TMTB Morning Wrap

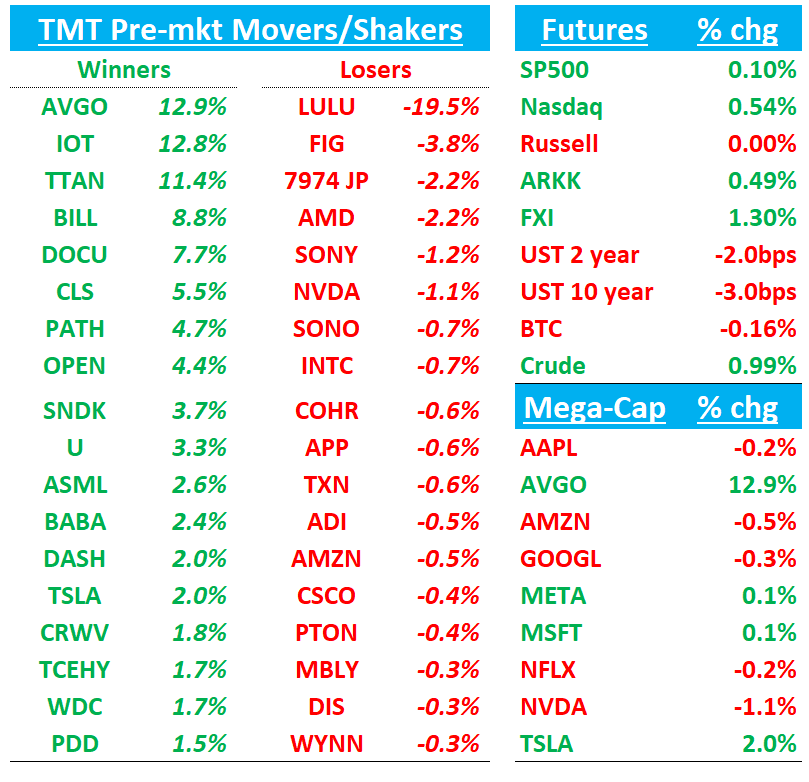

Futures up 55bps ahead of NFP print. BTC +1.8%. China +1.3%. Asian markets were up across the board with NKY +1% TAIEX +1.3%.

*BLS EXPERIENCING TECHNICAL DIFFICULTIES BEFORE PAYROLLS REPORT…we’ll see when it comes out…

Big news overnight was AVGO blowing out expectations with their commentary around FY26 and FY27. Likely some digestion with NVDA/AMD today as some investors shift more to the ASIC trade.

Let’s get to it…

AVGO +13%: Beat-and-raise with a new $10B fourth XPU customer (FT confirms its Open AI); FY26 AI outlook accelerates, margins step down on mix, and Hock extends as CEO to 2030.

The bullish FY26 and FY27 commentary/guide much outweighs the modest Q3 beats. Bulls were already at $12-14 in CY27, but with the $10B addition in FY26 puts AI growth closer to 110% y/y vs 55-60% prior and with Hock suggesting FY27 AI sales could accelerate even further on additional programs/newcustomers (he said this on the callback according to couple sell-siders), growing 110% in CY27 takes EPS power to $17-$20. My sense is buyside will fall in around $15-$16 after yesterday, but if you take Hock at face value, the #s go even higher. Let’s say $16+ at 30x multiple gets you $480.

Not much to not like and we continue to think AVGO one of best compounders in AI semi land.

Key Takeaway:

Management said a prior prospect is now a qualified XPU customer with “over $10B of orders of AI racks” and that FY26 AI revenue should “improve significantly” vs. last quarter’s outlook. In Q&A they added the fourth customer arrives with “immediate and fairly substantial demand,” altering how FY26 looks.

Hock: 2026 growth will “accelerate” and be a “fairly material improvement” over FY25, with mix tilting further toward XPUs; networking will be a smaller percentage of AI given faster XPU growth.

Tomahawk‑5 (scale‑up to 512 nodes), Tomahawk‑6 (102 Tbps) flattens to two tiers; Jericho‑4 (51.2 Tbps) targets 200k+ node clusters across nearby data centers. Hock: “The network is the computer.”

Consolidated backlog reached $110B; at least ~50% is semiconductors. Non‑AI bookings are “up year‑on‑year in excess of 20%.”

