TMTB Morning Wrap

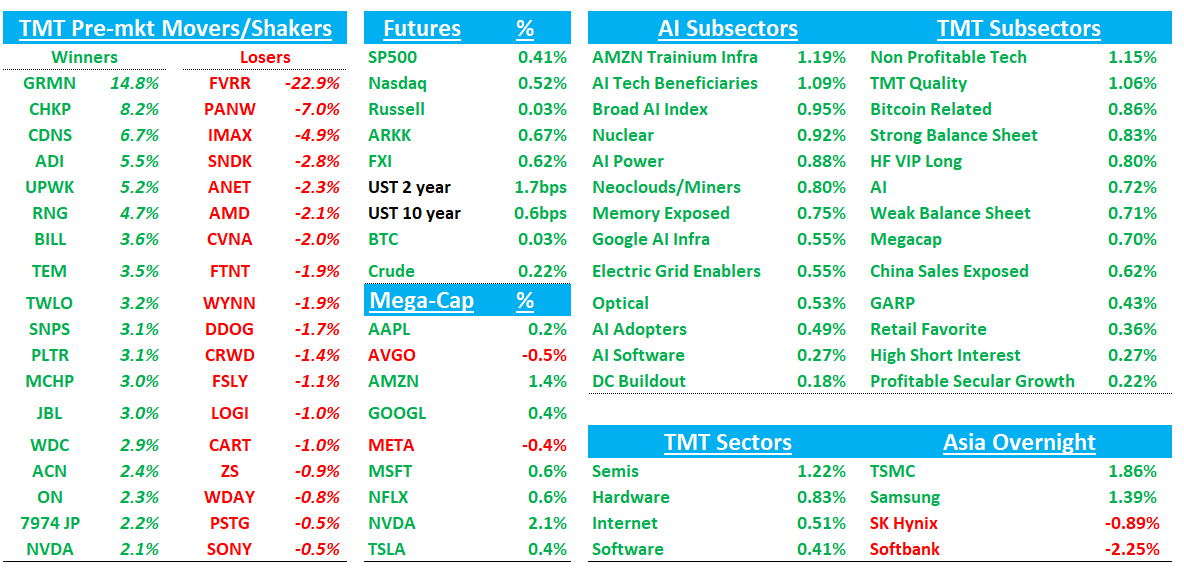

Good morning. Futures +50bps. Most of Asia still closed but TPX/NKY +1%. Yields flat to up across the curve.

We’ll hit earnings first (PANW, CDNS, ADI) then move onto the usual. Lots to get to, so let’s get straight to it…

EARNINGS

PANW -6% modest top-line/NGS beats vs street that missed buyside targets and reiterated long-term targets, but near-term margin/EPS guidance looks optically weaker organically

Stock mainly weaker on limited organic upside in Q2 in addition to inorganic moving pieces that bears will say making it harder to figure out true performance of core biz. Q2 organic NNARR +11% y/y — guide implies the same. Q3/FY26 operating margin guide below street also a sticking point. Mgmt sounded decent on the call explaining their new stack.

Bull vs. Bear Debate

Bulls will argue PANW is executing on the most durable cybersecurity narrative right now: platform consolidation at scale, with a portfolio broad enough to win “architecture-level” decisions. Platformization counts rose to ~1,550 (+35% y/y), retention in platformized cohorts remained very strong, and the company continues to land large multi-product transformations (SASE + SecOps bundles in the tens of millions). Even if the quarter wasn’t a “blowout,” bulls see a company that is steadily taking share as enterprises move away from first-generation point solutions that don’t cover today’s threat complexity (and now, AI-driven complexity). Bulls also see AI as a multi-year tailwind that expands the attack surface and creates new control points where PANW is positioning early (Prisma AIRS, agentic security, observability at AI scale). The “AI-native” datapoints already showing up: Prisma AIRS scaling past 100 customers with a nine-figure pipeline, plus Chronosphere signing a multi-year nine-figure expansion with a leading AI model provider. On top of that, bulls like the strategic logic of the M&A stack: identity (CyberArk), observability (Chronosphere), and endpoint/agentic extension (Koi) are framed as the next pillars that can be cross-sold into PANW’s installed base, driving revenue synergies and sustaining growth.

