entertainment segments. Main positive though is sizable lift in the FY25 EPS outlook, now calling for +16% growth (up from prior high-single digits).

CEO Bob Iger: "Following an excellent first half of the fiscal year, we have a lot more to look forward to, including our upcoming theatrical slate, the launch of ESPN’s new DTC offering, and an unprecedented number of expansion projects underway in our Experiences segment."

Q2 Highlights:

Revenue: $23.6B vs. Street $23.1B

Entertainment: $10.7B vs. $10.5B

Sports: $4.53B vs. $4.33B

Experiences: $8.89B vs. $8.72B

Segment Operating Income: $4.44B vs. Street $3.95B

Entertainment: $1.26B vs. $957M

Sports: $687M vs. $654M

Experiences: $2.49B vs. $2.38B

Free Cash Flow: $4.89B vs. Street $1.72B

EPS: $1.45 (+20%) vs. Street $1.19

Buybacks: $1B repurchased in the quarter; $3B full-year target reiterated.

FQ3 Guide:

Modest increase expected in Disney+ subs (Street had modeled a decline of ~1.1M).

FY25 Outlook:

EPS Guidance Raised: $5.75 (+16% Y/Y) vs. prior guidance for high-single digit growth.

The raise driven primarily by Sports (OI growth now +18% vs. +13% previously), with Entertainment and Experiences/Parks growth targets unchanged.

Cash from operations forecast raised by $2B to $17B, benefiting from tax payment deferrals.

AMD +4%: Solid quarter with upside across revenue and segment results (Gaming, Client and DC), though gross margin was hit by inventory charges tied to China export controls (ex-charge, margins would have beat at 54%, ahead of street). Bulls vs. Bears undecided.

Stock traded up initially, but sold off when CEO wouldn’t give a more detailed GPU guide, saying AI revenue would continue to be “up strong double digits.” Street is at $7b (which implies 40% y/y growth); Buyside closer to $6.5 (30% y/y) and Bears at $6B (20% y/y growth). Hard to read into what is implied without more detail…Still, commentary sounded fairly good on AI saying they added multiple Tier 1 cloud and enterprise customers this q, including one of the largest LLM developers (OpenAI?). AI event on 6/12.

For 2Q 2025 the company guided revenue to $7.4 billion even after a $700 million China export‑control hit, but the guide also embedded an $800 million inventory write‑down that drags reported gross margin to 43 % (about 54 % ex‑charge). Management estimated a full‑year $1.5 billion revenue impact from the MI308 ban, most of it in 2Q–3Q (so ~$800M in Q3)

Bulls will say that AMD’s multi-cylinder engine finally firing in sync with a beat across the board and #’s moving higher (something we haven’t seen in a while), positioning is cleaner, stock is cheap at sub 20x P/E for a 20% top line/ 25-30% EPS grower, China #s de-risked, and expectations for AI / PC market are significantly reset. Ex- China headwind, the topline beat was even bigger than the headline suggests. Bulls will say Mi350 checks getting better and will drive upside momentum in the 2H, while Mi4xx series looks to be more comparable to NVDA’s Rubin. In other words: AMD has been playing catch-up, but with Mi350/Mi4xx and Ai instances moving to inference from training, they have a much better shot at being competitive with NVDA.

Bears will say quality of the beat was low quality driven by Client and Gaming while AI numbers are going down (missed AI in Q1) and no more China upside. Bears will say AMD will never catch up to NVDA given awful software and no ecosystem. Bears will also point out that outsized contributions from high‑ASP desktops and graphics that likely reflect tariff‑related PC pull‑ins or short‑lived channel restocking, raising the risk of a sub‑seasonal second half just as Intel fights back with aggressive pricing. Bears also stress that even after stripping out the inventory charge, gross margin guidance fell 50 bps short of consensus, and opex is climbing as AMD races to keep pace with Nvidia’s rack‑scale solutions—pressuring operating leverage precisely when investors want margin proof.

Our View: Lots of cross-currents on this one, but we lean more positive than negative, mainly on the improving AI narrative (inference shift, better performance vs. NVDA with mi350/mi4xx) + better checks heading into 2H and AI expectations likely bottomed for now. China revs de-risked for now as well. We like the r/r here as don’t think stock gets back under $90 unless we see another market meltdown. For now, just b a very small starter — Still feeling out the right timing / set up / risk-reward on this one…

AMD: BofA upgrades to Buy. Vivek has been a pretty vocal non-believer on AMD (was at neutral) - so a notable upgrade

The firm upgrades AMD to Buy, citing several catalysts: (1) potential for 20%+ topline growth in CY25 and CY26 despite China headwinds; (2) continued PC/server CPU share gains as INTC remains constrained; (3) achievable AI GPU goals, including $6.2B in CY25 sales (+23% YoY), bolstered by MI350 ramp in 2H; (4) margin expansion with EBIT margins targeted near 30% by CY27 (up from 22% in CY25); and (5) attractive valuation at 18x CY26 PE, with EPS CAGR of 27% from CY24-27. While some near-term softness in gaming and consumer PCs may linger, the firm sees ASP and share gains driving upside.

ANET -4%: Beat and raise with revs, GMs, and EPS all above…Q2 raised but FY only reiterated

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.