TMTB Morning Wrap

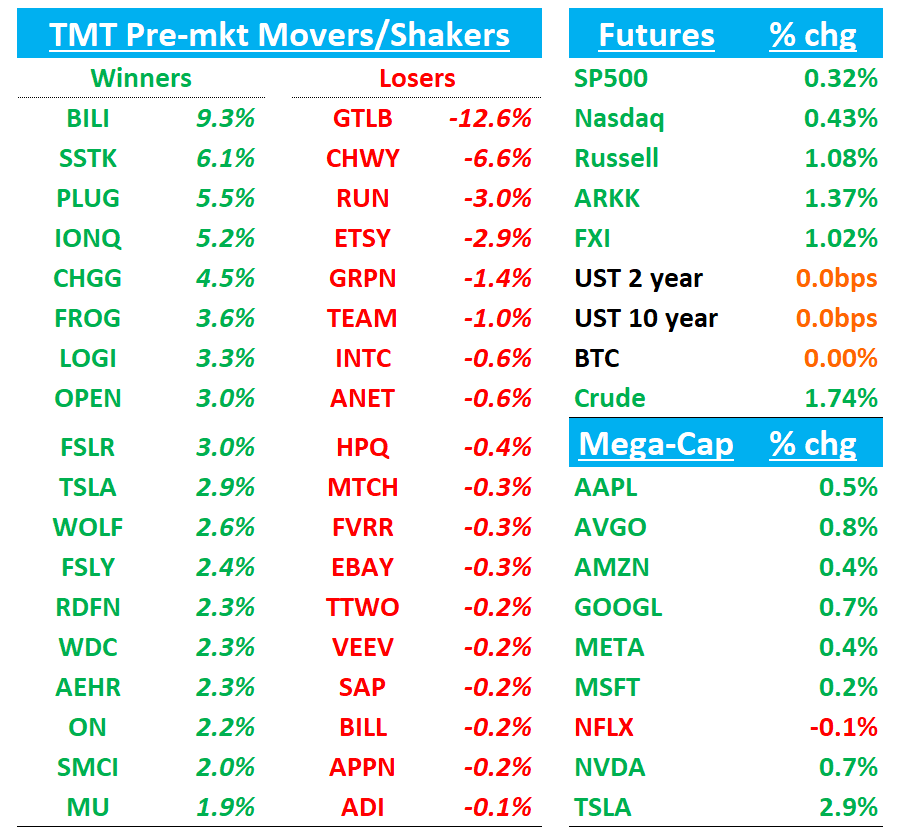

Good morning. QQQs +55bps after a cooler CPI. Yields are flattish. BTC is flat.

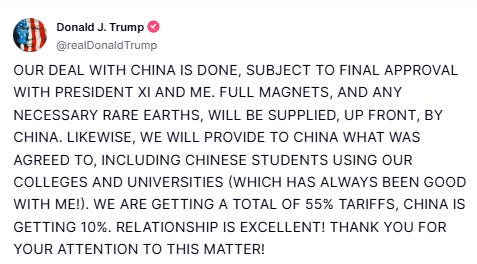

10% universal + 20% fentanyl + Section 301 tariffs = 55% tariff rate on US imports from China - I believe that’s where that 55% # is coming from…

We’ll hit on GTLB and CHWY first, then dive into Tech/Research. Let’s get to it…

EARNINGS:

GTLB -12%: Skinny top line beat but Billings, Margins, and FCF better. AI Competition debate remains unsettled.

Expectations were fairly low heading in here given concerns around AI competition - the skinny top line beat didn’t help that and will fuel concerns on that front, but overall the q didn’t seem completely bad with better billings and strong profitability metrics. Mgmt did an ok job explaining competitive threats, but debate won’t be solved after this print as there’s a little of everything for both bulls and bears…

The #s:

Revenues of $214.5 M 27 % y/y vs Street at $213 M 26 %; and buyside expecting $215-$216…skinniest beat on record for the co

EPS $0.17 vs $0.15;

Billings $222 M 35 % y/y vs $211 M 29 %, an acceleration from 31% last quarter

cRPO $8584.8M vs street at $587M…RPO $955M vs street at $948M

FCF $104 M vs Street $55 M.

Q2 revenue guide $226.5 M 24 % y/y vs Street $226.6 M;

FY‑26 revenue $939 M 24 % y/y vs Street $940 M and op‑income midpoint $119 M vs Street $117 M.

Key Takeaways:

Mgmt called out mix & timing, not demand, drove the “thin beat”: higher SaaS (now 30 % of rev., +35 % y/y) and back‑end linearity deferred revenue recognition.

