TMTB Morning Wrap

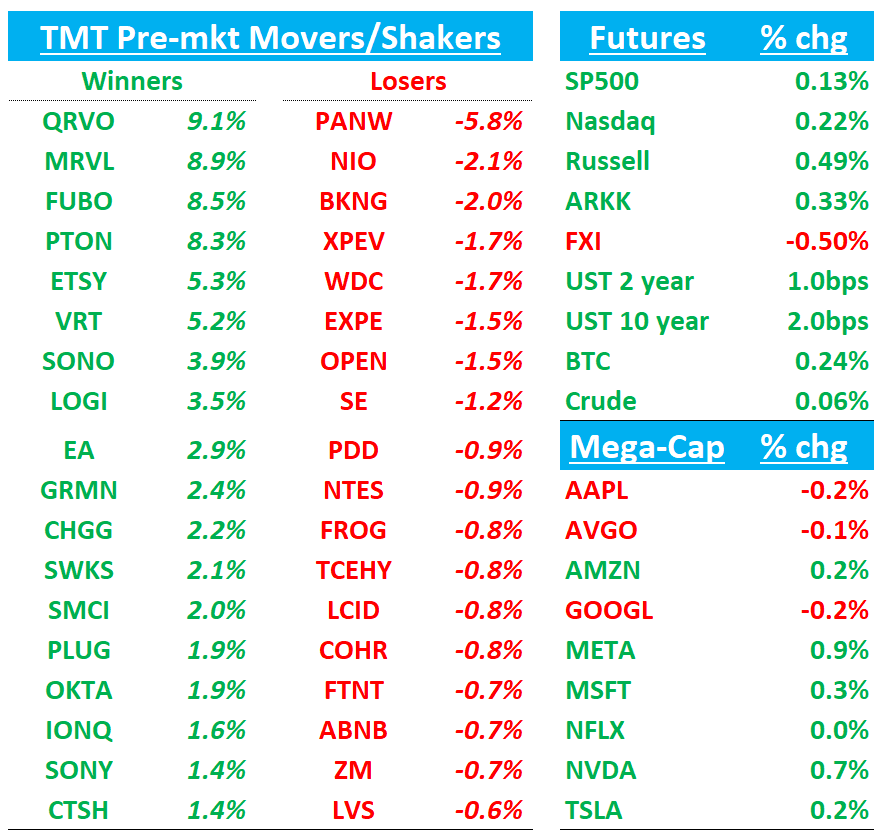

Good morning. QQQs +15bps as the big 2-day Tech Earnings extravaganza begins today. We sent out bogeys last night (check your inbox) for all the big names. Yields ticking up slightly today. BTC flat. Talk of the morning is the Fubon note at Jefferies talking up Maia3 #s for MRVL (see details below).

We’ll get to earnings quick hits first the move onto Tech/Reseach.

Lots to get to so let’s dive in…

EARNINGS QUICK RECAPS:

CHKP -6% on a Billings and RPO miss. Billings +4% at $642M below street at $649M and below buyside bogey at +6%. Sentiment was mixed heading into the print and billings miss will embolden bears. down ~4% Miss billings, RPO miss Street. Revenue: $665M, ahead of Street at $662M. Non-GAAP Operating Income: $271M, below Street at $276MNon-GAAP EPS: $2.37, in line with consensus

BKNG unch on a q2 slight beat across the board but q3 guide a bit soft although will be viewed as conservative as usual. Room nights rose 8% Y/Y to 309M (vs. +4–6% guide), gross bookings of $46.7B (+9% Y/Y ex-FX) beat by ~1%, revenue of $6.8B (+12% Y/Y ex-FX, 14.6% take rate) topped by ~4%, and adjusted EBITDA of $2.4B (35.6% margin) came in ~10% above consensus. Q3 guidance a bit soft, with room nights growth of 3.5–5.5% Y/Y (vs. Street at 5.8%), gross bookings up 8–10% Y/Y (vs. 8.9%) including 4pts of FX tailwind, and revenue up 7–9% Y/Y (vs. 8.6%), also with 4pts of FX tailwind. Adjusted EBITDA is expected at $3.9–$4.0B (vs. $3.99B consensus). Seems like typical conservativism Guidance reflects macro and geopolitical risks and called out tougher comps in Sept, lowering ADRs and increased merchandising/self funded discounts activity. Mgmt. pointed to continued weakness in the US travel environment:

“However, in the US, we observed lower ADRs as well as a shorter length of stay and booking window. This may suggest that US consumers are being more careful with spending in the current economic environment.”