Broadband is the standout; enterprise networking/storage still soft. Expect U‑shaped recovery with more meaningful improvement by mid‑/late‑’26.

GM steps down on mix but profitability remains best‑in‑class. Q3 GM 78.4%; Q4 GM ~77.7% on higher XPU/wireless mix; Q4 EBITDA margin 67%. Street/analysts note ASIC GMs sit below corporate average (50s) but OM is accretive.

Management indicated ASIC GMs in the 50s, consistent with the Q4 GM guide down on mix; nonetheless, EBITDA/OM remain strong.

On the callback, Hock indicated low appetite for large‑scale M&A given abundant organic AI investment opportunities

VMware/Software steady with VCF 9.0. Q3 software $6.8B (+17% y/y), bookings >$8.4B; VCF 9.0 enables containerized AI on private cloud. >90% of top 10k accounts have bought VCF; deployment/expansion will span the next two years.

Hock Tan will remain CEO through 2030

AVGO: OpenAI set to start mass production of its own AI chips with Broadcom

OpenAI is set to produce its own artificial intelligence chip for the first time next year, as the ChatGPT maker attempts to address insatiable demand for computing power and reduce its reliance on chip giant Nvidia. The chip, co-designed with US semiconductor giant Broadcom, would ship next year, according to multiple people familiar with the partnership. Broadcom’s chief executive Hock Tan on Thursday referred to a mystery new customer committing to $10bn in orders.

DOCU +7.5%: Beat/Raise with big billings upside (early renewals), improved NDR, and higher FY26 revenue/OM guide; Q3 billings normalizes as timing tailwind reverses.

Revenue was $800.6M (+8.8% y/y), EPS $0.92, and billings $818M (+12.9% y/y)—all ahead of Street, driven by stronger direct demand and early renewals; NDR improved to 102% on better gross retention. FY26 guidance was raised (revenue and OM), while Q3 billings guide embeds a headwind from the pull‑forward of early renewals. Management continues to see stable demand, strong e‑sign usage, and early but broadening IAM traction, with FY26 the peak year for hosting costs before easing in FY27.

Key Takeaways:

Management is not seeing macro weakness; consumption and envelope sends were healthy across most verticals (FS, healthcare, business services), with real estate slower. Macro assumptions in guidance remain consistent.

Net Dollar Retention rose to 102% (from 99% y/y), mostly on better gross retention; early renewals are healthier (more with expansion, fewer flat/partial churn).

IAM traction broadening. IAM bookings mix increased; >50% of enterprise reps closed at least one IAM deal, and IAM customers tend to increase e‑sig usage; DOCU remains on track for IAM to be a low double‑digit % of the book exiting FY26.

CLM momentum. CLM bookings grew well into double digits y/y; large enterprise wins (e.g., T‑Mobile) and IDC MarketScape leadership for AI‑enabled buy‑side CLM cited.

International grew 13% and is 29% of revenue; Azure Marketplace drove the largest F2Q win; new GSA partnership opens Federal doors (still early).

Management may replace “billings” with an alternative topline metric; more detail expected with F3Q results.

Bull vs. Bear Debate:

Bulls argue DOCU’s IAM platform meaningfully expands TAM beyond e‑signature, deepening its moat via proprietary agreement data and AI (near 100M agreements ingested; agents coming), while e‑sig remains healthy and stable. Improving NDR (102%) on gross‑retention gains and CLM reacceleration point to a portfolio that can support sustained double‑digit growth as IAM mix rises; channel momentum (Azure Marketplace), GSA entry, and international +13% y/y add durable vectors. Despite investing through the cloud migration peak, DOCU is already delivering ~30% non‑GAAP OM and ~27% FCF margin, setting up operating leverage in FY27 as hosting costs ease. On valuation, bulls see a path to ~10–12% revenue growth through FY27–FY28 (Street FY27E ~$3.41B), and believe the data/AI edge plus leverage merit 6.5–7.5x FY27E EV/Sales, implying ~$110+