Key quotes around this:

The two things that happened in the quarter that I mentioned were the mix favored SaaS … linearity was a little bit more back‑end weighted…From a rev‑rec standpoint, self‑managed contracts recognize more up‑front, whereas on SaaS it’s 100 % ratable; with more deals tilting to SaaS this quarter, less revenue showed up in‑period…There were fewer days in the quarter, so that’s another contextual factor behind the tighter top‑line beat, although it didn’t really drive any change to guidance.”

Demand indicators healthy: billings +35 %, RPO +40 %, cRPO +34 %; federal vertical “over‑exceeded” expectations; only 1‑2 deals cited tariff hesitation.

Tier & AI momentum: Ultimate is 52 % of ARR (up 600 bp y/y) and featured in 8/10 largest deals; first‑time Duo customers +35 % q/q; Duo Workflow agentic AI on track for winter GA.

The price-sensitive SMB segment represents just 9% of ARR with GitLab citing 'very little' exposure to ~100-employee start-ups….GitLab downplayed any model contribution from the EAP SKU

KPIs soft under the hood: DBNRR dipped to 122 % (‑1 pt); net‑new $5 k+ logos 211 (‑44 % y/y); $100 k+ adds lowest since IPO.

Profitability inflecting: 1 400 bp y/y op‑margin expansion and FY‑26 FCF margin now expected >20 %.

Key quotes on competition with AI-coding assistants:

“It’s very common that customers tell us they’re “testing Duo side‑by‑side with Copilot, Cursor and Windsurf”…they’re buying multiple tools so engineers can compare them, and every line of code those assistants create still flows into GitLab for testing, security and deployment.”

“Cursor and Windsurf help engineers write code; GitLab picks up where those assistants leave off — testing, securing, packaging, deploying…they already work great with GitLab today, and our own Duo Code Suggestions offers the same IDE‑level creation capabilities while we maintain an open, interoperable platform.”

“We embrace the innovation those start‑ups bring…we don’t see them challenging the parts of the DevSecOps lifecycle where we’re world‑class, and long‑term the extra code they generate is a tail‑wind for us

Bull vs. Bear Debate:

A little of everything for both sides…

Bulls argue that the underlying demand picture is far stronger than the surface‑level “thin” revenue beat implies. They point to accelerating billings and RPO, ramping FCF, Ultimate’s 52 % share of ARR, rapidly rising Duo adoption and a 49 % FCF margin as evidence the platform is consolidating DevSecOps share and converting AI interest into monetizable upgrades; they also note management raised profit guidance despite macro caution, suggesting ample leverage remains and will say they didn’t pass through the beat to FY to set a low bar for the new CFO. Bulls will say negativity is priced in with shares already trading sub 6x CY26 revs.

Bears counter that this quarter confirms a slowing growth narrative: customer adds and DBNRR both eased, the company did not raise its revenue outlook for the first time since going public, and the beat was the smallest on record. They worry higher SaaS mix and competitive noise from GitHub Copilot, Cursor, Widnsurf and others — including bundling by hyperscalers - could keep topline surprises muted. By bundling Duo Chat & Code Suggestions into Premium and Ultimate, bulls see faster seat traction, but bears worry GitLab “eliminates a potential incremental revenue stream” and risks an extended wait for paid Duo Pro/Enterprise conversions.

CHWY -6%: Q1 Revs +8.3% u/y ahead of street at 7% and inline with buyside. Net Adds 242K vs bogeys of 220k and street at 100k. But Gross and EBITDA margins light vs street. FY reitereaated.

Expectations were high going in - the gross margin miss here will be looked at unfavorably by both bulls and bears….Call ongoing…

1Q Net Sales: $3.12B vs. Street at $3.079B (guide was $3.06B–$3.09B)

1Q Active Customers: 20.8M vs. Street at 20.63M

1Q ARPU: $583 vs. Street at $585

1Q Gross Margin: 29.6% vs. Street at 29.9%

1Q EBITDA: $192.7M vs. Street at $192M

1Q Adj. EPS: $0.35 vs. Street at $0.32 (guide was $0.30–$0.35)

2Q Net Sales Guide: $3.06B–$3.09B vs. Street at $3.04B

2Q Adj. EPS Guide: $0.30–$0.35 vs. Street at $0.29

FY26 Net Sales Guide: $12.3B–$12.45B vs. Street at $12.507B (no change)

FY26 EBITDA Margin Guide: 5.4%–5.7% vs. Street at 5.36% (no change)

TECH RESEARCH/NEWS

ORCL Bogeys: Q4 IaaS > 55% vs street at 54.5%. FY26 Revs reiterate prior target of $66B vs street at $65.2B. OCI 60%+ vs Q3 at 54% last q.

Musk Says Tesla Robotaxi Launch Tentatively Planned for June 22 - WSJ (10 Day Delay)

Micron Rumored to Hike DDR4 Prices by 50% as Samsung Runs Out Early; Industry Says Pricing in Chaos

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.