Call was heavily focused on AI as has been the case the last few calls. Bernstein recaps mgmt’s stance on AI saying mgmt agrees disruption is coming but at a gradual pace—Google click volumes are still rising for now, though this likely won’t last. Booking argues that: (1) channel diversification is a net positive, and it’s well positioned to partner with hyperscalers; (2) its global scale and 60% direct traffic allow it to invest early in AI; and (3) AI should enhance margins through better service, cross-sell, and conversion. Bernstein says what remains unaddressed is the risk to take rates if AI shifts travel decisions away from Booking’s traditional search funnels.

ETSY +5% as GMS -3% ex Reverb better than expects and EBTIDA $169M, a slight beat. ETSY is guiding Q3 GMS $2.6B - $2.7B (-10% vs street at -7%) but commented: ”“our third quarter consolidated GMS guidance represents a quarter-over-quarter improvement in the apples-to-apples growth rate at the midpoint” which compares to -2.6% y/y, and is slightly better than street/expectations which expected a decel . Guided to 25% margin. Guiding 24.5% take rate, implying $649M revs at mid (cons $641M), $162M EBITDA, missing vs street at $168M.

"We're seeing early success in our efforts to build a more browsable shopping experience, particularly on our App,"

TER +3% on a strong beat but weaker guide. F2Q revenue came in at $652M vs. guidance of $645M and the Street at $650.6M. EPS was $0.57, ahead of both the $0.525 guide and Street consensus of $0.54. For F3Q, the company guided revenue to $740M, below the Street at $759.1M, and EPS to $0.78, also well under Street expectations of $0.89. Outperformance led by Semiconductor Test, which helped counter softness in Robotics and Product Test. Growth was driven largely by strength in System-on-a-Chip (SoC), particularly in AI-related applications. Management highlighted improving visibility for the second half of the year, citing rising demand across compute, networking, and memory: “We believe that AI will be a key driver of strong second-half results for Teradyne.”

QRVO +10% on a nice beat and raise: F1Q26 revenue was $818.8M, beating Street expectations of $776.4M, with EPS of $0.92 vs. $0.63 consensus. Margins improved by 200bps, with management noting this expansion should persist into fiscal 2027. For F2Q26, the company guided revenue to $1.025B (vs. $955.5M Street) and EPS to $2.00 (vs. $1.61 consensus).

STX -5% on inline-ish results with mixed guide as HAMR ramp still intact. Seagate posted inline June results with revenue of $2.44B and EPS of $2.59 vs. Street at $2.42B/$2.45. Gross margin was stronger at 37.9% (vs. 37%) and operating margin rose 270bps q/q to 26.2% (vs. 25.1%).

SepQ guidance came in slightly below at $2.5B/$2.30 (Street: $2.52B/$2.36), though GM is expected to improve to 38.7% (vs. 37.4%) on better pricing, higher HAMR mix, improved utilization, and lower cost/TB.

The soft revenue guide may reflect: Tariff-related pull-in risk (not confirmed by mgmt), HAMR qualification limiting near-term capacity, Weaker non-cloud demand.

HAMR remains on track with three customers ramping; mix expected to hit ~40% by FY26-end and 50%+ by mid-FY27.

VRT +6%: Solid beat across revenue, earnings, and cash flow, with strong order momentum pointing to continued infrastructure demand despite slightly weaker margins

Organic orders increased 15% Y/Y and 11% Q/Q, driving backlog +8% Q/Q to $8.5bn and implying ~$3.2bn of reported vs expectations closer to $3B orders in the quarter.

