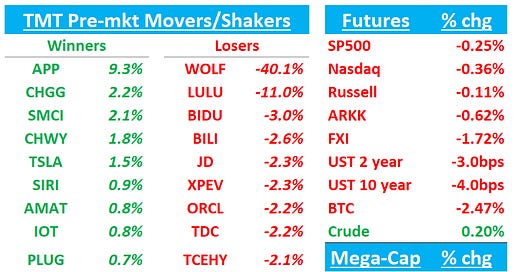

Good morning. QQQs -40bps as Core PCE slightly hotter than expected. China -1.6%. BTC -2.4%

Let’s get straight to it.

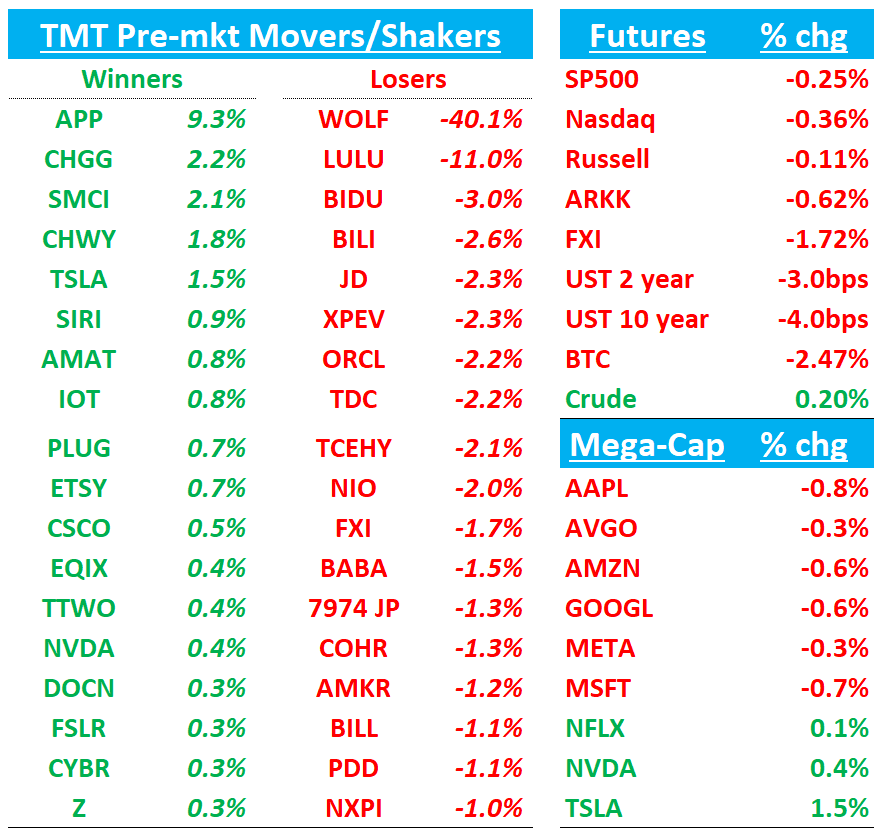

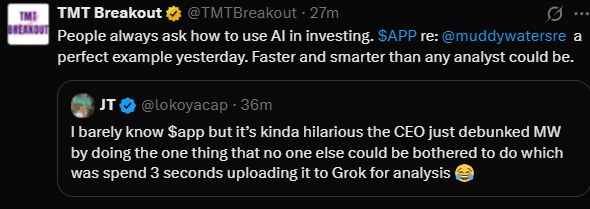

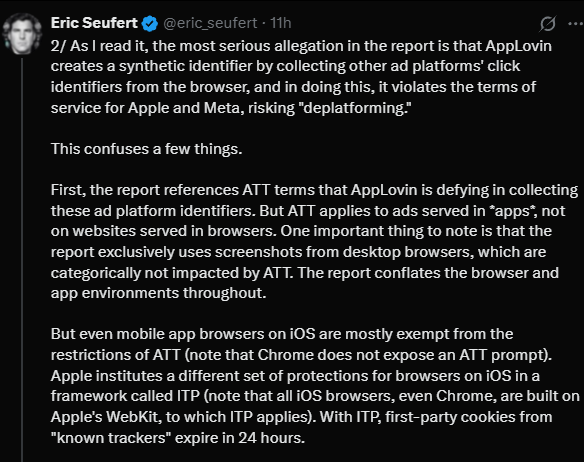

APP: AppLovin responds to Muddy Waters report

A Note from Our CEO: Discussing Web Advertising Opportunity and Unpacking Pixels | link here: AppLovin

“The Muddy Waters report may exaggerate AppLovin’s practices to stoke fear, but the mechanics—JavaScript tracking, event-based data, merchant-driven integration—are bog-standard. There’s no smoking gun here; AppLovin’s pixel is just another player in a crowded, well-trodden field.”

