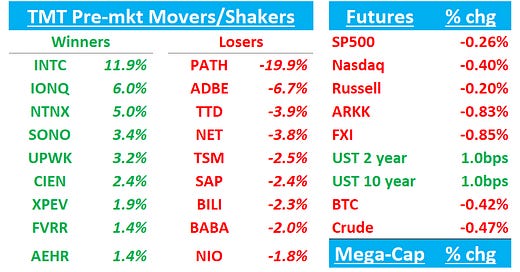

QQQs -35bps; BTC flat; China -1%. PPI came in a bit cooler than expected, flat m/m vs street at +0.3%.

Let’s get straight to it…

ADBE -6%: Roughly down the line quarter with NN DM ARR $415M bs bogeys of $410-$420M. FY’25 targets re-affirmed and Q1 guide inline.

Not much to write home about; every q that passes without a significant change in the AI narrative for ADBE makes the bears feel more emboldened — mgmt sounded unexcited on the call imo. In other words: a lack of narrative change in the bull (valuation - 19x CY26 EPS and AI traction just starting) vs bear (structural AI loser, competition) debate favors the bears right now. Bears also hooked onto limiting disclosures from ADBE as they will only update the new ARR AI line item line “periodically” and not “quarterly” ($125M this q, $250M by YE) although they are providing some new details in terms of segmenting the corporate / enterprise business vs. the consumer / creative business. Despite NN ARR DM coming in-line, RPO and bookings missed widely (bookings $5.53B vs expectations for $6B+) and cRPO growth of 12% decelerated from 16% in Q4, likely from enterprise softness. ADBE didn’t specifically say much about the macro (tariffs, trade wars, consumer tightened) but highlighted structural digital tailwinds, diverse biz and no direct tariff exposure. ADBE summit on the 17th next week.

ADBE RESULTS: Q1

- ADJ EPS $5.08 vs. $4.48 y/y, EST $4.97

- Revenue $5.71B, +10% y/y, EST $5.66B

- Digital experience revenue $1.41B, +9.3% y/y, EST $1.4B

- Subscription revenue $5.48B, +12% y/y, EST $5.42B

- Product revenue $95M, -20% y/y, EST $95.4M

- R&D expenses $1.03B, +9.3% y/y, EST $1.01B

- ADJ operating income $2.72B, +10% y/y, EST $2.66B

- Services and other revenue $136M, -7.5% y/y, EST $144.3M

GUIDANCE: Q2

- Guides ADJ EPS $4.95 to $5.00, EST $5.00

- Guides revenue $5.77B to $5.82B, EST $5.8B

- Guides digital media revenue $4.27B to $4.30B, EST $4.28B

- Guides digital experience revenue $1.43B to $1.45B, EST $1.45B

- Guides Digital Experience subscription revenue $1.32B to $1.33B, EST $1.33B

Earnings quick-hits:

S: Another disappointing q and guide. 4Q financials relatively in-line, but ARR of $920.1mn missed St at $921mn, and guided 1Q Rev growth of 22.3% vs cons 26.4% & FY growth of 22.9% vs cons 25.7%. NNARR guided to $200M vs street at $215M and called out demand risks: “we're mindful of macroeconomic conditions, deal timing, and federal spending uncertainty” as well as a $10M F26 ARR hit from the sunsetting of their deception product. Bears will also hate that mgmt was talking up the growth quarter intra-q and just whiffed - no one likes to be walked off a cliff.

Bulls will try to hand their hats on a 4x C26 EV/sales multiple and 20% rev/ARR growth and say new CFO means guide was conservative although bears will push back there’s not much FCF support and its a single product company which is deserving of a low multiple.

PATH: 1st top line miss as public co and Q1/FY26 guided well below street. 1Q ARR to 11% vs cons +13%. Guiding to 10% ARR growth for FY25, below street at 13-14%. Mgmt did not sound great on the call and called out DOGE as a specific headwind. Stock had been shorted given these fears along with AI disruption risk.

Key quotes:

“while we remain optimistic about the long-term opportunity in the US Public sector, the ongoing transition has created short-term uncertainty for deal closures, and we have factored this into our guidance for fiscal 2026 with a more pronounced impact in the first half of the year.”

“There has also been a significant increase in volatility in the overall macroeconomic environment, particularly in the last two weeks. In recent discussions with customers, the external environment has created uncertainty around their budgets. Foreign exchange rates have also significantly fluctuated over the last week. Given these trends, we are taking a measured approach for fiscal 2026, adding additional prudence to our overall guidance given the volatile environment”

Gets a dg at BofA: BofA downgraded UiPath to Underperform from Neutral with a price target of $10, down from $18, following the company's "disappointing" FY26 outlook. Macro pressure in the Federal vertical was cited, though commentary suggests that pressure is more broad-based and "unlikely to abate soon," says the analyst, who sees few catalysts for the shares, even at current level.

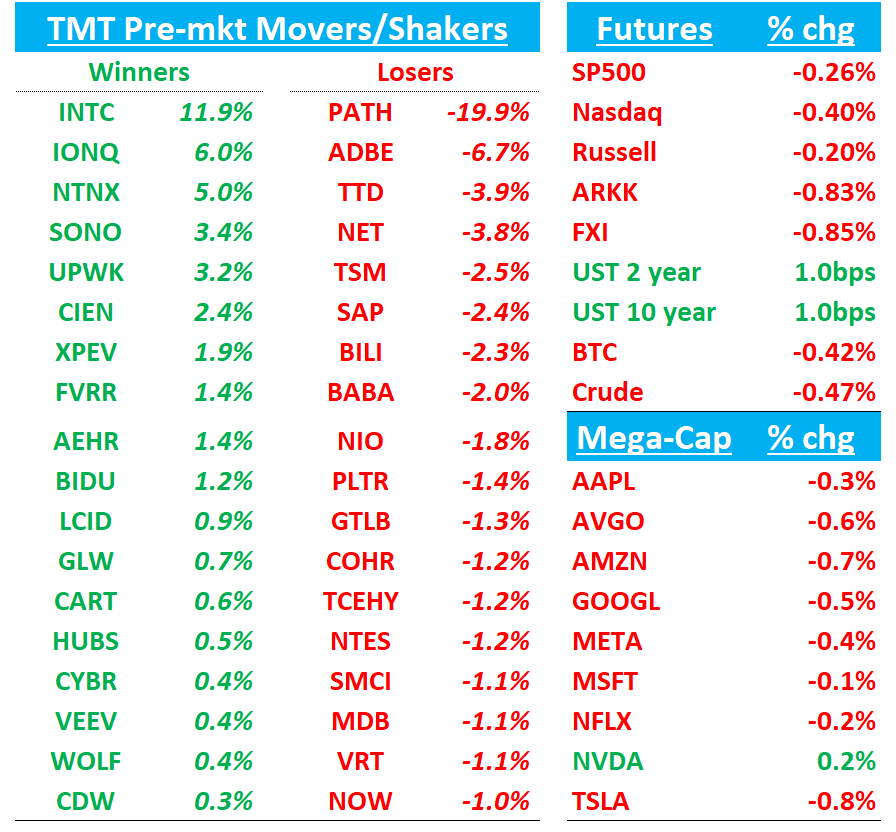

Reminder, Federal Exposure in SW. From MS:

3P roundup:

ABNB: BofA says AirDNA estimates in Feb 9% y/y a decel vs Jan at 19% y/y. AirDNA now estimates 7% y/y for the full q, below street at 8%….M Science notes on ABNB this AM that “Volume growth has been sequentially weaker in the U.S. over the past three weeks.”

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.