TMTB Morning Wrap

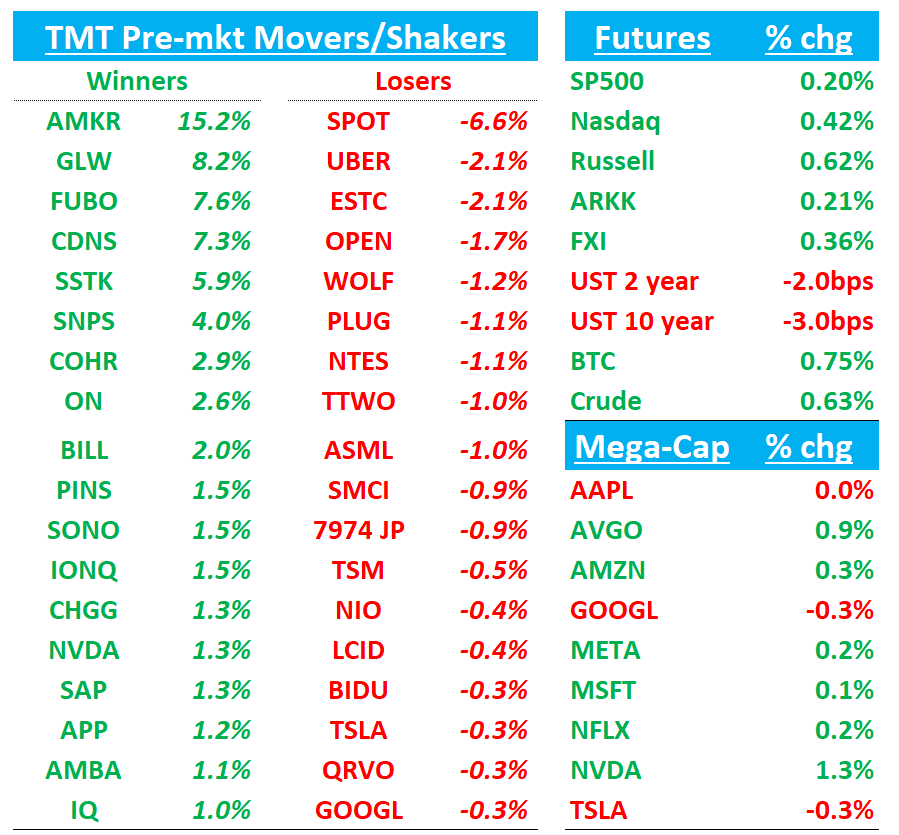

Good morning. QQQ +43bps as AI semis leading the way higher again with NVDA/AMD +1% helped by some positive news flow (EU buying $50B of chips + TSMC ramping chips for China) along with some good beat-and-raise prints and positive AI commentary from CLS, AMKR, GLW, and Advantest. The Hot AI Summer continues…

In other earnings, SPOT q was squishy as expected and tone on the call not great so far. PYPL also not the cleanest quarter while CDNS looked strong on better Hardware revs.

Yields ticking down 2-3bps across the curve, BTC +1%, China +30bps.

We’ll dive into all those earnings first, then move onto Research/News.

Let’s get to it…

SPOT -6%: Net adds + MAUs better but Revs + GM guide below

A bit of a messy quarter as expected. Net Adds +8M vs expects of 6M and guiding to +5M inline with buyside. GMs the main nitpick with Q3 guide of 31.1% light of street although buyside was already a bit lower and if you add back regulatory charge headwinds, you get to 31.5% where expectations were.

Upped buyback to $2B from $1B

Call ongoing…so far Ek sounds a bit more guarded saying he’s focused more on long-term vs. short term. Price action will be interesting here post the NFLX sell off…

3Q25 Guidance Details:

MAUs: 710M (+11% Y/Y), slightly above Street at 707M.

Premium Subscribers: 281M (+12% Y/Y), implying ~5M net adds, ahead of Street at 279M.

Revenue: €4.2B (+5% Y/Y), well below Street’s €4.48B, driven by ~490bps FX headwind.

Gross Margin: 31.1%, flat Y/Y and ~40bps below Street at 31.5%.

Operating Income: €485M (11.5% margin), below Street’s €570M.

