TMTB Morning Wrap

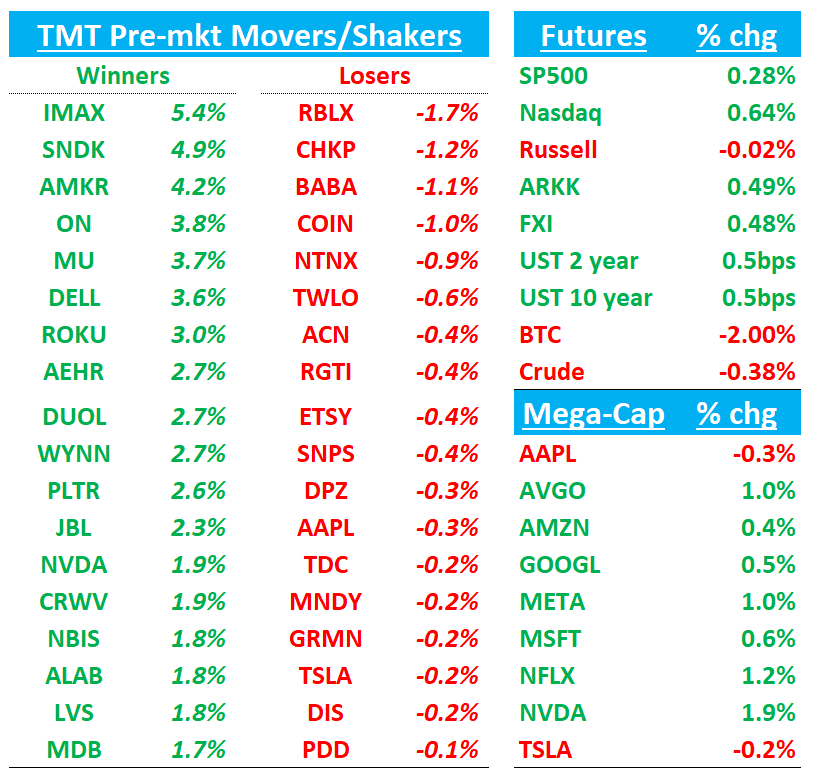

Good morning. Futures +60bps to start what should be another fun week of earnings.

We had a summary of the BG2 podcast w MSFT CEO Satya and OpenAI CEO Sam here and some good discussion around it in TMTB chat here.

Asia saw gains on Monday: Hang Seng +0.97%, HSCEI +0.98%, SHCOMP +0.55%, Shenzhen +0.44%, Taiwan TAIEX +0.36%, Korea KOSPI +2.78%. Japan and Korea just had monster October’s with the Nikkei and Kospi up 17%/20% respectively. Memory was strong again overnight as DRAM/NAND prices continue to rise.

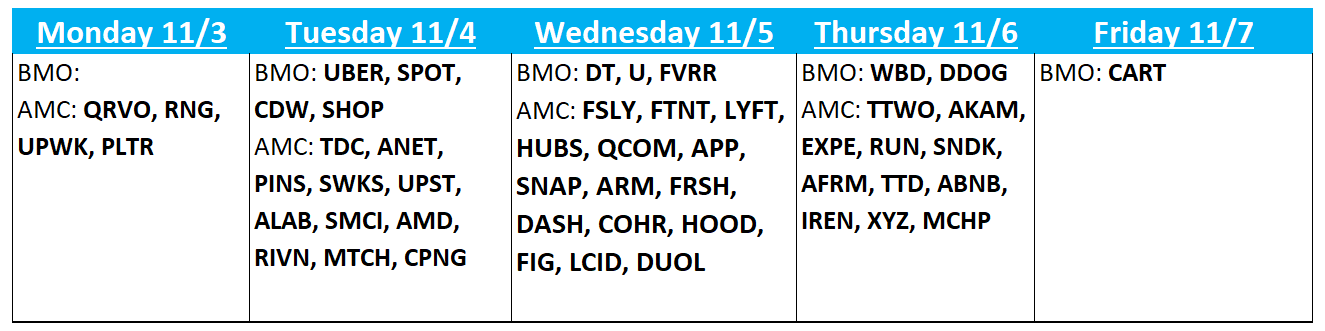

Another big earnings week awaits us:

We’re finalizing our bogey matrix for the week…

Let’s get to it…

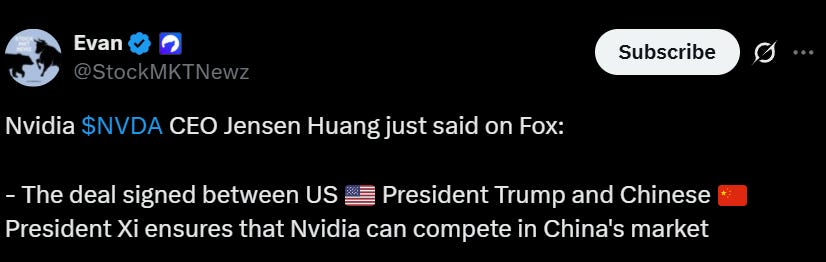

NVDA

NVDA: Trump says China, other countries can’t have Nvidia’s top AI chips

Artificial intelligence giant Nvidia’s (NVDA.O), opens new tab most advanced chips will be reserved for U.S. companies and kept out of China and other countries, U.S. President Donald Trump said.

During a taped interview that aired on Sunday on CBS’ “60 Minutes” program and in comments to reporters aboard Air Force One, Trump said only U.S. customers should have access to the top-end Blackwell chips offered by Nvidia, the world’s most valuable company by market capitalization.