Bears will argue the print reinforced the central concern: PANW is becoming harder to “read” quarter-to-quarter, and the market may not reward complexity with a premium multiple, especially if organic growth is normalizing. This quarter’s organic signals were okay but not emphatic: the organic NGS ARR outcome effectively hugged the top end of the guided range and missed bogeys, and organic net-new ARR growth was only LDD. Services growth came in a bit soft, and while management pointed to mix/pro-services lumpiness, bears worry this can mask either competitive pricing pressure or slower wallet expansion for core subscriptions. The other bear wedge is profitability optics and integration risk. Even with a Q2 margin beat, the forward guide steps down materially: FY26 OM guidance moved below Street, and FQ3 OM/EPS guide is notably under consensus. Bears will frame this as evidence that acquisitions are dilutive for longer, that “revenue synergies” are harder to harvest than promised, and that purchase accounting + product/services mix shifts can create persistent noise. They’ll also highlight dilution (share issuance for CyberArk), ARR definition changes (CyberArk subscription-only ARR; 2–3% lower vs their prior definition), and the potential for customer confusion or slower sales execution while go-to-market teams integrate.

The #s:

Q2:

Revenue $2.594B, +14.9% y/y (last q +15.7% y/y) vs Street $2.583B, +~14.4%; Product strength drove the beat (services slightly soft).

NGS ARR $6.334B, +32.6% y/y vs Street $6.128B, +~28.3% (organic NGS ARR +28% y/y, at the top end of guide but missing bogeys by 3-4%); RPO $16.0B, +23% y/y vs Street $15.805B, +~21.5%.

Non‑GAAP EPS $1.03 vs Street $0.94; Non‑GAAP OM 30.3% vs Street 29.4%; FCF $502M vs Street ~$537M (FCF margin 19.4% vs ~20.8%).

Q3 Guide (inclusive of M&A)

Revenue ~$2.943B (midpoint), +28.6% y/y vs Street ~$2.603B, +~13.7%

NGS ARR ~$7.95B (midpoint), +56% y/y vs Street ~$6.48B, +~27.3%

RPO ~$17.90B (midpoint), +32–33% y/y vs Street ~$16.3B, +~(mid/high teens)

Non‑GAAP EPS ~$0.79 (midpoint) vs Street ~$0.92

Non‑GAAP Operating Margin ~25.9% vs Street ~28.7%

FY’26 Guidance

Revenue ~$11.295B (midpoint), +22–23% y/y vs Street ~$10.531B, +~14.2%

NGS ARR ~$8.57B (midpoint), +53–54% y/y vs Street ~$7.05B, +~26–27% (Street largely pre-M&A)

RPO ~$20.25B (midpoint), +~28% y/y vs Street ~$18.65B, +~(high teens) (Street largely pre-M&A)

Non‑GAAP Operating Margin 28.5–29.0% vs Street ~29.7%

Non‑GAAP EPS $3.65–$3.70 vs Street ~$3.86

Adjusted FCF Margin 37% vs Street ~38.4

Management reiterated 37% adj FCF margin for FY26 and FY27, and 40% by FY28, plus the longer-term $20B NGS ARR goal by FY30.

CDNS +7%: solid beat + record $7.8B backlog; 1Q guide clearly ahead; FY26 guide only modestly above Street as “agentic AI” narrative ramps but will be seen as conservative

Key Takeaways:

4Q25 Revenue $1.440B, +6% y/y (last q +10% y/y) vs Street $1.424B, +~5%, with Non‑GAAP EPS $1.99 vs Street $1.91 and Non‑GAAP OM 45.8% vs Street 45.4%. 1Q26 guidance: Revenue $1.42–$1.46B (mid $1.44B, +~16% y/y) vs Street ~$1.38B, +~11%; Non‑GAAP EPS $1.89–$1.95 (mid $1.92) vs Street ~$1.80; Non‑GAAP OM 44–45% (mid 44.5%) vs Street 43.6%.