Guiding to 5% fx headwind which weighing on EBIT

PYPL -3%: Mixed - Better Revs and EPS, Branded + TM% a bit light, Raises FY Guide

Not the cleanest quarter with branded missing and a one time benefit that helped TM$ but Venmo growth and EPS ahead while branded (online + offline) inline and guidance raised. Won’t change bull vs. bear case here but squishier than I had hoped for — I’ll likely keep my small long for now on here given 3p data showing accelerating branded/Venmo growth in July and this should be trough growth/margin quarter as the renegotiated braintree contract headwind begins to roll off next q. Again “B/B-” idea here, nothing too exciting.

Details:

3Q:

Branded growth 5% vs bogeys of 5-6% but Branded experiences, which includes offline, inline at 8% y/y. Venmo

Venmo TPV accel’d to 12% from 8% last q

Transaction Margin Dollars: $3.79B at midpoint (3–4% Y/Y), slightly above Street’s $3.775B, with ex-float growth of +5–7% Y/Y.

Adj. EPS: $1.20, in line with Street, flat Y/Y.

FY25 Outlook:

Adj. EPS: Raised ~4% to $5.23 (midpoint), up 12% Y/Y and ~2.5% above Street’s $5.10 (+9.5% Y/Y).

TM Dollars : Raised to $15.35–15.5B (+5–6% Y/Y) from $15.2–15.4B prior, in line with Street’s $15.3B.

Includes $125M headwind from lower rates (was $150M).

TM ex-float Growth: Raised to +6–7% Y/Y (from +5–7%).

Adj. Non-Transaction OpEx: Reiterated at low-single-digit growth, in line with Street’s +3%.

Adj. Tax Rate: Lowered to 20% (from ~21–22%), below Street’s ~21.5%.

Buybacks: Reiterated at ~$6B, in line with Street.

Free Cash Flow: Reiterated at $6–7B, in line with Street’s $6.3B.

4Q Implied Guidance:

TM Dollars: ~$4.11B, ~1.5% above Street’s $4.05B .

Adj. EPS: $1.30, ~1% above Street’s $1.28 .

CLS +12%: Beat and Raise across the board

Expectations were high given how much the stock had run, but bulls will like this q as this was significantly better than expected and help support bull case that CLS is transitioning from a low‑margin EMS vendor to a strategic AI hardware partner. The bull case centers on surging HPS attach, deeper Meta/OpenAI programs and incremental share in 800 G/1.6 T switching underpin while diversified AI opportunities (sovereign clouds, Tier‑2 hyperscalers) help de‑risk the customer mix and this q hit on all.

The #s:

Q2 Revenues were $2.89 B, +21 % y/y vs Street +12 %; dj‑EPS $1.39 vs $1.24.

3Q and FY25 Guidance:

3Q25 revenues guided to $2.875–3.125B ($3B at the midpoint), vs. Street at $2.8B.

3Q25 operating margin guided to 7.4%, vs. Street at 7.3%.

3Q25 EPS guided to $1.37–1.53 ($1.45 at the midpoint), vs. Street at $1.31.

FY25 revenue guide raised to $11.55B (previously $10.85B), vs. Street at $11B.

FY25 operating margin guide raised to 7.4% (previously 7.2%), vs. Street at 7.22%.

FY25 EPS guide raised to $5.50 (previously $5.00), vs. Street at $5.10.

FY25 FCF guide raised to $400M (previously $350M).

Key points:

Q2, typically the seasonally strongest quarter for both the overall business and CCS, delivered 28% year-over-year growth and 13% sequential growth in the segment. Within CCS, Enterprise revenue came in above guidance at $433M, though still down 37% year-over-year due to an ongoing customer transition in AI/ML compute. Communications +76% year-over-year the standout, likely driven by sustained HPS demand and accelerating 800G adoption. ATS posted 7% year-over-year growth.

Two hyperscalers (Google ~31 %, Meta ~13 %) now exceed 10 % of sales; Amazon slipped below the threshold

CDNS: Strong beat and raise with hardware driving upside should keep bulls in control

The #s:

Q2 Revs $1.275B (+20 % y/y) vs Street at $1.26B (+18 %);

Q2 non-GAAP EPS of $1.65 versus $1.56 .

Q2 Operating margin printed 42.8 % versus 41.9 % expected

Q3 revs $1.32B (~9 % y/y) vs Street $1.318B; non-GAAP EPS $1.78 vs $1.73.

FY 25 midpoint now at $5.24 B (+13% y/y) vs Street $5.20 B;

FY non-GAAP EPS $6.90 vs $6.76.

Management also nudged FY 25 operating-cash-flow up to ~$1.7 B.

Key takeaways

China BIS restrictions pulled regional sales ~10 % lower y/y, yet broad strength in the Americas, Europe and Japan drove the top-line beat.