Bears contend e‑signature is increasingly commoditized, inviting pricing pressure (especially down‑market) and competitive incursions (Adobe, Microsoft, others). They worry normalized billings ~10% y/y in Q2 (ex‑timing) still falls short of the double‑digit trajectory bulls want; Q3 billings guide underscores sensitivity to renewal timing. The potential replacement of “billings” could reduce Street visibility, and OM down 240 bps y/y raises questions about how much reinvestment is needed to reignite growth while margins hold near 30%. Execution risk around IAM/CLM integration and product cadence (including acquisitions) also features in the bear narrative. On valuation, bears model ~5–7% growth with competitive/pricing pressure limiting mix shift and assume ~4.0–5.0x FY27E EV/Sales (e.g., 4.5x → ~$75–$80/share), arguing DOCU should trade closer to slower‑growth, single‑product peers until IAM’s uplift is more visible in NDR and billings

IOT +13%: Broad beat with NNARR re‑acceleration and raised FY26 guide; tariff overhang effectively cleared.

IOT delivered F2Q26 revenue +30% y/y and EPS ahead of Street, with net‑new ARR up 19% and a record 17 new $1m+ ARR customers. Management raised Q3 and FY26 outlook and reiterated that all Q1 tariff‑impacted deals closed and there was no incremental tariff impact in Q2

Key Takeaways:

Demand normalized; tariff fears eased. Management said Q1’s few elongated cycles tied to “Liberation Day” tariffs all closed in Q2 and “we didn’t experience any further tariff‑related impact in the quarter.” Street notes frame this as putting the tariff bear narrative “to bed.”

Large‑customer momentum accelerating. A record 17 $1m+ ARR adds (now 147 total; >20% of ARR) and $1B+ of ARR from $100k+ customers (59% mix, +35% y/y) underscore up‑market traction; seven $1m+ net‑new ACV deals closed in the quarter.

New products are contributing sooner. 8% of NNACV came from products launched in the past year (Asset Tags, Connected Workflows/Training, Asset Maintenance, AI Multicam, Commercial Navigation), including the largest‑ever Asset Tag deal (15k tags at Bonnie Plants).

Profitability inflecting. Q2 non‑GAAP GM 78%, OM 15% (+9 pts y/y), and FCF margin 11% (+7 pts y/y); FY26 OM raised to 15%. Guides remain conservative but leave room for upside, per sell side.

Q3 revenue guided to $398–$400M (+24% y/y) and FY26 to $1.574–$1.578B (+26% y/y); EPS and OM raised alongside. Samsara Inc Earnings Call 20259…

Europe accelerated to its highest NNACV growth in four quarters; Construction led NNACV for the 8th straight quarter, with public sector and manufacturing also strong.

TECH/RESEARCH

ASML: UBS Upgrades to Buy, Sees Inflection Point Ahead in 2027

UBS upgraded ASML to Buy from Neutral, highlighting a major inflection in lithography demand expected in 2027. Analyst Francois-Xavier Bouvignies points to the ramp of TSMC’s A14 node as a driver for higher lithography intensity, with ASML’s EUV tools central to production. He notes that after a 20% stock decline last year, concerns around Chinese exposure and slowing intensity are well digested, setting up for recovery. UBS also cites ASML’s High NA adoption as a long-term growth catalyst and stresses the company’s entrenched role in customer roadmaps, which allows investors to look past a weaker 2026. The firm projects ASML to return to compounding EPS growth of ~20% from 2026–2030. Shares are already up 8.7% YTD, but UBS believes further upside lies ahead.

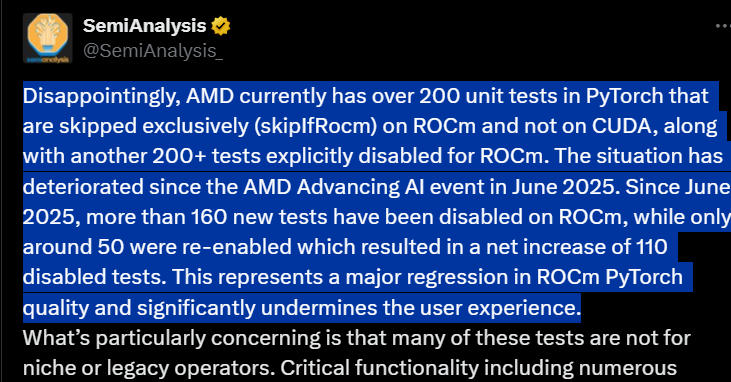

AMD:

NVDA: Nvidia Partner Hon Hai Sales Rise on Sustained AI Demand

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.