Year‑end backlog $7.8B (+~15% y/y). CDNS said ~67% of FY26 revenue is already covered by beginning backlog.

FY26 Revenue guide $5.90–$6.00B (mid $5.95B, +~12% y/y) vs Street ~$5.94B, +~12%; Non‑GAAP EPS $8.05–$8.15 (mid $8.10) vs Street ~$8.06; Non‑GAAP OM 44.75–45.75% (mid 45.25%) vs Street 45.1%. Bulls will call this conservative given backlog; bears will note it’s not a big “raise” and implies deceleration vs FY25’s ~14% revenue growth. Guidance assumes export-control rules stay substantially similar, and China is expected to remain about 12–13% of revenue (with mgmt noting strong design activity but more limited visibility later in the year).

Mgmt explicitly pushed back on the idea that customer/internal AI reduces EDA demand, framing AI as increasing tool usage (more runs/iterations) and creating new monetization vectors (agentic workflows).

The ChipStack launch/positioning matters because it targets historically manual work (front-end design/verification tasks) and is being framed as a “virtual engineer” monetization layer on top of increased base-tool usage.

Mgmt described accelerating design activity and a healthier demand environment entering 2026 (AI infrastructure build-out + broader semi improvement vs a year ago). They cited strength not only at AI leaders/hyperscalers, but also improving outlook for more “traditional” semi segments.

Bull vs. Bear Debate

Bulls argue CDNS is still one of the cleanest ways to own the AI-driven silicon complexity cycle with high visibility and a broadening monetization surface area. The quarter reinforces that view: backlog hit a new high, 1Q guidance came in clearly ahead of Street, and management reiterated that AI is not a substitution threat but rather a workload accelerant (more design exploration, verification, and iterations). In that framing, “agentic” workflows expand the “addressable unit of work” beyond traditional seat-based EDA and can pull through incremental demand across the stack (EDA software + hardware systems + IP + SD&A). Bulls also like the multi-pronged growth drivers: hyperscalers doing more silicon internally, packaging/3D‑IC complexity, and IP attach (especially memory/HPC interfaces tied to AI infrastructure). Bulls also point to share gains and the stickiness of physics-based, foundry-certified sign-off flows as structural moats.

This quarter, they’ll specifically cite 1) the record backlog and backlog coverage into FY26 as evidence that demand is not “rolling over,” 2) the narrative that agentic AI will be monetized as an incremental layer (not cannibalizing existing tools), and(3) the strong 1Q guide as a signal that management’s FY26 framework could prove conservative. They’ll also argue the pending Hexagon D&E deal (not embedded in FY26 guidance) adds another long-duration vector in “physical AI” and simulation workloads.

Bears focus on the risk that CDNS is transitioning from a period of unusually strong growth (AI build-out, hardware cycle, IP momentum) into a more normalized trajectory saying the stock still screens expensive versus many software peers. Quarter-specific for bears: total revenue growth in 4Q was only mid‑single digits and the revenue beat was smaller than CDNS’s “typical” beat magnitude; FY26 guidance is only modestly above street implying a step down from FY25’s ~14% top-line growth. Bears also point to weaker/volatile SD&A performance (including a reported y/y decline in the quarter), which can revive concerns about exposure to broader industrial/simulation demand softness and the lumpiness tied to contracting model transitions.

On the AI debate, bears don’t necessarily claim AI eliminates EDA overnight (at least most rational ones don’t), but worry it could reshape pricing power or enable more internal tooling over time, especially in parts of the workflow that look more “software-like” than “sign-off physics.” They also highlight competitive intensity (incumbent peer competition + startups) and the possibility that hyperscaler in-housing (“COT”) is not automatically margin-accretive if pricing becomes more competitive or customers push for different commercial terms.

ADI +6%: Beat + better-than-expected April guide (rev + margins + EPS)

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.