Emulation/prototyping (Palladium & Protium) again led growth; management reminded investors the second year of a hardware cycle is historically the fastest and could run into 1H 26.

Over half of advanced-node designs now use Cerebrus AI; new “Agentic AI” workflow promises 20 % PPA gains and 5-10× turnaround improvement.

Backlog rose ~7 % y/y to $6.4 B, and book-to-bill is guided >1× for both 3Q and 4Q.

Bull vs. Bear Debate:

CDNS long-term bulls argue that the company sits at the center of every secular growth vector in semis: exploding AI complexity, 2 nm and GAA ramps, 3D-IC adoption and the shift toward heterogeneous chiplets. They highlight 90 %+ subscription-like gross margins, a hardware portfolio that is now essential (not discretionary) for AI design schedules, and a deepening moat from AI-native tools such as Cerebrus and the new Agentic AI platform. This quarter confirmed that view: core EDA up mid-teens, IP up mid-20 %, record backlog, and a guidance raise delivered even while China revenues fell. Bulls will say modest raise is conservative and leaves room for successive beats as China rebounds and ARM Artisan IP closes.

Bears concede the franchise quality but point to valuation risk—the stock trades near the upper end of its 22-52× historical P/E range and at a 2-3× PEG premium to broader semi peers. They worry the beat was hardware-heavy and could reflect shipment pull-ins, that non-GAAP gross margin slipped 120 bp y/y, and that China export controls may linger longer than hoped, pointing to the 10% china decline. A further fear is that once the current hardware refresh crests, revenue growth could revert toward high-single-digit EDA norms just as the multiple remains stretched.

Gets a dg at Piper today citing valuation:

Piper cut its rating on Cadence Design Systems to Neutral, citing stretched valuation at ~45x CY26 P/E and ~48x normalized FCF, despite continued strong execution. The firm acknowledged CDNS's critical role in the chip design ecosystem and noted robust Q2 results — including 20% y/y revenue growth and a 2% beat versus consensus, with EBIT margins coming in 100bps ahead. Piper highlighted that demand remained resilient despite U.S. export controls, with strong y/y growth across core EDA, Systems Design, and IP. However, Piper says its $350 PT already embeds a mid-teens growth outlook and peak-level margins near 50%, making it difficult to justify further upside without a step-change in semi demand trends.

TECH RESEARCH/NEWS

NVDA: Nvidia orders 300,000 H20 chips from TSMC due to robust China demand

Nvidia (NVDA.O), opens new tab placed orders for 300,000 H20 chipsets with contract manufacturer TSMC (2330.TW), opens new tab last week, two sources said, with one of them adding that strong Chinese demand had led the U.S. firm to change its mind about just relying on its existing stockpile.

The Trump administration this month allowed Nvidia to resume sales of H20 graphics processing units (GPUs) to China, reversing an effective ban imposed in April designed to keep advanced AI chips out of Chinese hands due to national security concerns.

AI Semis: EU plans €40 billion AI chip purchase in US trade agreement

The European Union plans to purchase €40 billion worth of AI chips as part of its trade agreement with the United States, according to a statement from the European Commission.

A Commission spokesperson said during a daily briefing that the EU is confident the trade agreement will receive backing from member countries, businesses, and citizens.

The spokesperson also noted that the EU has transmitted "faithful intentions" of EU businesses’ plans for US energy purchases and investments.

Waymo coming to Dallas, partners with CAR

UBER -2%

Waymo will offer our ride-hailing service to the public through the Waymo app, and our fleet will be managed through a new strategic, multi-year partnership with Avis Budget Group, a leading global mobility solutions provider. Avis brings decades of fleet management expertise, a track record of fast, efficient execution, and a commitment to adopting cutting-edge technology, which will help us scale the Waymo Driver even faster. Avis will provide end-to-end fleet management services, including infrastructure, vehicle readiness, maintenance, and general depot operations.

Wedbush comments on the news warning 40% of Mobility Bookings Exposed to AV Disruption. Wedbush flagged growing risk to Uber as Waymo expands, announcing a Dallas launch via Avis in 2025. While Uber still holds exclusive Waymo access in Atlanta and Austin, that edge may fade as third-party AV distribution scales. Wedbush sees limited near-term financial impact but expects AVs to eventually disrupt rideshare economics. The firm estimates ~40% of Uber’s mobility bookings are exposed to AV risk, with ~28% already in cities where AVs operate and another 12% likely to follow.

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.