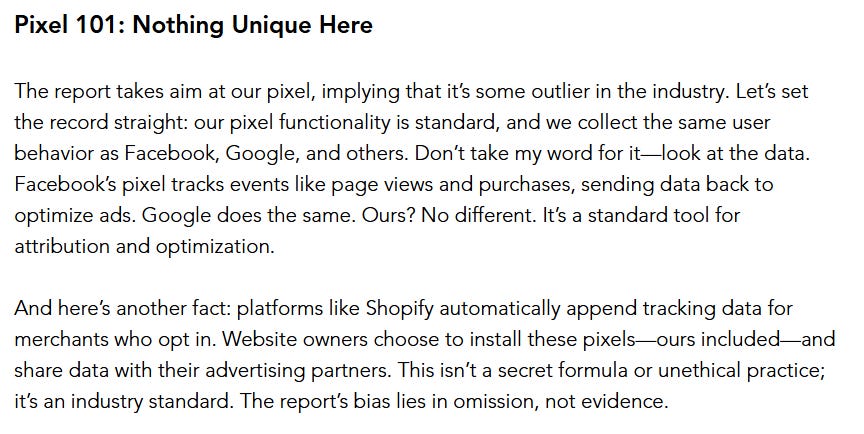

Good rebuttal here as well:

APP: Some AppLovin short report claims 'easily disproved,' says Loop Capital

Loop Capital notes that AppLovin shares were hit by a short report alleging faulty conversions, violation of iOS and Android terms of service, a limited technology moat and fraudulent reporting. However, the analyst tells investors that accusations of faulty conversions and fraud are "easily disproved by speaking with performance marketers and measurement companies." The firm, which is "confident the platform is delivering excellent performance," keeps a Buy rating and $650 price target on AppLovin shares.

APP: Wells Fargo says ad checks run counter to AppLovin short report claims

Wells Fargo analyst Alec Bonello says the firm's checks indicate that AppLovin's e-commerce incrementality is "strong," with agency checks indicating that e-commerce customers are 55%-60% net new to brand, contrary to a short report's claim of a greater than 50% retargeting mix. The firm, which also notes that Muddy Waters only checked with five customers, argues that churn is explained by the nascent stage of the e-commerce business. Wells keeps an Overweight rating and $538 price target on AppLovin shares.

'I am almost done...': Elon Musk reveals date he'll 'ditch Trump' and quit Washington DC after DOGE purge - Economic Times

Elon Musk plans to step down from his cost-cutting role in the Trump administration at the end of May after reducing the US deficit by $1 trillion, the tech billionaire said on Thursday, according to The Fox News. Musk, 54, expressed confidence in getting close to that goal, which would halve the annual federal deficit, in just 130 days — saying his team was averaging “$4 billion a day, every day, seven days a week.”

Fox News interview here

After watching 5-10 minutes of the interview, which I thought was very good, my sense of how people will feel after watching it…

So add Musk finishing with DOGE to the slate of catalysts beginning in June - deliveries next hurdle to get past next week…on that front:

TSLA: M-sci says Q1 deliveries tracking lower y/y through late March but FSD share has ticked up

TSLA: DB Lowers target to $345 from $420 citing weaker volume and modelQ Rollout

Approaching the Q1 2025 delivery announcement, DB has adjusted their Tesla auto volume forecasts for the quarter, full year, and 2026 to reflect weakening demand and slower Model Q rollout. Their tracking indicates Q1 deliveries of 340-350k, likely putting further pressure on auto margins. For 2025, DB now forecasts deliveries falling 5% year-over-year to roughly 1.7 million, with a phased Model Q launch starting in the US before expanding to Europe and China. According to DB, Tesla stock has recently struggled due to weaker volumes, broader growth stock devaluation (especially among Mag 7), and political/policy uncertainties. DB notes that, as historically observed, Tesla's progress with robotaxi and humanoid technologies will likely be non-linear. They maintain a Buy rating while reducing their price target to $345.

TSLA: RBC Capital sees Tesla Q1 deliveries below consensus

RBC Capital maintains its Outperform rating and $320 target price for Tesla, though they project Q1 deliveries of 364,000 units, falling short of the 398,000 consensus estimate. According to RBC's analyst note to investors, Tesla's January-February performance was affected by planned production halts related to the Model Y update. RBC believes some customers likely delayed purchases in anticipation of both the refreshed Model Y and the new lower-priced model expected to launch in Q2.

ORCL -2%: Oracle, Leidos Contract Targeted by US Pentagon Cost-Cutters - Bloomberg

CSCO: ISI saying CSCO refresh + Cyclical recovery should enable “higher for longer”

ISI’s analysis highlights that enterprise networking is recovering after six months of signs. While HPE and EXTR saw estimate increases, Cisco estimates declined, which ISI believes underestimates Cisco's market position and 10% growth potential versus 3% consensus. ISI expects a campus networking product refresh from Cisco in early H2 2025, providing additional growth alongside market recovery. ISI notes Cisco has issued End of Life notices to partners, suggesting this refresh cycle could be stronger than 2017's. The report remains bullish on Juniper despite its pending acquisition and sees Cisco positioned for higher numbers in coming quarters. After CY22-23 growth followed by CY24 Q1-Q3 declines due to supply issues and inventory corrections, ISI believes the market has bottomed and expects growth to return in CY25.

CSCO: Clev positive saying Apr tracking to high end of guide on improvement of orders

3P DATA ROUNDUP

GOOGL: Yipit says search/ad continues to track 2-3ppts below street. M-sci lowers ad estimates as y/y growth decel’d from feb to March with YT key source of u/p

AMZN: Yipit says AMZN NA retail tracking 0-1ppts ahead of street before current ongoing spring sale. M-sci lowers NA retail saying feb was weaker than jan and march but spending share gains have accelerated - they are v. slightly below street.

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.