TMTB Morning Wrap

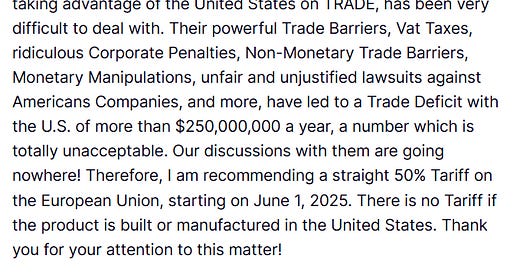

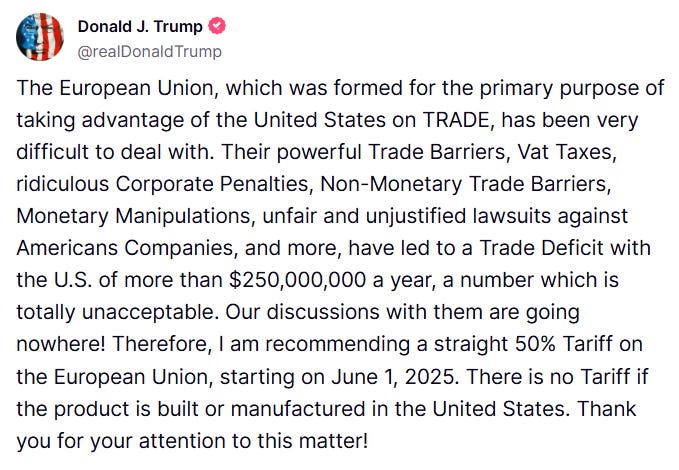

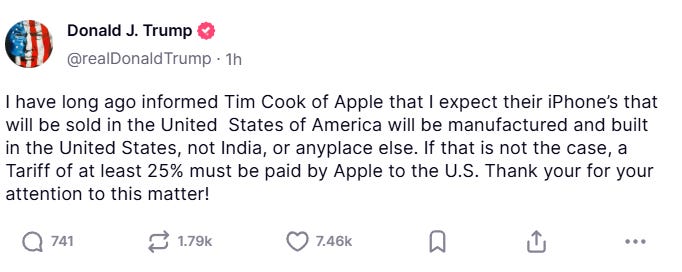

And you thought it was going to be a slow Friday? QQQs -1.7% as “bad for stocks” Trump is back…50% tariffs on European Union by June 1st…

AAPL 25% tariffs on iPhones

Yields dipping a bit down 4-6bps across the curve.

BTC -2%, flirting with a false breakout, similar to the ones we’ve called out with PLTR and CVNA over the past couple of days. Another one I’m paying close to attention to as similar to PLTR and CVNA, BTC led us off the bottom…

Other than that, fairly slow research day. We’ll hit it up INTU, ADSK, WDAY earnings then dive into Research/News.

Let’s get to it…

EARNINGS

WDAY -8%: Revs beat but lower than expected subscription, cRPO and billings miss bogeys as bears more vocal after print

Sentiment had improved over the last several weeks given better sw prints, but this print should put the bulls narrative on hold until 2H…

Q1 Revs of $2.240 bn (+1 % vs street at$2.218 bn)

Subscription revenue beat street by just $7 million (slightly light of bogeys) and cRPO growth of 15.6% only matched the midpoint of guidance once a 50–100 bp accounting tailwind is removed

Billings missed street by 7%

2Q-26 guide: 12-month cRPO expected to rise 15–16 %, about a point helped by newly recognized “tenant” contracts. So in effect, missed bogeys/street once that’s taken out.

Total revenue $2.34 bn (+12 %) subscription $2.16 bn (+13.5 %) roughly inline

FY-26 top-line unchanged: management kept total-revenue guidance at $9.5 bn (+12 % y/y) and subscription revenue at $8.8 bn (+14 %).

Key Takeaways

On Macro, WDAY still describes a “choppy” environment but says budget freezes or deal push-outs remain isolated. Large-enterprise cycles are stable, mid-market deals are accelerating thanks to Workday Go, and partner-sourced ACV now exceeds 20 %. Management did, however, flag that U.S. SLED pipelines are slowing as federal funding becomes less certain and that international customers could turn more cautious about buying from a U.S. vendor if the macro backdrop worsens.