NVDA: US allows Microsoft to ship Nvidia AI chips to use in UAE for first time

The US has allowed Microsoft to ship the latest Nvidia chips to the United Arab Emirates for the first time, paving the way for the Big Tech group to expand its investment in the Gulf. US President Donald Trump struck a deal in May with UAE president Sheikh Mohamed bin Zayed al-Nahyan to build a vast AI data centre campus in Abu Dhabi. The Middle East has become a key battleground in Washington’s struggle with Beijing for AI leadership. But Microsoft’s project had been held back by the Department of Commerce’s export controls on the powerful Nvidia chips needed to run the latest AI systems.

NVDA: Nvidia to supply 260,000 Nvidia GPUs to South Korea

At the APEC Summit, Nvidia (NVDA) announced Samsung (SSNLF), SK Group, Hyundai (HYMLF), NAVER and Korea’s government will deploy 260,000 Nvidia Blackwell GPUs in order to power sovereign AI, robotics, manufacturing and digital transformation across industries. The announcement marks one of the largest national investments in agentic and physical AI to date, and it’s backed by a coalition of Korea’s top organizations

IREN/DELL/MSFT: Microsoft Signs $9.7 Billion AI Cloud Deal With IREN

The five-year agreement will provide Microsoft access to Nvidia Corp. accelerator systems in Texas built using the GB300 architecture for AI workloads and includes a 20% prepayment, IREN said in a statement on Monday. Sydney-based IREN also said it’s agreed to purchase the requisite GPUs and related equipment for $5.8 billion from Dell Technologies Inc.

Once the deal is fully implemented, it’s expected to generate approximately $1.94 billion in annualized revenue, IREN Chief Executive Officer Daniel Roberts said via email. It will use about 10% of IREN’s total capacity, leaving room for the infrastructure provider to sign more contracts and generate additional revenue.

For DELL, Wells thinks this deal would add 30-40c of incremental EPS through 2026 (for reference, DELL’s CY26 street EPS is $11.20)

China to Suspend Some Rare-Earth Curbs and US Chip Firm Probes

China will effectively suspend implementation of additional export controls on rare-earth metals and terminate investigations targeting US companies in the semiconductor supply chain, the White House announced.

Under the deal, China will issue “general licenses” valid for exports of rare earths, gallium, germanium, antimony and graphite “for the benefit of US end users and their suppliers around the world,” meaning the “de facto removal” of controls Beijing imposed in April 2025 and October 2022, the White House said. The US and China previously said Beijing would suspend more restrictive controls announced in October 2025 for one year.

SNDK: Morgan Stanley Removes Top Pick, Keeps OW Amid Balanced Risk/Reward

Morgan Stanley reiterated its Overweight on SanDisk but removed it from the firm’s Top Pick list, citing a more balanced near-term risk/reward after a strong run. The firm lifted its EPS forecast to $16.35 in 2026 and set a $230 price target, with a bull case of $300, noting that earnings growth will need time to catch up with the stock’s move. MS says the NAND cycle remains in early innings, supported by tight supply and limited new capacity, and continues to see multi-year upside driven by AI-related storage demand, new eSSD products, and pricing strength into Q4 and Q1. The analyst adds that while visibility remains mixed near term, the longer-term setup is favorable, with industry pricing up 10–15% and the potential for multiple expansion over 2026.

CSCO: UBS Upgrades to Buy, Citing AI Demand and Campus Refresh Acceleration

UBS upgraded Cisco to Buy with a price target of $88 (from $74), noting a multi-year growth cycle powered by AI infrastructure demand, a major Campus refresh, and renewed security momentum. The firm highlights over $2B in AI orders booked for FY25, mostly from hyperscalers, with enterprise and sovereign demand also ramping. UBS expects Campus growth to accelerate from 5% in FY26 to roughly 7% in FY27, helped by upgrades to AI-enabled Smart Switches. The analyst adds that next-gen security products like Hypershield are growing more than 20% as Splunk integration deepens. UBS Evidence Lab data points to broad-based strength in Campus sales, with 83% of surveyed customers reporting “strong or very strong” outlooks for demand.

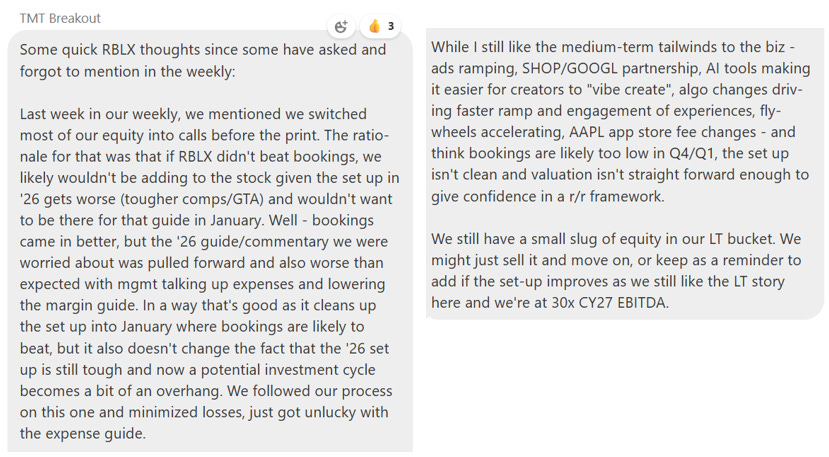

RBLX: Hedgeye moving to Active Short from Active Long

RBLX: Some RBLX thoughts in the chat from me this morning in case you missed it

RGTI: B. Riley Downgrades to Neutral, Lifts PT to $42 on Valuation After 190% Rally

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.