Adjusted operating margin was 18.5%, down 110 basis points compared to second quarter 2024, primarily reflecting ongoing tariff impacts.

Key quote:

Compared to our prior guidance for second quarter and full year 2025, we have accelerated ER&D and growth fixed cost investments. In addition, two factors impacted our second quarter adjusted operating margin results: (1) higher than anticipated supply chain and manufacturing transition costs to mitigate tariffs and (2) operational inefficiencies and execution challenges stemming from stronger than anticipated growth acceleration. We have clear action plans in place and expect these temporary factors to be materially resolved by year end.

"Beginning 1Q26, we are evolving our approach to orders disclosure. Rather than providing quarterly updates, we will shift to annual reporting of order growth rates, book-to-bill ratio, and backlog. During 4Q25 earnings call, we will provide outlook for these metrics for full year 2026 with updates during the year as needed".

TECH/RESEARCH NEWS

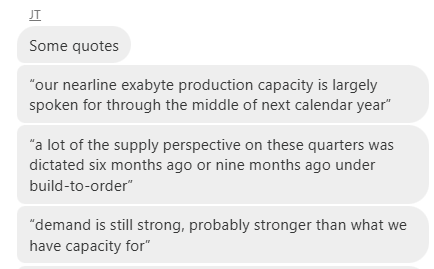

MRVL +8.5% as Fubon sees Maia300 unit and ASP upside boosting potential revs to >$10B

Fubon notes Microsoft has upgraded its Maia300 GPU to a 2 nm/HBM4 spec and now plans a 4Q26 launch at 300‑400 k units, scaling to 1.2‑1.5 m in 2027—volumes nearly on par with AWS’s Tra1n2. With an estimated $8 k ASP, that trajectory could drive about $2.4 bn in 2026 and $10‑12 bn in 2027 of turnkey revenue for Marvell at mid‑50%–60% margins. Foundry samples are already running smoothly, and suppliers are lining up capacity ahead of a mid‑2026 volume push, Fubon says

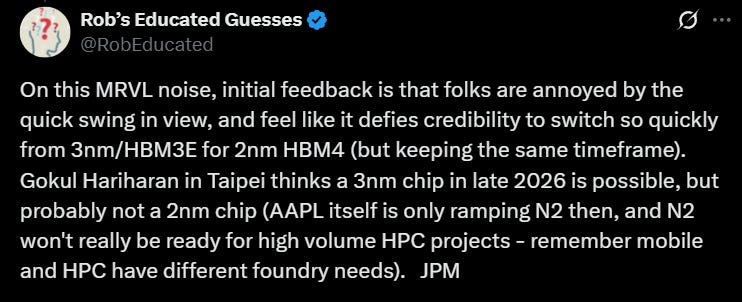

JPM pushing back a bit:

AMD downgraded to Sell from Buy at DZ Bank

AMD (OUT YESTERDAY): Alethia Sees AI Revenue Surging to $20B in 2026, Sets $220 PT on Helio Ramp

This was out yesterday morning (MS also had CoWoS 2x’ing in ‘26), but thought was interesting…I’m hearing Asia bulls closer to $15B+ in GPU revs in 2026 vs that ~$13B # I’ve been hearing…

Alethia expects the MI308 alone could contribute over $2B in 2H25, with additional upside from gaming. Alethia is particularly bullish on the Helio MI455 rack, which they say could deliver ~15x the content value of today’s MI355 UBB and offer a more attractive value prop than NVIDIA’s VR144. Shipments of 5–6K Helio racks in 2026 to customers like OpenAI, Meta, and Oracle could bring in $12–13B in revenue. Combined with the MI3XX line, Alethia thinks AI-related sales could reach $15–20B next year, more than doubling from ~$7B in 2025.

AMD: SIG lifts PT to $210 on China GPU license revival, expects margin lift from low‑cost MI308 sales

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.