AI and full-suite momentum continues: 25 % of expansion deals included at least one AI agent and net-new AI ACV more than doubled y/y; >30 % of new logos bought the full platform, with Workday Go shortening mid-market deployments to 30-60 days.

Cost discipline is driving leverage: February’s 8.5 % RIF and slower hiring combined with a heavier partner mix in services pushed non-GAAP operating margin to 30.2 % (220 bps above Street) and FCF up 23 % y/y; the board added $1 billion to the buy-back authorization.

Bull-versus-bear narrative

Bears more vocal today and have a hold of the narrative until there is more clarity on 2H - WDAY likely remains a funding short in the near-term going forward:

Bears argue that holding the revenue line—after a 1Q beat and a smaller currency headwind—effectively trims organic growth assumptions and leaves more execution risk in the back half, especially if state-and-local, higher-ed or certain international markets soften. Bears will also say that the quality of growth is eroding: cRPO benefited from re-classified “tenant” contracts, billings missed sharply, and management declined to pass the first-quarter upside—or an incremental FX tailwind—into FY-26 subscription guidance, effectively trimming the organic outlook for the next three quarters. They also point to macro-sensitive verticals (SLED, healthcare) and international exposure as latent headwinds, arguing that without visible acceleration in 2H-26 the stock’s multiple should compress further.

Bulls argue the quarter proves WDAY’s durable model: subscription revenue is still compounding in the mid-teens, AI attach rates are rising, full-suite wins are broadening beyond HCM into Financials, and operating leverage is materializing faster than peers. Valuation is not expensive as shares trade at roughly 21× CY-26 FCF—about a 25 % discount to large-cap software—with an achievable path to 30 %+ margins and re-acceleration in the back half as closed deals ramp and the leap-year compare fades.

INTU +8%: Solid beat-and-raise: Q3 Consumer/Tax revs beat and FY guide raised

Q3 Revs +15 % Y/Y to $7.75 bn versus the Street’s $7.56 bn;

Non-GAAP EPS $11.65 vs. $10.96, and operating margin expanded ~90 bp to 56 %.

Management lifted FY25 revenue to $18.74-18.76 bn (~15 % growth) from $18.16-18.35 bn and took the EPS range to $20.07-20.12 from $19.16-19.36, implying ~100 bp more margin expansion to 40.3 %.

Momentum was broad-based but the delta to street driven by TurboTax Live and Credit Karma.

Key takeaways

Macro Management still sees a “generally stable” SMB backdrop: underlying payments volume accelerated (leap-year-adjusted), and credit partners “leaned in” to CK; no broad demand cracks were flagged.

Tax season outperformance. Consumer revenue grew 11 % to $4.05 bn; TurboTax Live revenue accelerated 47 % Y/Y, units 24 %, lifting Live to ~40 % of Consumer sales and driving a 13 % jump in average revenue-per-return.

Credit Karma snap-back. CK revenue hit $579 m, +31 % Y/Y and roughly $115 m above street on strength in credit cards and personal loans.

Small-business steady. Global Business Solutions grew 19 %, with QuickBooks Online accounting up 21 % and the online ecosystem up ~20 %; Mailchimp stayed flat and remains a ~1 pt headwind to FY25 growth.

AI and up-market push. Intuit emphasised its forthcoming agentic AI offerings for mid-market QuickBooks customers and cited 12 % faster DIY tax completion times this season.

Bull-vs-bear narrative

Bulls argue that TurboTax Live’s breakout confirms INTU can tap the far larger assisted-filing TAM, underpinning durable double-digit Consumer growth, while QuickBooks’ up-market shift and early AI agents add incremental levers; three straight quarters of Credit Karma surprise reinforce the cross-sell thesis and de-risk the model even if SMB macro softens. Sub 30x FCF for best in class company not super expensive

Bears counter that Live’s mix shift cannibalizes the core DIY base and sets up tougher comps, Mailchimp’s stagnation masks slower momentum in the wider online ecosystem, and valuation already discounts flawless execution; bears will also question whether CK’s rebound is cyclical rather than structural and warn that a weaker small-business cycle or IRS free-file expansion could quickly pressure growth and margins.

INTU is executing well and bull narrative sounds interesting, but we are not involved here.

ADSK +2%: Decent Q as revs beat while billings inline and cRPO accelerated. FY26 nudged up. Guidance embeds macro prudence

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.