TMTB Morning Wrap

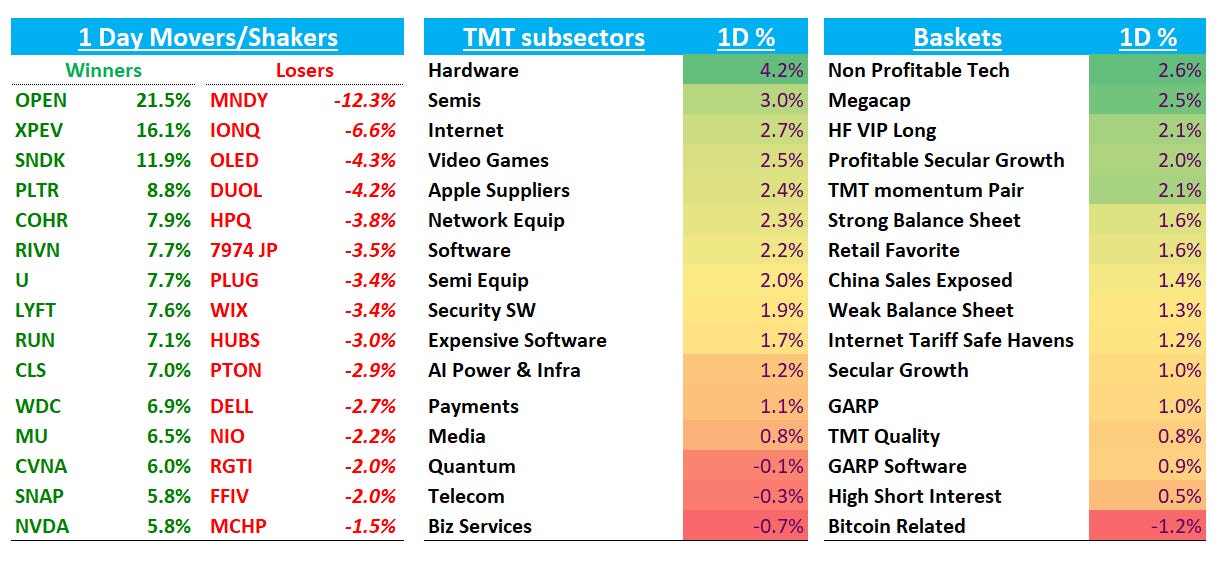

QQQs +2.21% with some nice follow through after Friday’s 50d bounce and hammer candle after the better gov’t shutdown news overnight - momentum names powering us back up although volumes were a bit muted across the board and breadth narrow again (winners continue to lead). We used the strength today to clean up our books and lower gross/net a bit, focusing on high quality/idio ideas and getting rid of “B” long ideas like RDDT or high valuation names with no NT catalysts like SHOP despite us liking the narrative.

Let’s get to it…

AI / SEMIS

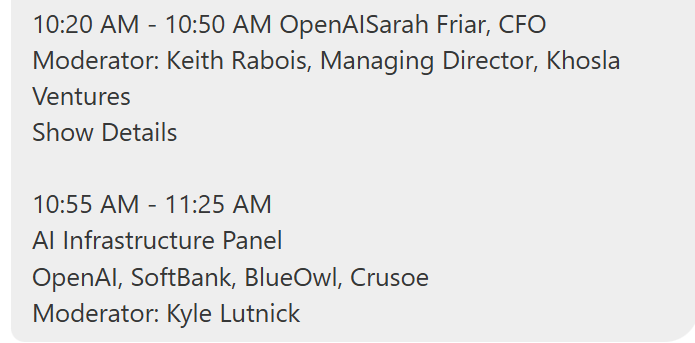

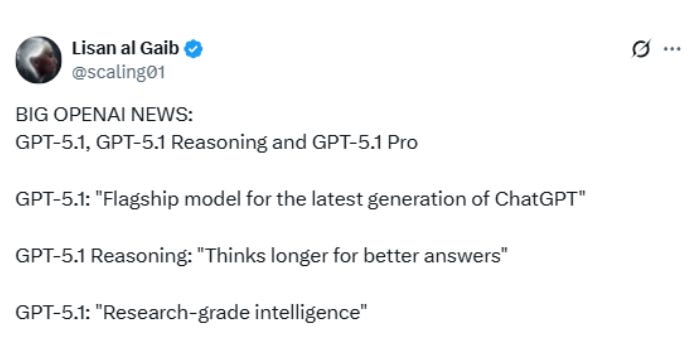

AI trade back in full force today with strength across the board — leaders continue to push us higher with memory/HDDs, optical, and TPU exposed names (LITE/COHR) leading us higher. Next AI datapoints post-CRWV today: AMD analyst day tomorrow, NBIS AMAT results this week, NVDA/BIDU next week, MSFT Ignite Nov 18-21, AMZN Re-invent Dec 1- 5, and ORCL SNOW MRVL DELL earnings in Dec. Rumors Gemini 3 due out in a couple weeks and ChatGPT 5.x out before Dec. Cantor conference tomorrow (h/t SBP in the chat):

Rumors ChatGPT 5.1 out Nov 24…

NVDA+6% as TSM +3% monthly results slightly better than expected, Jensen asking TSM for more wafers (‘very strong demand .. growing month by month, stronger and stronger’), MS saying Q4 racks 14-15k, and several positive previews across the street today ahead of earnings next week

AMD +4% ahead of analyst day tomorrow. Mgmt has been pretty clear in call backs that this is a financial event and no additional customers coming tomorrow, so that’s not expected (some speculating AMZN comes at Re:invent instead), Investors want a big TAM number and focused on GMs and maybe some LT EPS guide. Tough to tell what bogeys are here, but most think getting a good sense of the ramp would be good, and a downtick on GMs the most negative. We trimmed a bit today as we follow our rule of taking some off the table after a rally into a catalyst.

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.