TMTB Morning Wrap

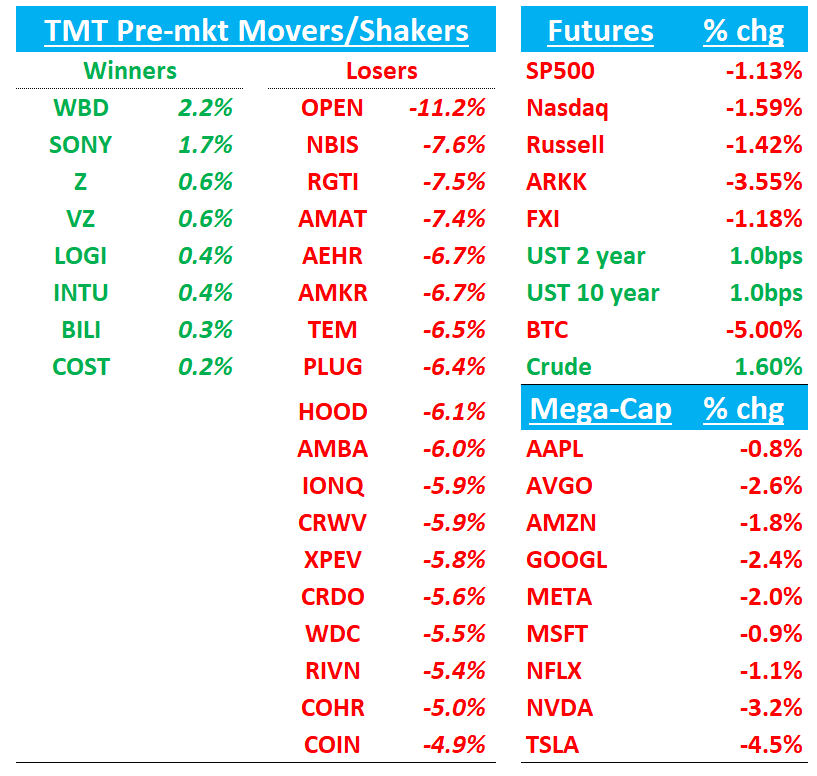

Good morning. Futures -1.5% off as seems like another day of risk off. Asia was met with selling across the board: TPX -0.65%, NKY -1.77%, Hang Seng -1.85%, HSCEI -2.1%, SHCOMP -0.97%, Shenzhen -1.36%, Taiwan TAIEX -1.81%, Korea KOSPI -3.81%. BTC -4% dipping below $95k.

We get to the usual first today then AMAT earnings at the bottom. Let’s get to it…

NVDA Previews

NVDA: KeyBanc Raises Estimates Ahead of F3Q Print, Citing Multiple Upside Drivers

KeyBanc says it expects Nvidia to post another strong October quarter and to guide January meaningfully higher, with several forces likely pushing results above expectations. The firm notes that rising B300 volumes should provide both unit and ASP lift, while smoother GB300 rack production—KeyBanc now models 28–30K FY26 racks—adds another leg of support. The analyst also highlights stronger Hopper output, which the firm suggests may reflect a resumption of shipments into China. At the same time, KeyBanc flags ongoing capacity constraints that could cap the magnitude of upside and potentially weigh on gaming GPU availability. With these dynamics in mind, the firm nudges estimates up and reiterates its Overweight stance.

NVDA: Morgan Stanley Lifts PT to $220 as Quarter Should Re-Center Market on Nvidia’s Leadership

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.