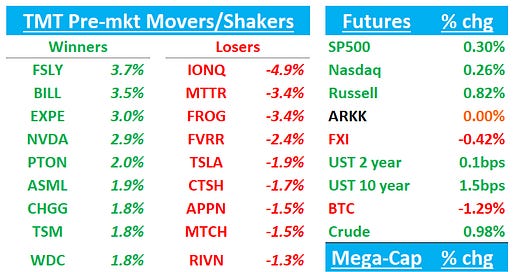

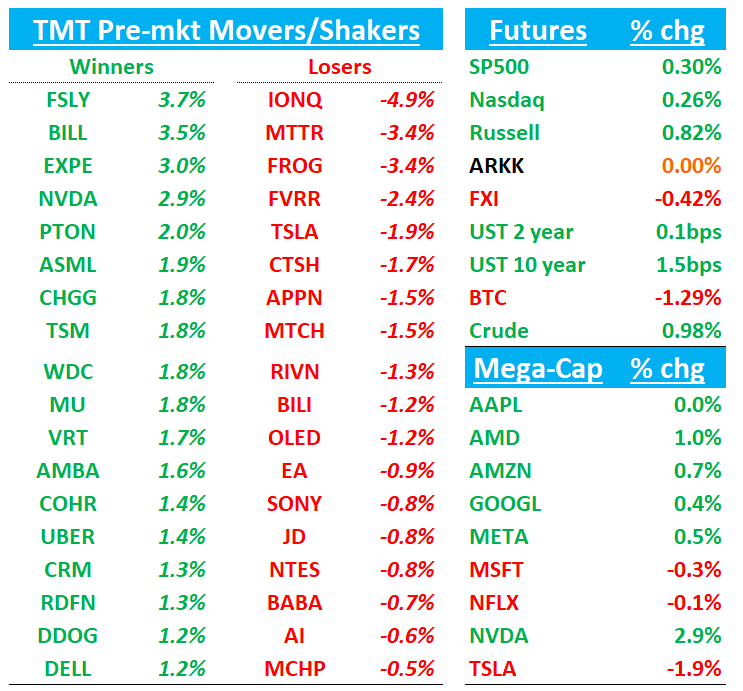

QQQs +17bpsbps as all eyes on FOMC this afternoon. MU EPS after the close. BTC -1.3% back to $105k. Yields ticking up slightly. NVDA +3% green in the pre-market! TSLA -2% red in the pre-market! What’s happening!!!

Let’s dive straight in…

MU Bogeys (reports after the close)

Sentiment generally subdued as DRAM pricing checks have been weak, but has improved over the last week (stock +15%) after AVGO’s print as bulls still comfortable looking past near-term DRAM weakness while remaining more positive on HBM ramp in ‘25 and beyond. Investors don’t want a repeat of AVGO and remember last q when MU beat despite weak checks so I’ve heard of short covering over the last week. Bears will point to Samsung ramping up and continued DRAM weakness given PC/smartphone weakness. Bogeys generally inline with street…

Q1 Revs: $8.75B vs street at $8.72B

Q2 Revs: In-line vs street at $9B

Q2 EPS: $1.90 vs street at $1.93

3p Roundup:

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.