TMTB Morning Wrap

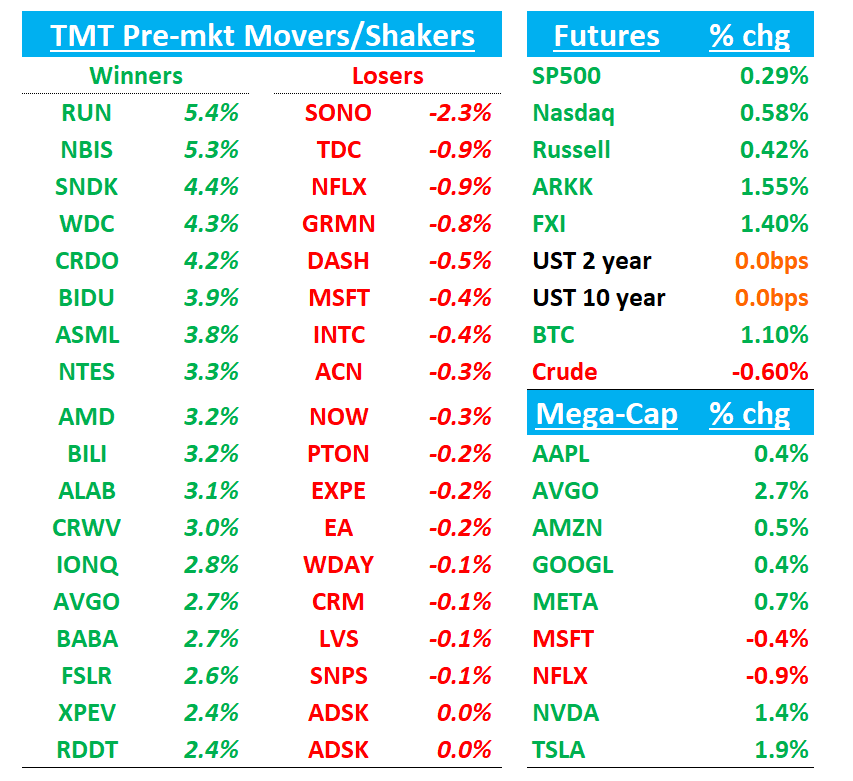

Futures +60bps as the AI trade continues in full force early. Memory names leading the way up early again (WDC +4%, SNDK +4%, STX +3%; ASML +4%). NVDA +1.4% to more ATHs while AMD +3% playing catch up as chart looking a lot better. Asian semis ripped with Hynix +10% and Samsung +4%, helped by the news OAI needs 900k wafers per month. HSTECH +3% as BABA +3% continues to hit new highs. BTC +1%. Yields flattish.

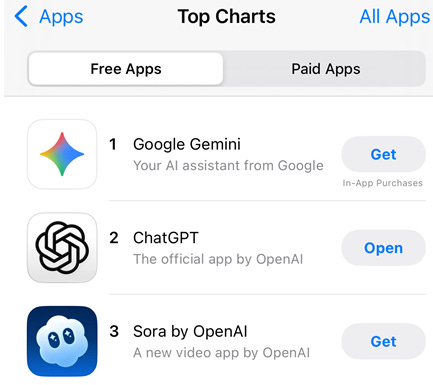

Sora hype continues…

Lots of focus on OAI Dev Day on Monday…what else is next after this week’s announcements…

Fairly slow news morning compared with we’ve gotten used to the last two weeks, but let’s get to it….

MSFT/NBIS: Microsoft Bets $33 Billion on Neoclouds like Nebius to Ease AI Crunch

Didn’t see a ton new in this article, but it does imply MSFT using these deals for training…

The arrangement, which is worth as much as $19.4 billion, sparked a rally in Nebius shares when it was outlined Sept. 8, but the announcement was short on specifics. As part of the deal, Microsoft will get access to more than 100,000 of Nvidia Corp.’s latest GB300 chips, said the people, who requested anonymity to discuss an internal matter.

“We are in very much land-grab mode in the AI space,” said Scott Guthrie, who leads Microsoft’s cloud efforts. “We’ve made the decision that we don’t want to be constrained in terms of capacity.”

The company isn’t only using neocloud servers to train AI models. Recent deals with Nscale in the UK and Norway will help Microsoft deliver AI services in those regions, Guthrie said. Early in the AI boom, the company announced it would rent capacity from Oracle Corp. to offer an AI-infused version of the Bing search engine.

FICO +16% on direct licensing of mortgage scores, major credit bureaus fall (EFX/TRU -12%)

TMTB chat was all over this yesterday - some really great discussion here on the news

FICO jumped in premarket trading on Thursday after the U.S. data analytics company said it would license its credit scores directly to mortgage resellers, raising concerns of margin pressure for major credit bureaus.

Fair Isaac said direct access to FICO scores for lenders and mortgage resellers would increase competition and bring price transparency.

“This new distribution model will allow lenders to avoid paying the current about 100% markup the credit bureaus currently charge for the FICO score,” analysts at brokerage Raymond James said.

“It implies that this would cut out the margin that the likes of Experian and Equifax make on the FICO credit score,” Citigroup analysts wrote in a note. “Our initial reaction is this is negative for Experian and Equifax.”

AVGO +2.5%/MediaTek Meta’s new orders are unstable, Google’s large orders are delayed, and MediaTek’s ASIC challenges continue

Although MediaTek has high expectations for the growth of its special purpose chip (ASIC) business after 2026, and it has been rumored in the supply chain that MediaTek will also grab Meta’s next-generation ASIC orders after winning Google’s big order, but the situation seems to have changed recently, and MediaTek’s difficulties have begun to emerge.

Chip supply chain operators revealed that MediaTek’s Meta’s new orders may face full challenges from Broadcom and Marvell, while Google’s orders have not been finalized. There is already a pessimistic view in the market that MediaTek may not be able to achieve the originally set ASIC growth target, which will put more pressure on MediaTek’s operations in 2026~2027.

GOOGL: Ads spotted in Gemini

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.